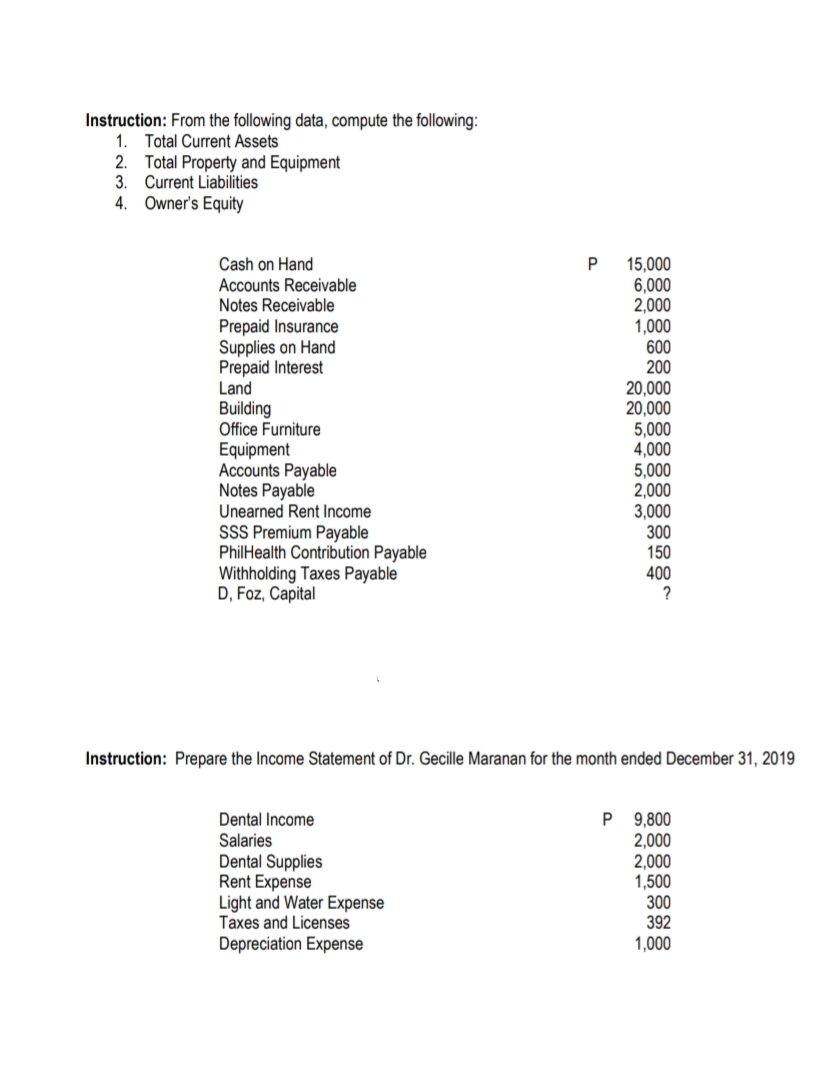

Instruction: From the following data, compute the following: 1. Total Current Assets 2. Total Property and Equipment 3. Current Liabilities 4. Owner's Equity P 15,000 6,000 2,000 1,000 600 200 Cash on Hand Accounts Receivable Notes Receivable Prepaid Insurance Supplies on Hand Prepaid Interest Land Building Office Furniture Equipment Accounts Payable Notes Payable Unearned Rent Income SSS Premium Payable PhilHealth Contribution Payable Withholding Taxes Payable D, Foz, Capital 20,000 20,000 5,000 4,000 5,000 2,000 3,000 300 150 400 ?

Instruction: From the following data, compute the following: 1. Total Current Assets 2. Total Property and Equipment 3. Current Liabilities 4. Owner's Equity P 15,000 6,000 2,000 1,000 600 200 Cash on Hand Accounts Receivable Notes Receivable Prepaid Insurance Supplies on Hand Prepaid Interest Land Building Office Furniture Equipment Accounts Payable Notes Payable Unearned Rent Income SSS Premium Payable PhilHealth Contribution Payable Withholding Taxes Payable D, Foz, Capital 20,000 20,000 5,000 4,000 5,000 2,000 3,000 300 150 400 ?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter4: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 9E: Determine on which financial statement each account listed below is reported. Use the following...

Related questions

Question

Please solve all... don't use ms Excel or any other. Please solve by hand. And solve all

Transcribed Image Text:Instruction: From the following data, compute the following:

1. Total Current Assets

2. Total Property and Equipment

3. Current Liabilities

4. Owner's Equity

15,000

6,000

2,000

1,000

600

200

20,000

20,000

5,000

4,000

5,000

2,000

3,000

300

150

400

?

Cash on Hand

Accounts Receivable

Notes Receivable

Prepaid Insurance

Supplies on Hand

Prepaid Interest

Land

Building

Office Furniture

Equipment

Accounts Payable

Notes Payable

Unearned Rent Income

SSS Premium Payable

PhilHealth Contribution Payable

Withholding Taxes Payable

D, Foz, Capital

Instruction: Prepare the Income Statement of Dr. Gecille Maranan for the month ended December 31, 2019

Dental Income

Salaries

Dental Supplies

Rent Expense

Light and Water Expense

Taxes and Licenses

P 9,800

2,000

2,000

1,500

300

392

1,000

Depreciation Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning