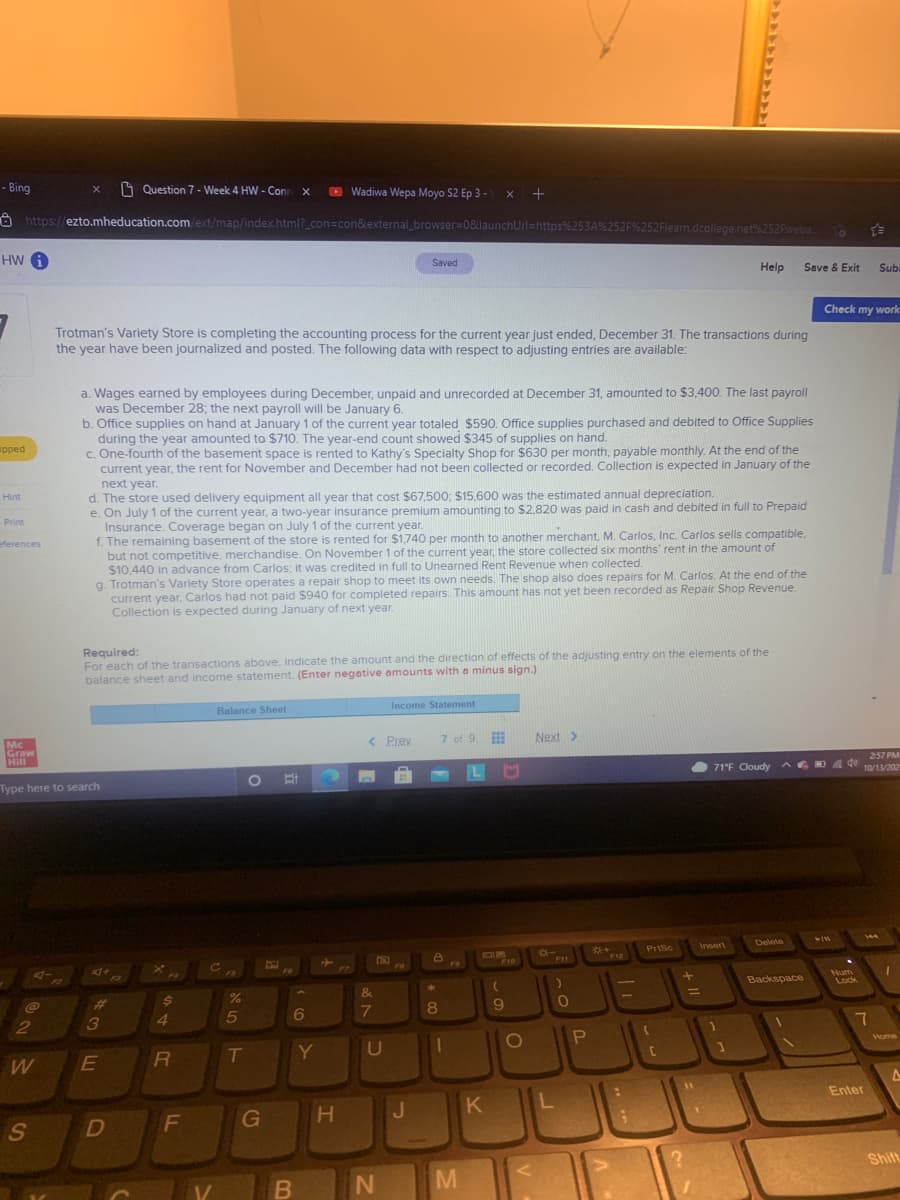

Trotman's Variety Store is completing the accounting process for the current year just ended, December 31. The transactions during the year have been journalized and posted. The following data with respect to adjusting entries are available: a. Wages earned by employees during December, unpaid and unrecorded at December 31, amounted to $3.400. The last payroll was December 28; the next payroll will be January 6. b. Office supplies on hand at January 1 of the current year totaled $590. Office supplies purchased and debited to Office Supplies during the year amounted to $710. The year-end count showed $345 of supplies on hand. c. One-fourth of the basement space is rented to Kathy's Specialty Shop for $630 per month, payable monthly. At the end of the current year, the rent for November and December had not been collected or recorded. Collection is expected in January of the next year. d. The store used delivery equipment all year that cost $67,500, $15,600 was the estimated annual depreciation. e. On July 1 of the current year, a two-year insurance premium amounting to $2.820 was paid in cash and debited in full to Prepaid Insurance. Coverage began on July 1 of the current year. f. The remaining basement of the store is rented for $1,740 per month to another merchant, M. Carlos, Inc. Carlos sells compatible. but not competitive, merchandise. On November 1 of the current year, the store collected six months' rent in the amount of $10,440 in advance from Carlos; it was credited in full to Unearned Rent Revenue when collected. g. Trotman's Variety Store operates a repair shop to meet its own needs. The shop also does repairs for M. Carlos. At the end of the current year, Carlos had not paid $940 for completed repairs. This amount has not yet been recorded as Repair Shop Revenue Collection is expected during January of next year. Required: For each of the transactions above, indicate the amount and the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. (Enter negetive amounts with a minus sign.) Income Statement Balance Sheet

Trotman's Variety Store is completing the accounting process for the current year just ended, December 31. The transactions during the year have been journalized and posted. The following data with respect to adjusting entries are available: a. Wages earned by employees during December, unpaid and unrecorded at December 31, amounted to $3.400. The last payroll was December 28; the next payroll will be January 6. b. Office supplies on hand at January 1 of the current year totaled $590. Office supplies purchased and debited to Office Supplies during the year amounted to $710. The year-end count showed $345 of supplies on hand. c. One-fourth of the basement space is rented to Kathy's Specialty Shop for $630 per month, payable monthly. At the end of the current year, the rent for November and December had not been collected or recorded. Collection is expected in January of the next year. d. The store used delivery equipment all year that cost $67,500, $15,600 was the estimated annual depreciation. e. On July 1 of the current year, a two-year insurance premium amounting to $2.820 was paid in cash and debited in full to Prepaid Insurance. Coverage began on July 1 of the current year. f. The remaining basement of the store is rented for $1,740 per month to another merchant, M. Carlos, Inc. Carlos sells compatible. but not competitive, merchandise. On November 1 of the current year, the store collected six months' rent in the amount of $10,440 in advance from Carlos; it was credited in full to Unearned Rent Revenue when collected. g. Trotman's Variety Store operates a repair shop to meet its own needs. The shop also does repairs for M. Carlos. At the end of the current year, Carlos had not paid $940 for completed repairs. This amount has not yet been recorded as Repair Shop Revenue Collection is expected during January of next year. Required: For each of the transactions above, indicate the amount and the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. (Enter negetive amounts with a minus sign.) Income Statement Balance Sheet

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter8: Controlling Information Systems: Introduction To Pervasive Controls

Section: Chapter Questions

Problem 3SP

Related questions

Question

How d you work it out

Transcribed Image Text:- Bing

1 Question 7 - Week 4 HW - Con x

O Wadiwa Wepa Moyo S2 Ep 3 - x +

8 https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flearn.dcollege.net%252Fweba..

o E

HW A

Saved

Help

Save & Exit

Sub

Check my work

Trotman's Variety Store is completing the accounting process for the current year just ended, December 31. The transactions during

the year have been journalized and posted. The following data with respect to adjusting entries are available:

a. Wages earned by employees during December, unpaid and unrecorded at December 31, amounted to $3.400. The last payroll

was December 28; the next payroll will be January 6.

b. Office supplies on hand at January 1 of the current year totaled $590. Office supplies purchased and debited to Office Supplies

during the year amounted to $710. The year-end count showed $345 of supplies on hand.

c. One-fourth of the basement space is rented to Kathy's Specialty Shop for $630 per month, payable monthly. At the end of the

current year, the rent for November and December had not been collected or recorded. Collection is expected in January of the

next year.

d. The store used delivery equipment all year that cost $67,500; $15,600 was the estimated annual depreciation.

e. On July 1 of the current year, a two-year insurance premium amounting to $2,820 was paid in cash and debited in full to Prepaid

Insurance. Coverage began on July 1 of the current year.

f. The remaining basement of the store is rented for $1,740 per month to another merchant, M. Carlos, Inc. Carlos sells compatible.

but not competitive, merchandise. On November 1 of the current year, the store collected six months' rent in the amount of

$10,440 in advance from Carlos; it was credited in full to Unearned Rent Revenue when collected.

g. Trotman's Variety Store operates a repair shop to meet its own needs. The shop also does repairs for M. Carlos. At the end of the

current year, Carlos had not paid $940 for completed repairs. This amount has not yet been recorded as Repair Shop Revenue.

Collection is expected during January of next year.

ipped

Hint

Print

eferences

Required:

For each of the transactions above, indicate the amount and the direction of effects of the adjusting entry on the elements of the

balance sheet and income statement. (Enter negative amounts with a minus sign.)

Income Statement

Balance Sheet

< Prev

7 of 9

Next >

Mc

Graw

Hill

257 PM

71'F Cloudy AG

D 0 10/13/202

Type here to search

144

Delete

Insert

PrtSc

DUM

F10

-..

F12

co

FS

F6

Backspace

Num

Lock

F3

F2

1

&

%3D

%23

7

8

9.

3

4.

5

Home

Y

U

W

Enter

J.

K

F

G

Shift

M

V

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning