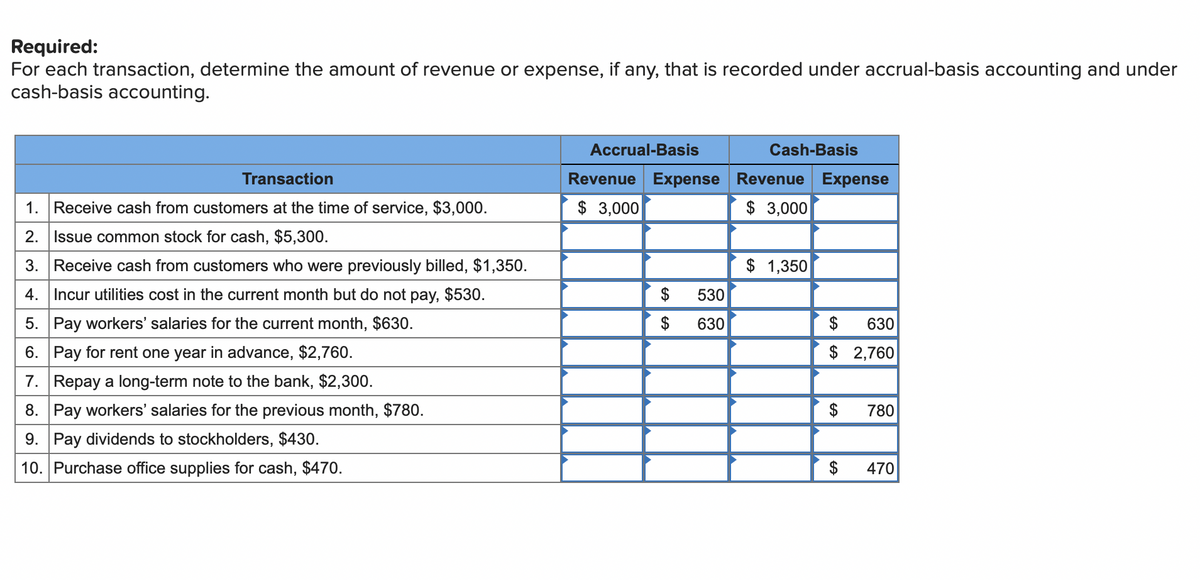

Required: For each transaction, determine the amount of revenue or expense, if any, that is recorded under accrual-basis accounting and under cash-basis accounting. Accrual-Basis Cash-Basis Transaction Revenue Expense Revenue Expense 1. Receive cash from customers at the time of service, $3,000. $ 3,000 $ 3,000 2. Issue common stock for cash, $5,300. 3. Receive cash from customers who were previously billed, $1,350. $ 1,350 4. Incur utilities cost in the current month but do not pay, $530. $ 530 5. Pay workers' salaries for the current month, $630. 6. Pay for rent one year in advance, $2,760. $ 630 630 $ 2,760 7. Repay a long-term note to the bank, $2,300. 8. Pay workers' salaries for the previous month, $780. 9. Pay dividends to stockholders, $430. $ 780 10. Purchase office supplies for cash, $470. 2$ 470

Required: For each transaction, determine the amount of revenue or expense, if any, that is recorded under accrual-basis accounting and under cash-basis accounting. Accrual-Basis Cash-Basis Transaction Revenue Expense Revenue Expense 1. Receive cash from customers at the time of service, $3,000. $ 3,000 $ 3,000 2. Issue common stock for cash, $5,300. 3. Receive cash from customers who were previously billed, $1,350. $ 1,350 4. Incur utilities cost in the current month but do not pay, $530. $ 530 5. Pay workers' salaries for the current month, $630. 6. Pay for rent one year in advance, $2,760. $ 630 630 $ 2,760 7. Repay a long-term note to the bank, $2,300. 8. Pay workers' salaries for the previous month, $780. 9. Pay dividends to stockholders, $430. $ 780 10. Purchase office supplies for cash, $470. 2$ 470

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 2PB: To demonstrate the difference between cash account activity and accrual basis profits (net income),...

Related questions

Question

Transcribed Image Text:Required:

For each transaction, determine the amount of revenue or expense, if any, that is recorded under accrual-basis accounting and under

cash-basis accounting.

Accrual-Basis

Cash-Basis

Transaction

Revenue Expense Revenue Expense

1. Receive cash from customers at the time of service, $3,000.

$ 3,000

$ 3,000

2. Issue common stock for cash, $5,300.

3. Receive cash from customers who were previously billed, $1,350.

$ 1,350

4. Incur utilities cost in the current month but do not pay, $530.

530

5. Pay workers' salaries for the current month, $630.

$

630

$

630

6. Pay for rent one year in advance, $2,760.

7. Repay a long-term note to the bank, $2,300.

$ 2,760

8. Pay workers' salaries for the previous month, $780.

9. Pay dividends to stockholders, $430.

780

10. Purchase office supplies for cash, $470.

$

470

%24

Expert Solution

Step 1 Introduction:

Expense refers to the amount or cost which is incurred by the business to generate income or revenues. Expenses can be operating or non-operating in nature. Expenses include cost of direct materials, depreciation, utilities, rent, direct labor, selling and distribution and office and administrative expenses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub