Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 55P

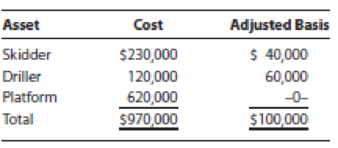

Jay sold three items of business equipment for a total of $300,000. None of the equipment was appraised to determine its value. Jay’s cost and adjusted basis for the assets are as follows:

Jay has been unable to establish the fair market values of the three assets. All he can determine is that combined they were worth $300,000 to the buyer in this arm’s length transaction. How should Jay allocate the sales price and figure the gain or loss on the sale of the three assets?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Jay sold three items of business equipment for a total of $300,000. None of the equipment was appraised to determine its value. Jay's cost and adjusted basis for the assets are shown below.

Asset

Cost

AdjustedBasis

Skidder

$230,000

$40,000

Driller

120,000

60,000

Platform

620,000

−0−

Total

$970,000

$100,000

Jay has been unable to establish the fair market values of the three assets. All he can determine is that combined they were worth $300,000 to the buyer in this arm's length transaction.

b. If Jay treats the assets as a single group, determine the amount and nature of the gain or loss. There is an overall gain of $______ of which $________ is § 1245 gain.

Please avoid images in Solutions thanks

Frank's Mini Mart sold a piece of equipment on an installment agreement, to a competitor on the other side of town. The other owner failed to make the payments and Frank had to repossess the equipment. What is Frank's gain or loss on repossessed personal property with a fair market value of $12,000 on the date of repossession, where the seller's basis in the installment obligation at the time of repossession is $7,500, and the costs of repossession were $500?

(a) Loss of $500.

(b) Gain of $4,000.

(c) Gain of $4,500

(d) Gain of $5,000.

Barry sold depreciable property used in his business to Ken for $192,000 cash plus a bond redeemable in 5 years for $95,000, but currently trading on the NYSE for $98,000. The property cost Barry $310,000 plus $45,000 in capital improvements and had actual accumulated depreciation at the time of the sale of $225,000. The amount of accumulated depreciation he should have taken was $205,000.

Determine the amount of gain or loss recognized. Explain your conclusions including the various components of how you determined your answer.

Q.2

During 2019, Anna had the following transactions:

Salary $90,000

Interest income on IBM bonds 3,000

Damages for physical personal injury (car accident) 115,000

Punitive damages (same car accident) 150,000

Stock dividends from Chevron Corp Stock with option to receive

cash of $15,000 or stock valued at $22,000 (Anna opted to that the stock)

Q.3

Joseph exchanged farmhouse that he used in his farming business for a building used by Sandy in her…

Chapter 17 Solutions

Individual Income Taxes

Ch. 17 - Prob. 1DQCh. 17 - Prob. 2DQCh. 17 - Prob. 3DQCh. 17 - Prob. 4DQCh. 17 - Prob. 5DQCh. 17 - Prob. 6DQCh. 17 - Prob. 7DQCh. 17 - A depreciable business dump truck has been owned...Ch. 17 - Prob. 9DQCh. 17 - Prob. 10DQ

Ch. 17 - Prob. 11DQCh. 17 - Prob. 12DQCh. 17 - Prob. 13DQCh. 17 - Prob. 14DQCh. 17 - Prob. 15DQCh. 17 - Prob. 16DQCh. 17 - Prob. 17DQCh. 17 - Prob. 18DQCh. 17 - Prob. 19DQCh. 17 - Prob. 20DQCh. 17 - Prob. 21CECh. 17 - Prob. 22CECh. 17 - LO.3 Renata Corporation purchased equipment in...Ch. 17 - LO.3 Jacob purchased business equipment for 56,000...Ch. 17 - Sissie owns two items of business equipment. Both...Ch. 17 - Prob. 26CECh. 17 - Prob. 27CECh. 17 - LO.4 Enzo is a single taxpayer with the following...Ch. 17 - Prob. 29CECh. 17 - Prob. 30CECh. 17 - LO.1, 2 Jenny purchased timber on a 100-acre tract...Ch. 17 - Prob. 32PCh. 17 - LO.2 A sculpture that Korliss Kane held for...Ch. 17 - Prob. 34PCh. 17 - Prob. 35PCh. 17 - Prob. 36PCh. 17 - Prob. 37PCh. 17 - Prob. 38PCh. 17 - Prob. 39PCh. 17 - Prob. 40PCh. 17 - Prob. 41PCh. 17 - Prob. 43PCh. 17 - Joanne is in the 24% tax bracket and owns...Ch. 17 - Prob. 45PCh. 17 - Prob. 46PCh. 17 - Prob. 47PCh. 17 - Prob. 48PCh. 17 - Prob. 49PCh. 17 - Jasmine owned rental real estate that she sold to...Ch. 17 - Prob. 51PCh. 17 - Prob. 52PCh. 17 - Prob. 53PCh. 17 - Prob. 54PCh. 17 - Jay sold three items of business equipment for a...Ch. 17 - Prob. 1RPCh. 17 - Prob. 2RPCh. 17 - Prob. 3RPCh. 17 - Prob. 4RPCh. 17 - Prob. 1CPACh. 17 - Prob. 2CPACh. 17 - Jerry uses a building for business purposes. The...Ch. 17 - Prob. 4CPACh. 17 - Prob. 5CPACh. 17 - Prob. 6CPACh. 17 - Wally, Inc., sold the following three personal...Ch. 17 - Net Section 1231 losses are: a. Deducted as a...Ch. 17 - Prob. 9CPACh. 17 - Prob. 10CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Barry sold depreciable property used in his business to Ken for $192,000 cash plus a bond redeemable in 5 years for $95,000, but currently trading on the NYSE for $98,000. The property cost Barry $310,000 plus $45,000 in capital improvements and had actual accumulated depreciation at the time of the sale of $225,000. The amount of accumulated depreciation he should have taken was $205,000. Determine the amount of gain or loss recognized. Explain your conclusions including the various components of how you determined your answer.arrow_forward. Ted, a sole proprietor, sells his office building to Sam. He originally purchased the building for $340,000. As of the date of the sale, Ted had recorded $140,000 of accumulated depreciation. His building was worth $240,000. Sam paid Ted $190,000 cash. In addition, Ted still owes $50,000 on debt incurred to purchase the building, and Sam is assuming this liability. Ted also paid a $5,000 commission to his realtor for facilitating the sale. What is Ted’s amount realized and what is Ted’s recognized gain or loss on the sale to Sam? 2. On May 15, 2019, Diane received a gift of 100 shares of stock from Fred. Fred had acquired the stock in 1990 for $20,000. At the time of the gift, the fair market value of the stock was $50,000. On November 30, 2019, Diane sold the stock for $52,000. What is the amount and character of Diane’s recognized gain or loss on the sale? 3. In the current year, Debbie receives stock as a gift from her uncle, Jerry. Jerry had originally purchased the stock for…arrow_forwardTalbot purchases business machinery for a price of $100,000. Talbot pays the seller $20,000 in cash and finances the rest by giving the seller a note for $80,000. What is Talbot’s initial basis in this machinery? Refer to the facts of Question #1. Assume Talbot uses the machinery, depreciates $60,000 of the machinery’s cost, and sells the machinery for $50,000 after that time period. Talbot reduced the principal amount of the note to $40,000 during the period of use. The buyer assumes the balance of the note and gives Talbot $10,000 in cash to complete the sale. What is Talbot’s gain on the sale of this machinery?arrow_forward

- On April 30, White sold land with a book value of $600,000 to Black for its fair value of $800,000. Black gave White a 12 percent, $800,000 note secured only by the land. At the date of sale, Black was in a very poor financial position and its continuation as a going concern was very questionable. white should...... a. Use the cost recovery method of accounting b. Record the note at its discounted value c. Record a $200,000 gain on the sale of the land d. Increase the allowance for uncollectibles for the full amount of the notearrow_forwardJoan sold depreciable property used in her business to Irene for $325,000 cash plus a ten year bond par value $200,000, and currently trading on the NYSE for $196,000. The property cost Joan $605,000 not including the $27,000 of capital improvements she made. During Joan’s ownership she erroneously deducted $315,000 of depreciation on the property and no depreciation on the improvements. The correct amount of depreciation that should have been deducted was $420,000 on the property and $12,000 on the improvements Determine the amount of recognized gain or loss.arrow_forwardLeonard and Arlene Warner sold the Warner Manufacturing Company to Elliott and Carol Archer for $610,000. A few months later the Archers sued the Warners in a state court for fraud connected with the sale. The parties settled the lawsuit for $300,000. The Warners paid the Archers $200,000 and executed a promissory note for the remaining $100,000. After the Warners failed to make the first payment on the $100,000 promissory note, the Archers sued for the payment in state court. The Warners then filed for bankruptcy of the Bankruptcy Code. The Archers claimed that the $100,000 debt was nondischargeable because it was for “money obtained by fraud.” Arlene Warner claimed that the $100,000 debt was dischargeable in bankruptcy because it was a new debt for money promised in a settlement contract and thus it was not a debt for money obtained by fraud.a. What are the arguments that the debt is dischargeable in bankruptcy?b. What are the arguments that the debt is not dischargeable in…arrow_forward

- On July 24 of the current year, Sam Smith was involved in an accident with his business use automobile. Sam had purchased the car for 30,000. The automobile had a fair market value of 20,000 before the accident and 8,000 immediately after the accident. Sam has taken 20,000 of depreciation on the car. The car is insured for the fair market value of any loss. Because of Sams history, he is afraid that if he submits a claim, his policy will be canceled. Therefore, he is considering not filing a claim. Sam believes that the tax loss deduction will help mitigate the loss of the insurance reimbursement. Sams current marginal tax rate is 35%. Write a letter to Sam that contains your advice with respect to the tax and cash flow consequences of filing versus not filing a claim for the insurance reimbursement for the damage to his car. Also prepare a memo for the tax files. Sams address is 450 Colonels Way, Warrensburg, MO 64093.arrow_forwardFarm Fresh Agriculture Company purchased Sunny Side Egg Distribution for $400,000 cash when Sunny Side had net assets worth $390,000. A. What is the amount of goodwill in this transaction? B. What is Farm Fresh Agriculture Companys journal entry to record the purchase of Sunny Side Egg Distribution? C. What journal entry should Farm Fresh Agriculture Company write when the company tests for impairment and determines that goodwill is worth $1,000 in the year following the purchase of Sunny Side?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License