-ing information 70,000 units @ $12 $ 840,000 90,000 units @ $8 cerial Cost ($259,000) or Cost ($233,000 erheads ($190,000) oss) $158,000 ional Information: cludes fixed cost $65,000 Is include fixed cost $36.000

-ing information 70,000 units @ $12 $ 840,000 90,000 units @ $8 cerial Cost ($259,000) or Cost ($233,000 erheads ($190,000) oss) $158,000 ional Information: cludes fixed cost $65,000 Is include fixed cost $36.000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 21E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

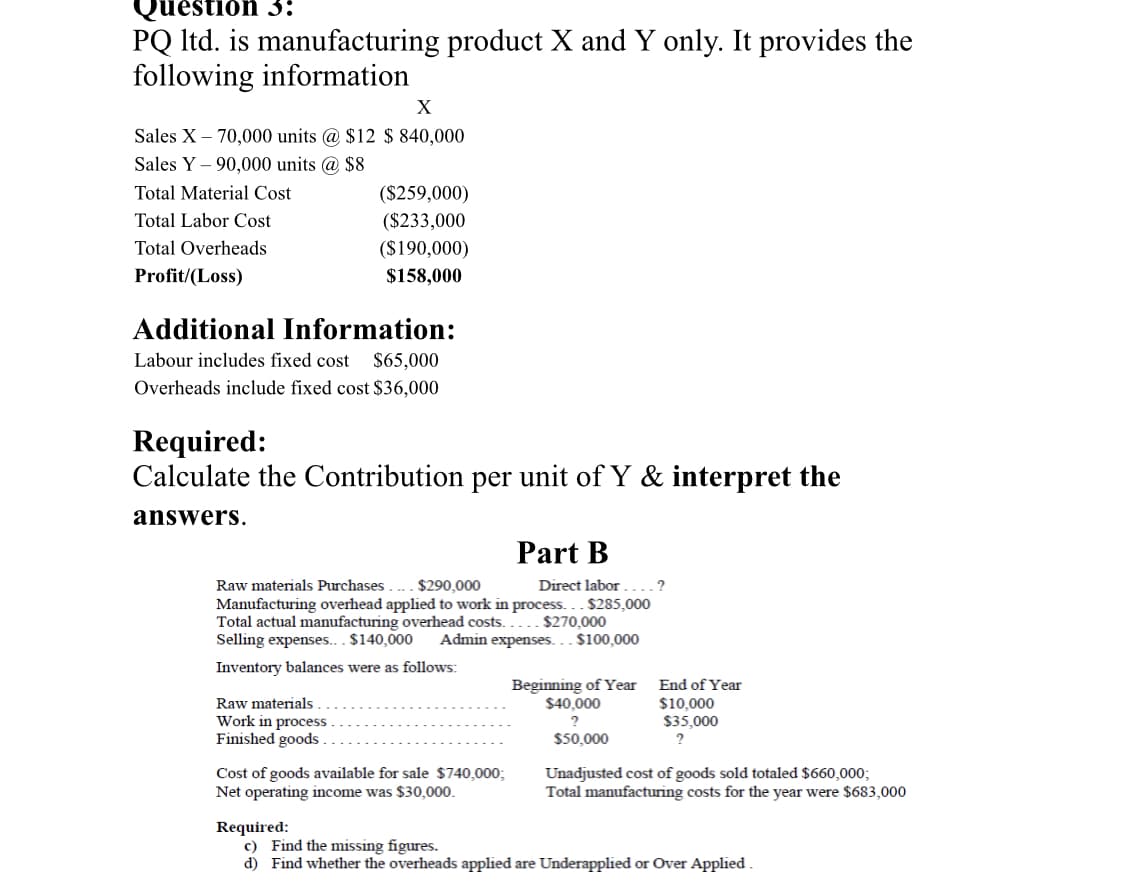

Transcribed Image Text:2uestion 3:

PQ Itd. is manufacturing product X and Y only. It provides the

following information

X

Sales X – 70,000 units @ $12 $ 840,000

Sales Y – 90,000 units @ $8

Total Material Cost

($259,000)

Total Labor Cost

($233,000

Total Overheads

($190,000)

Profit/(Loss)

$158,000

Additional Information:

Labour includes fixed cost

$65,000

Overheads include fixed cost $36,000

Required:

Calculate the Contribution per unit of Y & interpret the

answers.

Part B

Raw materials Purchases ... $290,000

Manufacturing overhead applied to work in process. . $285,000

Total actual manufacturing overhead costs. .... $270,000

Selling expenses.. $140,000

Direct labor....?

Admin expenses.

$100,000

Inventory balances were as follows:

Beginning of Year

$40,000

End of Year

Raw materials

Work in process

Finished goods.

$10,000

$35,000

$50,000

Cost of goods available for sale $740,000;

Net operating income was $30,000.

Unadjusted cost of goods sold totaled $660,000;

Total manufacturing costs for the year were $683,000

Required:

c) Find the missing figures.

d) Find whether the overheads applied are Underapplied or Over Applied .

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning