Instructions: Below are terms pertinent to adjusting entries. Match each definition with its related term. Write your answer on the space provided. Terms Definifions/Transacions 1 Accrued Expense 2 Deferred Expense Revenues not yet earned, collected in advance. Ofice supplies on hand, used next accounting period. Rentrevenue collected, not yet earned. d. Rent not yet collected, already earned. An expense incurred, not yet paid or recorded. Revenue earned, not yer collected. An expense not yet incurred, paid in advance. h. Property taxes incurred, not yet paid. At the end of the year, slaries payable of P3,600 had not been recorded or paid. į Supplies for office use were purchased during the year for P500, and P100 of the ofice supplies remained on hand (unused) at year-end. k. Interest of P250 on a note receivable was earned at year-end, altfhough collecion of the interest is not due unfil the following year. Atthe end of the year, service revenues of P2,000 was collected in cash but was not yet earned. m. An expense that is unpaid and unrecorded. a. b. 3 Accrued Revenue C. 4 Deferred Revenue e. g. i.

Instructions: Below are terms pertinent to adjusting entries. Match each definition with its related term. Write your answer on the space provided. Terms Definifions/Transacions 1 Accrued Expense 2 Deferred Expense Revenues not yet earned, collected in advance. Ofice supplies on hand, used next accounting period. Rentrevenue collected, not yet earned. d. Rent not yet collected, already earned. An expense incurred, not yet paid or recorded. Revenue earned, not yer collected. An expense not yet incurred, paid in advance. h. Property taxes incurred, not yet paid. At the end of the year, slaries payable of P3,600 had not been recorded or paid. į Supplies for office use were purchased during the year for P500, and P100 of the ofice supplies remained on hand (unused) at year-end. k. Interest of P250 on a note receivable was earned at year-end, altfhough collecion of the interest is not due unfil the following year. Atthe end of the year, service revenues of P2,000 was collected in cash but was not yet earned. m. An expense that is unpaid and unrecorded. a. b. 3 Accrued Revenue C. 4 Deferred Revenue e. g. i.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 3PB: Identify which type of adjustment is indicated by these transactions. Choose accrued revenue,...

Related questions

Question

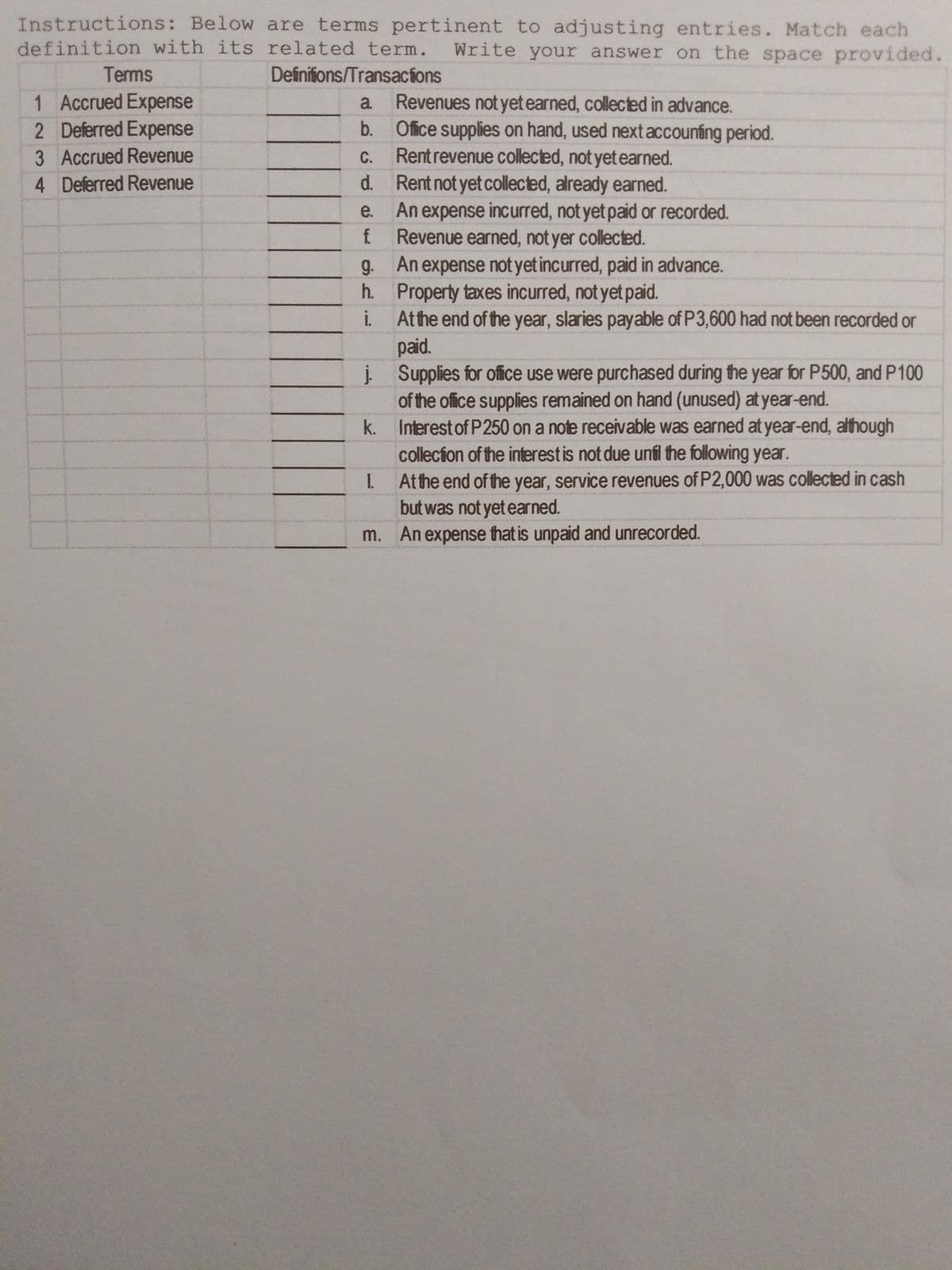

Transcribed Image Text:Instructions: Below are terms pertinent to adjusting entries. Match each

definition with its related term.

Write your answer on the space provided.

Terms

Definifions/Transacions

1 Accrued Expense

2 Deferred Expense

Revenues not yet earned, collected in advance.

b. Ofice supplies on hand, used next accounting period.

Rentrevenue collected, not yet earned.

d. Rent not yet collected, already earned.

An expense incurred, not yet paid or recorded.

f Revenue earned, not yer collected.

g. An expense not yet incurred, paid in advance.

h. Property taxes incurred, not yet paid.

i. Athe end of the year, slaries payable of P3,600 had not been recorded or

paid.

į Supplies for office use were purchased during the year for P500, and P100

of the office supplies remained on hand (unused) at year-end.

k. Interest of P250 on a note receivable was earned at year-end, although

collecion of the interestis not due unil the following year.

Atthe end of the year, service revenues of P2,000 was collected in cash

but was not yet earned.

m. An expense that is unpaid and unrecorded.

a.

3 Accrued Revenue

C.

4 Deferred Revenue

e.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning