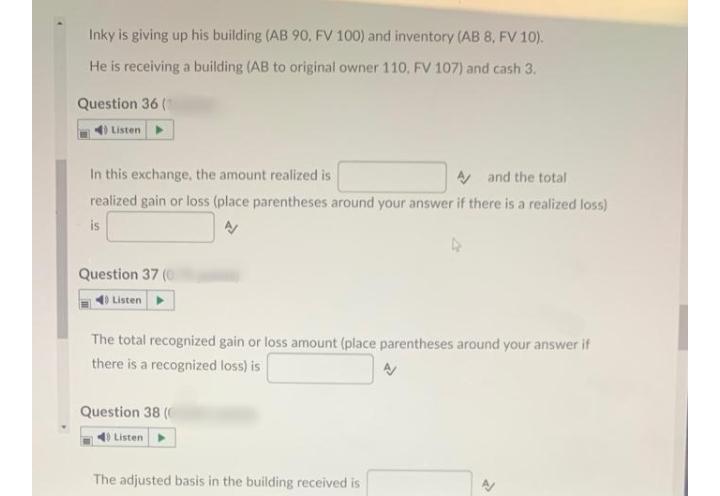

Inky is giving up his building (AB 90, FV 100) and inventory (AB 8, FV 10). He is receiving a building (AB to original owner 110, FV 107) and cash 3. Question 36 (1 Listen In this exchange, the amount realized is A and the total realized gain or loss (place parentheses around your answer if there is a realized loss) is Question 37 (0 Listen The total recognized gain or loss amount (place parentheses around your answer if there is a recognized loss) is Question 38 ( Listen The adjusted basis in the building received is

Inky is giving up his building (AB 90, FV 100) and inventory (AB 8, FV 10). He is receiving a building (AB to original owner 110, FV 107) and cash 3. Question 36 (1 Listen In this exchange, the amount realized is A and the total realized gain or loss (place parentheses around your answer if there is a realized loss) is Question 37 (0 Listen The total recognized gain or loss amount (place parentheses around your answer if there is a recognized loss) is Question 38 ( Listen The adjusted basis in the building received is

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 68P

Related questions

Question

Transcribed Image Text:Inky is giving up his building (AB 90, FV 100) and inventory (AB 8, FV 10).

He is receiving a building (AB to original owner 110, FV 107) and cash 3.

Question 36 (1

) Listen

In this exchange, the amount realized is

A and the total

realized gain or loss (place parentheses around your answer if there is a realized loss)

is

Question 37 (0

40 Listen

The total recognized gain or loss amount (place parentheses around your answer if

there is a recognized loss) is

Question 38 (

Listen

The adjusted basis in the building received is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT