Instructions 1. Journalize the entries to record the transactions indentified below. 2. Determine the account balances for Work in Process and Finished Goods. 3. Prepare a schedule of unfinished jobs to support the balance in the Work in Process account.

Instructions 1. Journalize the entries to record the transactions indentified below. 2. Determine the account balances for Work in Process and Finished Goods. 3. Prepare a schedule of unfinished jobs to support the balance in the Work in Process account.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter5: Process Cost Accounting—general Procedures

Section: Chapter Questions

Problem 13E

Related questions

Question

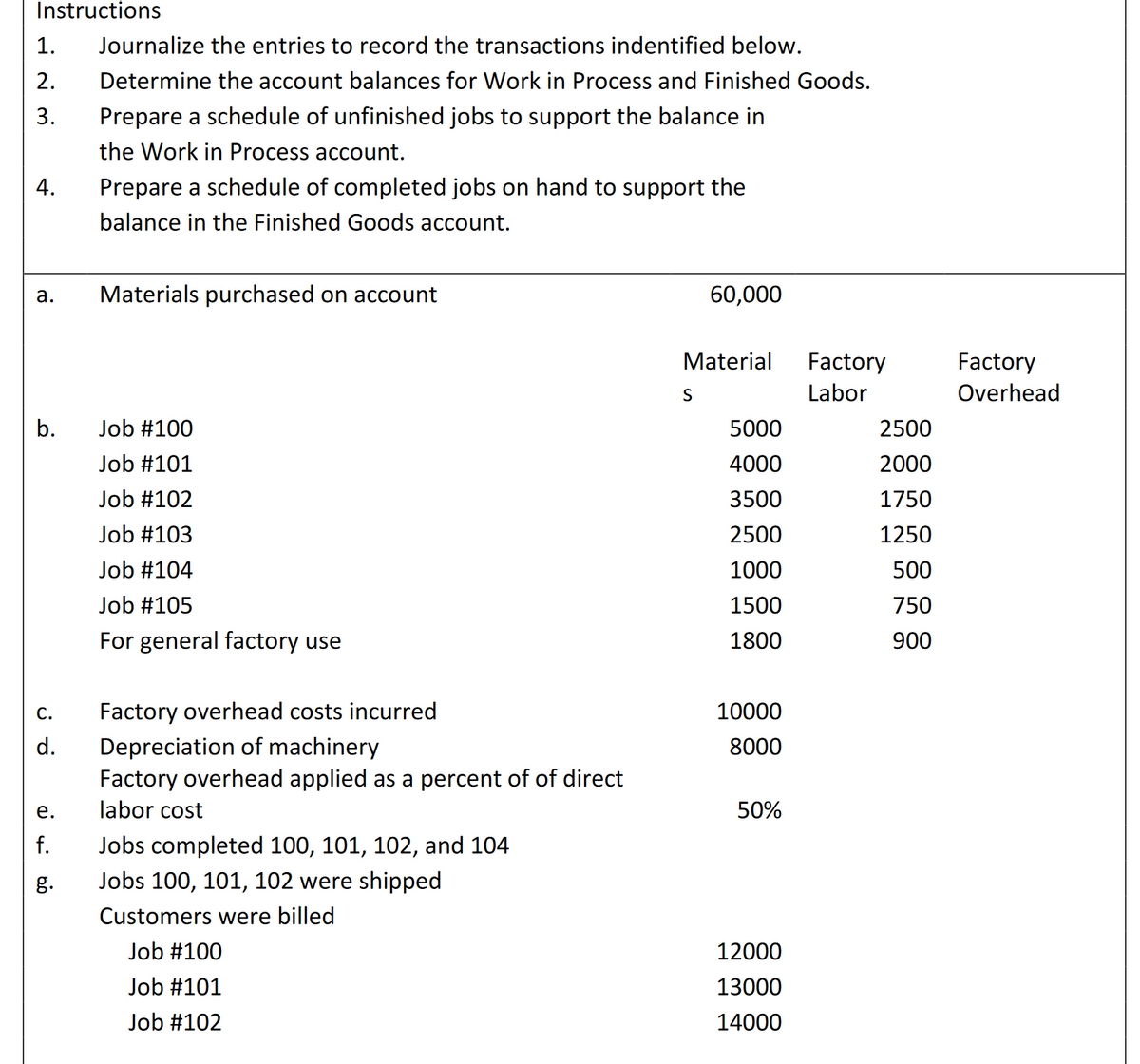

Transcribed Image Text:Instructions

1.

Journalize the entries to record the transactions indentified below.

2.

Determine the account balances for Work in Process and Finished Goods.

3.

Prepare a schedule of unfinished jobs to support the balance in

the Work in Process account.

4.

Prepare a schedule of completed jobs on hand to support the

balance in the Finished Goods account.

a.

Materials purchased on account

60,000

Material

Factory

Factory

Labor

Overhead

b.

Job #100

5000

2500

Job #101

4000

2000

Job #102

3500

1750

Job #103

2500

1250

Job #104

1000

500

Job #105

1500

750

For general factory use

1800

900

С.

Factory overhead costs incurred

10000

d.

Depreciation of machinery

Factory overhead applied as a percent of of direct

8000

е.

labor cost

50%

f.

Jobs completed 100, 101, 102, and 104

g.

Jobs 100, 101, 102 were shipped

Customers were billed

Job #100

12000

Job #101

13000

Job #102

14000

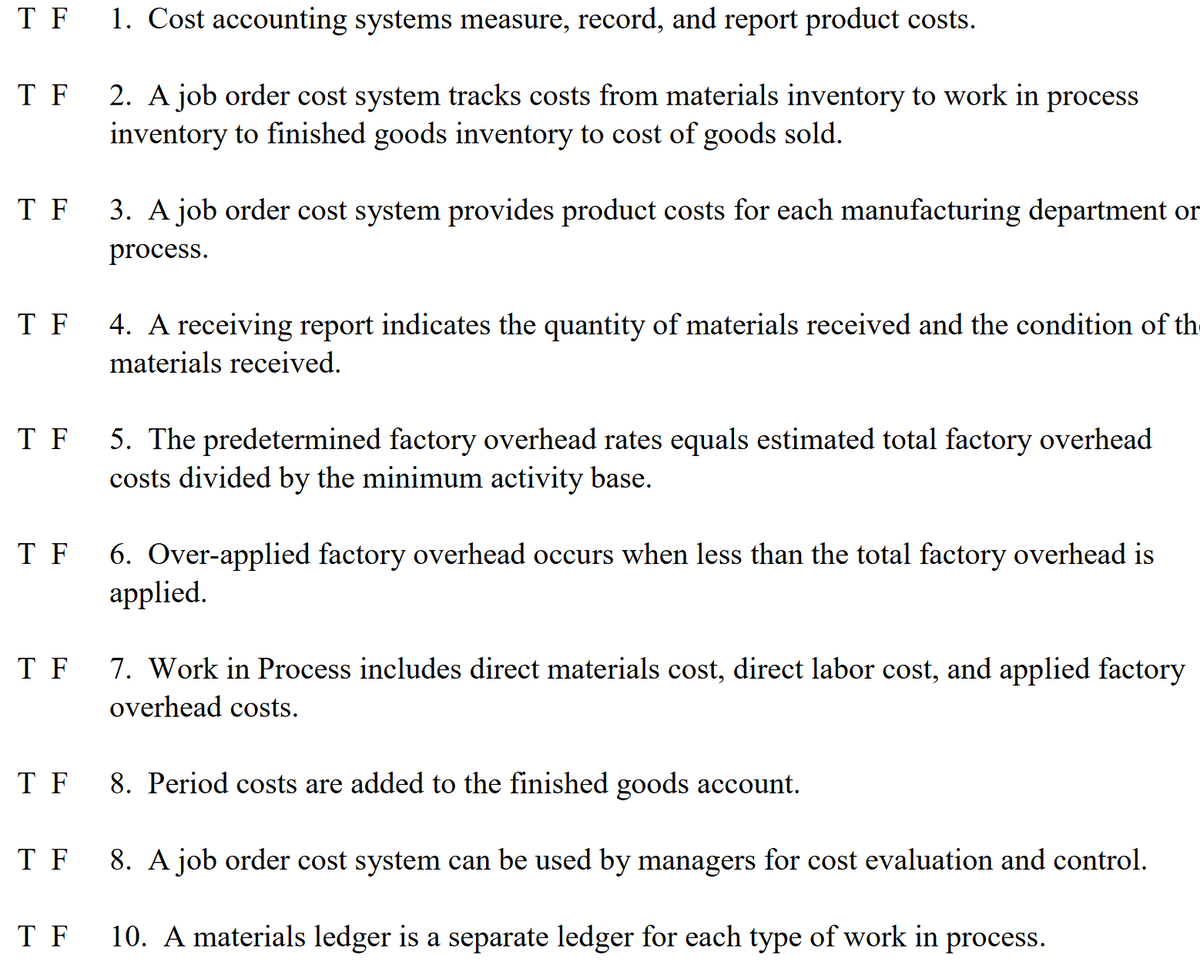

Transcribed Image Text:T F

1. Cost accounting systems measure, record, and report product costs.

T F

2. A job order cost system tracks costs from materials inventory to work in process

inventory to finished goods inventory to cost of goods sold.

T F

3. A job order cost system provides product costs for each manufacturing department or

process.

T F

4. A receiving report indicates the quantity of materials received and the condition of th-

materials received.

T F

5. The predetermined factory overhead rates equals estimated total factory overhead

costs divided by the minimum activity base.

T F

6. Over-applied factory overhead occurs when less than the total factory overhead is

applied.

T F

7. Work in Process includes direct materials cost, direct labor cost, and applied factory

overhead costs.

T F

8. Period costs are added to the finished goods account.

T F

8. A job order cost system can be used by managers for cost evaluation and control.

T F

10. A materials ledger is a separate ledger for each type of work in process.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,