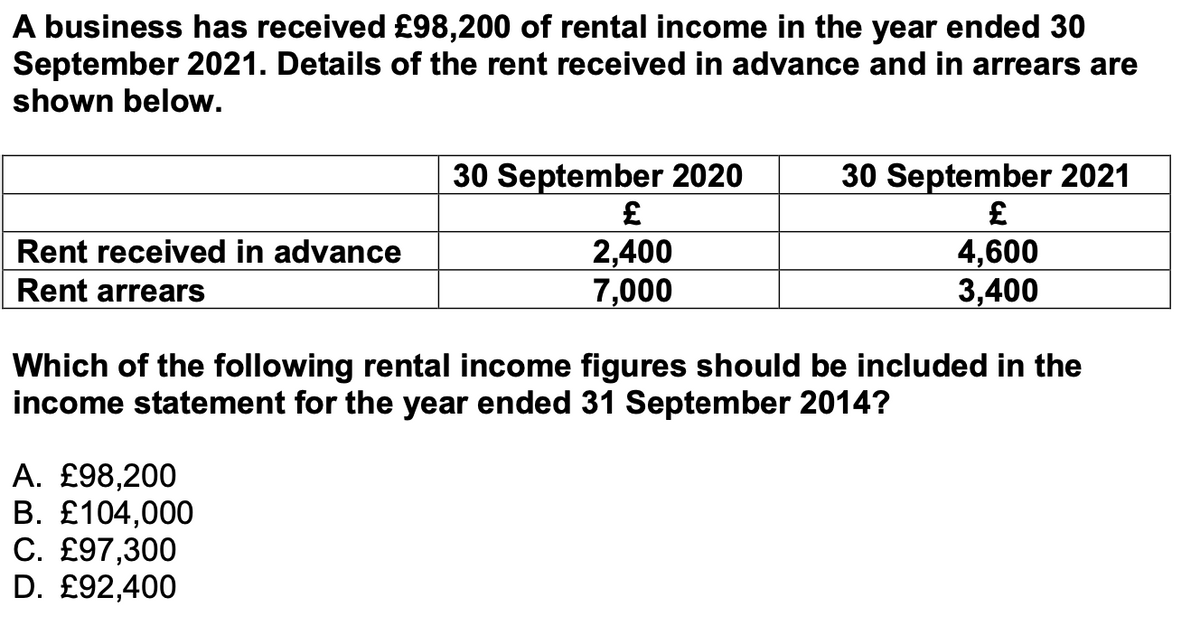

Which of the following rental income figures should be included in the income statement for the year ended 31 September 2014?

Q: It takes 100,000 direct labor hours to manufacture the product. Total overhead for the product is…

A: Introduction: Traditional costing refers to the allocation of factory overhead to products based on…

Q: An auditor is likely to perform each of the below procedures to obtain evidence regarding the…

A: Audit Contrary to unfavorable opinions, scope restrictions or the presence of significant…

Q: 4. State whether the following phrases match well with management accounting or financial…

A: Financial accounting, cost accounting, and management accounting are the areas of accounting that…

Q: Standard Materials 6 unit $ 2 per unit Labor 1/4 hour 8 per hour Variable factory overhead 3/4 hour…

A: Journal - A journal is a thorough account that documents all of a company's financial activities. It…

Q: For the year 2021, the partnership of AMMAR and BANU realized a net profit of P240,000. The capital…

A:

Q: A business operated at 100% of capacity during its first month and incurred the following costs:…

A: Introduction: Total cost is an accounting measure. It includes not only the actual monetary spend…

Q: (a) Why is the BSC approach to performance measurement more useful for measuring performance for…

A: The Balanced Scorecard is a method which displays organization's performance into four dimensions…

Q: Comment on the movements in the ratios over two years and adequacy of the level of gearing and…

A: Financial ratios refers to the ratios which determine the line items of the financial items of the…

Q: The financial condition of two companies is expressed in the following accounting equation:…

A: Dividends are paid to investors from the retained earnings only of there is available balance for…

Q: Your company bought a production line 5 years ago for $75,000. At that time, it was estimated to…

A: Replacement analysis refers to the method which helps the company in deciding whether the present…

Q: Jackson, Inc. is a manufacturer of lead crystal glasses. The standard direct materials quantity is…

A: Variances are the differences between the costs that have been budgeted by an entity relating to…

Q: A business operated at 100% of capacity during its first month, with the following results: Sales…

A: Absorption Costing - Under this method of the income statement, all the product costs whether fixed…

Q: The functions of and documents generated by which of the below departments determine when a…

A: Lets understand the basics. In organization, there are various department which are inter connected…

Q: If Hawkins Company has net income of $45,200, which closing entry is correct? Group of answer…

A: Closing Entry :— It is the journal entry passed at the end of the period to transfer balances of…

Q: Nowitzki Corporation manufactures swishbombs,a basketball related product. They have a heavily…

A: The traditional method of overhead allocation is based on a predetermined overhead rate. The…

Q: BK Corporation estimated its overhead rate for the year to be SAR 140 per direct labor hour. Job…

A: Lets understand the basics. Job costing is a technique under which cost of preparing and selling of…

Q: A business operated at 100% of capacity during its first month and incurred the following costs:…

A: Introduction: A variable costing income statements report that subtracts variable expenses from…

Q: Use the following time value of money tables for Questions 1-4. Round answers to the nearest dollar.…

A: Solution: Amount deposited to saving account = $3,000 Interest rate = 6% Period = 3 Years

Q: PLEASE PROVIDE COMPUTATION!

A: Equity Share - Share capital and equity finance are other names for equity capital. It is referred…

Q: After the accounts have been adjusted at April 30, the end of the fiscal year, the following…

A: Preparation of closing entries is a method used by the business entity to close its temporary…

Q: Provide at least three plausible explanations for a situation where the announcement of a $30…

A: Securities and Exchange Commission requires publicly traded companies to report their quarterly…

Q: entity shall report information about an operating segment that meets any of the following…

A: Under segment reporting, operating segments require to be reported which covers under specified…

Q: Conversion cost consist of A) direct materials and direct labour B) direct labour and manufacturing…

A: There are two types of costs - 1. Prime Cost 2. Conversion Cost This costs are required to prepare…

Q: Asset management ratios Market value ratios Debt management ratios Liquidity ratios

A: Lets understand the basics. Management calculate various ratios to calculate the result of the…

Q: Direction. Read and understand the case and answer the requirements. On December 31, 2020, Shipyard,…

A: The cumulative profit that remains with the firm after the dividend payment is made is referred to…

Q: 10 Max was party to a cross-purchase, buy-sell agreement when he died and owned 100 shares of TKL…

A: Capital gain refers to the profit earned by selling assets it may include real estate, shares,…

Q: MY FRIEND AND I ARE SPLITTING THE COST OF EVERYTHING. I SPENT $1162.00 SHE SPENT $733.00. TO MAKE…

A: Cost Incurred :— cost incurred is a cost for which a business has become liable, even if it has not…

Q: If an entity prepares restated financial statements in accordance with the requirements of IAS29,…

A: Financial statements refer to the recording of the business activities in written form and…

Q: Return on Equity* Return on Capital Employed* Gross profit margin Operating profit margin Interest…

A: Lets understand the basics. Return on equity shows how much return is generated by using the equity…

Q: On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83,660…

A: Balance sheet is the financial statement which is prepared to check the financial health of the…

Q: Estimated inventory (units), July 1 Desired inventory (units), July 31 Expected sales volume…

A: Given : Estimated inventory (units) July 1 = 8500 desired inventory (units) July 31 = 10500 Expected…

Q: efine the term materiality and explain why it may be d

A: Materiality is quite important in preparing the financial statement and it is very important to the…

Q: Christina bought a car that cost $18000. She put $4000 down and financed the rest at 3.8%/a…

A: Time value of money :— According to this concept, value of money in present day is greater than…

Q: Given the following information, what is the amount of Equity. Buildings £50,000, Inventory £7,500,…

A: Stockholders' equity: Stockholders' equity means the net assets available to shareholders after…

Q: *** For the government wide. I need help with this only**** Previously unrestricted cash of…

A: Journal - Writing a general diary entry allows one to visualize the financial operations of any…

Q: 1. Determine the margin of safety units for Macro Hardware Limited in the financial year ending 30…

A: Given in the question: Information for the year which end on 30 June 2022 Laptop…

Q: Part 1 Accounting for Merchandise Inventory Purchases ournalize the following transactions of…

A: Journal Entry :— It is an act of recording transaction in accounting books. We record journal…

Q: you some advice. He would like to know how much he can contribut the current year without over…

A: RRSP is registered retirement saving plan in which you can deposit certain amount which is tax…

Q: What are some examples of effective monitoring and control practices, and how do they help address…

A: Introduction: A budget is founded on a set of hypotheses that, in most cases, aren't too dissimilar…

Q: Assume Allen incurs a $6,100 operating loss. The remaining assets are sold for the value shown on…

A: Accounting Equation :— It states that companies assets is equal to total liabilities plus…

Q: The international CPA firm of Arthur Andersen faced significant liability in conjunction with its…

A: A case audit is typically carried out by an auditor, though an audit coordinator may also do it.…

Q: Patel and Sons Inc. uses a standard cost system to apply factory overhead costs to units produced.…

A: Journal entry :— It is an act of recording any transaction in books of account. When transaction…

Q: company received a deposit for $19600 last month for services to be provided in the current month,…

A: Unearned Service Revenue :— Unearned revenue is money received by an individual or company for a…

Q: b. What is the net decrease in cash during the month? 8,100 c. What is the net increase in retained…

A: >Requirement [f], [g] and [h] has been asked. >Net Income retained in the business is the…

Q: 14) An employer has computed the following amounts for its employee Mary during a week in January:…

A: Given in the question: Gross Wages $500.00 FNPF $80.00 LICI $50.00 PAYE…

Q: Question 9 Assume that once you have done the analysis, you have found that it is visible to run the…

A: Funding is the most critical part of starting a business since it cannot be started without it.…

Q: The public accounting firm of Hanson and Brown was expanding very rapidly. Consequently, it hired…

A: Financial statements are the reports which are prepared to signify the financial health and…

Q: Beginning of the year: Assets Liabilities End of the year: Assets Liabilities During the year:…

A: Equity is the amount which represents the ownership of the shareholders in the business entity.…

Q: A client that recently loosened its credit-granting policies uses percentages of aging categories as…

A: Lets understand the basics. Management prepares allowance for doubtful debt account in order to…

Q: Sawyer and Sawyer, CPAs, audited the financial statements of Rattler Corporation that were included…

A: Audit the Financial statement :— Auditor Audit the Financial Statement of the Entity &…

Step by step

Solved in 2 steps

- Dallas Company loaned to Ewing Company on December 1, 2019. Ewing will pay Dallas $720 of interest ($60 per month) on November 30, 2020. Dallass adjusting entry at December 31, 2019, is: a. Interest Expense ........... 60 c. Interest Receivable ....... 60 Cash ......................... 60 Interest Income ........ 60 b. Cash ............................ 60 d. No adjusting entry is required. Interest Income ........ 60At the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000

- Rons Diner received the following bills for December 2019 utilities: • Electricity: $625 on December 29, 2019 • Telephone: $150 on January 5, 2020 Both bills were paid on January 10, 2020. On the December 31, 2019, balance sheet, Rons Diner will report accrued expenses of: a. $0 b. $150. c. $625. d. $775.Umasa Company reported rental revenue of P2,210,000 in the cash basis income tax return for the year ended November 30, 2020. Rent receivable – Nov. 30, 2020 is P1,060,000; Rent receivable – Nov. 30, 2019 is P800,000; and Uncollectible rent written off during the fiscal year is P30,000. Under accrual basis, what amount should be reported as rent revenue? P2,240,000 P1,920,000 P1,980,000 P2,500,00016. Umasa Company reported rental revenue of P2,210,000 in the cash basis income tax return for the year ended November 30, 2020. Rent receivable – Nov. 30, 2020 is P1,060,000; Rent receivable – Nov. 30, 2019 is P800,000; and Uncollectible rent written off during the fiscal year is P30,000. Under accrual basis, what amount should be reported as rent revenue? a. P1,920,000 b. P2,240,000 c. P2,500,000 d. P1,980,000

- Under the accrual basis rental income of EL Company for the calendar year 2020 is P600,000. Additional information regarding rental income are presented below: Unearned rental income, January 1, 2020 P50,000 Unearned rental income, December 31, 2020 75,000 Accrued rental income, January 1, 2020 30,000 Accrued rental income, December 31, 2020 40,000 Under the cash basis, how much rental income should be reported by EL Company in year 2020? Group of answer choices d. P655,000 c. P625,000 b. P615,000 a. P585,000KPL Ltd has a year end of 31 March 2021. During the year it paid £1,600 for rent. At the start of the year it had an accrual of £400 and at 31 March 2021 had prepaid £250 of rent in respect of the year starting 1 April 2021. What is the charge to the income account for the year ended 31 March 2021? a) £950 b) £1,600 c) £1,450 d) £1,750During 2020, Mami Corp. received P8,000,000 from tenants. The balance sheet contained the following data: 2019 2020 Rentals receivable P 960,000 P1,240,000 Unearned rentals 3,200,000 2,400,000 What amount of rental revenue should be reported for 2020?

- Light Co. reported rent income of P600,000 under cash basis accounting for 2020. Additional information as follows: Unearned rental income, December 31, 2019, 50,000 Unearned rental income , December 31, 2020, 75,000 Accrued rental income , December 31, 2019, 30,000 Accrued rental income, December 31, 2020, 40,000 How much is the rental collection on 2020?During 2020, JamJam Company received P8,000,000 from tenants. The balance sheet contained the following data: 2019 2020Rentals receivable P 960,000 P1,240,000Unearned rentals 3,200,000 2,400,000What amount of rental revenue should be reported for 2020?Under the accrual basis, rental income of EM Corporation for the calendar year 2019 is ₱600,000. Additional information regarding rental income are presented as follows: Unearned rental income, January 1, 2019 –₱50,000; Unearned rental income, December 31, 2019 –₱75,000; Accrued rental income, January 1, 2019 –₱30,000; Accrued rental income, December 31, 2019 –₱40,000. Under the cash basis, how much rental income should be reported? ₱ 625,000 ₱ 655,000 ₱ 585,000 ₱ 615,000