Instructions: a) Journalize and post the July transactions. b) Prepare a trial balance on July 31. c) Enter the following adjustments. 1. Depreciation on computers for the month was $150. 2. The insurance for July has occurred . 3. supplies count by July 31 shows a value of $1500. 4. unpaid employee salaries were $2500. d) Journalize and post adjusting entries. e) Prepare the Income Statement and Owner's Equity Statement for July and a Classified Balance Sheet on July 31. f) Use the work sheet. g) Journalize and post-closing entries and complete the closing process. h) Prepare a Post-Closing Trial Balance on July 31.

Instructions: a) Journalize and post the July transactions. b) Prepare a trial balance on July 31. c) Enter the following adjustments. 1. Depreciation on computers for the month was $150. 2. The insurance for July has occurred . 3. supplies count by July 31 shows a value of $1500. 4. unpaid employee salaries were $2500. d) Journalize and post adjusting entries. e) Prepare the Income Statement and Owner's Equity Statement for July and a Classified Balance Sheet on July 31. f) Use the work sheet. g) Journalize and post-closing entries and complete the closing process. h) Prepare a Post-Closing Trial Balance on July 31.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter5: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 6CE

Related questions

Question

Transcribed Image Text:6:31

ul 4G 14.

Shroog

CH.4 Homework

CH.4 Homework

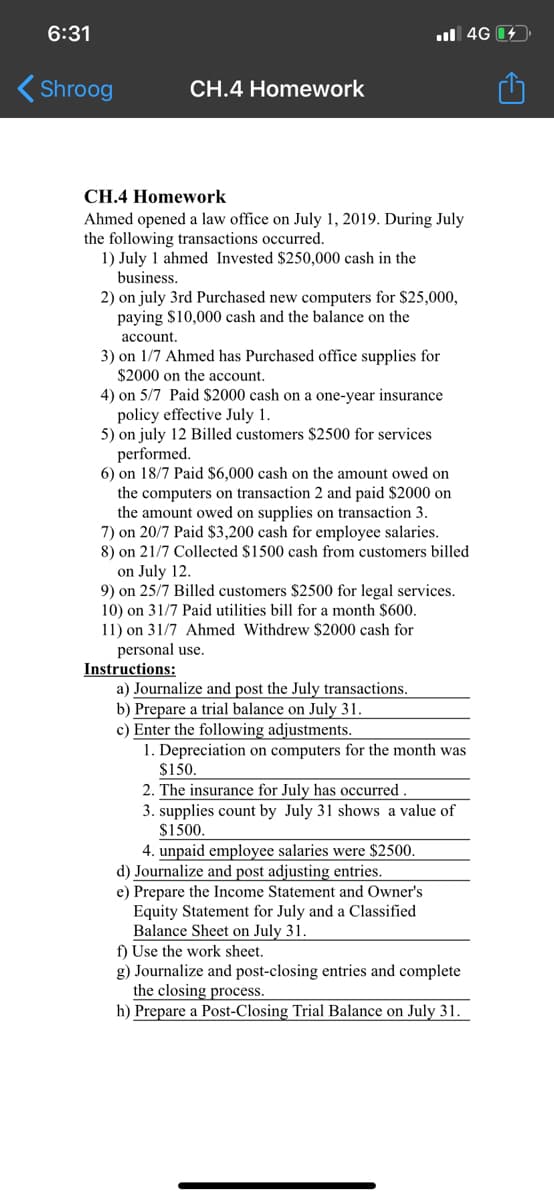

Ahmed opened a law office on July 1, 2019. During July

the following transactions occurred.

1) July 1 ahmed Invested $250,000 cash in the

business.

2) on july 3rd Purchased new computers for $25,000,

paying $10,000 cash and the balance on the

account.

3) on 1/7 Ahmed has Purchased office supplies for

$2000 on the account.

4) on 5/7 Paid $2000 cash on a one-year insurance

policy effective July 1.

5) on july 12 Billed customers $2500 for services

performed.

6) on 18/7 Paid $6,000 cash on the amount owed on

the computers on transaction 2 and paid $2000 on

the amount owed on supplies on transaction 3.

7) on 20/7 Paid $3,200 cash for employee salaries.

8) on 21/7 Collected $1500 cash from customers billed

on July 12.

9) on 25/7 Billed customers $2500 for legal services.

10) on 31/7 Paid utilities bill for a month $600.

11) on 31/7 Ahmed Withdrew $2000 cash for

personal use.

Instructions:

a) Journalize and post the July transactions.

b) Prepare a trial balance on July 31.

c) Enter the following adjustments.

1. Depreciation on computers for the month was

$150.

2. The insurance for July has occurred.

3. supplies count by July 31 shows a value of

$1500.

4. unpaid employee salaries were $2500.

d) Journalize and post adjusting entries.

e) Prepare the Income Statement and Owner's

Equity Statement for July and a Classified

Balance Sheet on July 31.

f) Use the work sheet.

g) Journalize and post-closing entries and complete

the closing process.

h) Prepare a Post-Closing Trial Balance on July 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,