Instructions Last Unguaranteed Financial Inc. purchased the following trading securities during Year 1, its first year of operations: Name Arden Enterprises Inc. French Broad Industries Inc. Pisgah Construction Inc. Total Arden Enterprises Inc. French Broad Industries Inc. Pisgah Construction Inc. Required: Number of Shares Cost 4,800 2,660 1,670 The market price per share for the trading security portfolio on December 31, Year 1, was as follows: Market Price per Share, Dec. 31, Year 1 $34 27 $134,400 60 58,520 106,880 $299,800

Instructions Last Unguaranteed Financial Inc. purchased the following trading securities during Year 1, its first year of operations: Name Arden Enterprises Inc. French Broad Industries Inc. Pisgah Construction Inc. Total Arden Enterprises Inc. French Broad Industries Inc. Pisgah Construction Inc. Required: Number of Shares Cost 4,800 2,660 1,670 The market price per share for the trading security portfolio on December 31, Year 1, was as follows: Market Price per Share, Dec. 31, Year 1 $34 27 $134,400 60 58,520 106,880 $299,800

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 16E

Related questions

Question

Transcribed Image Text:Instructions

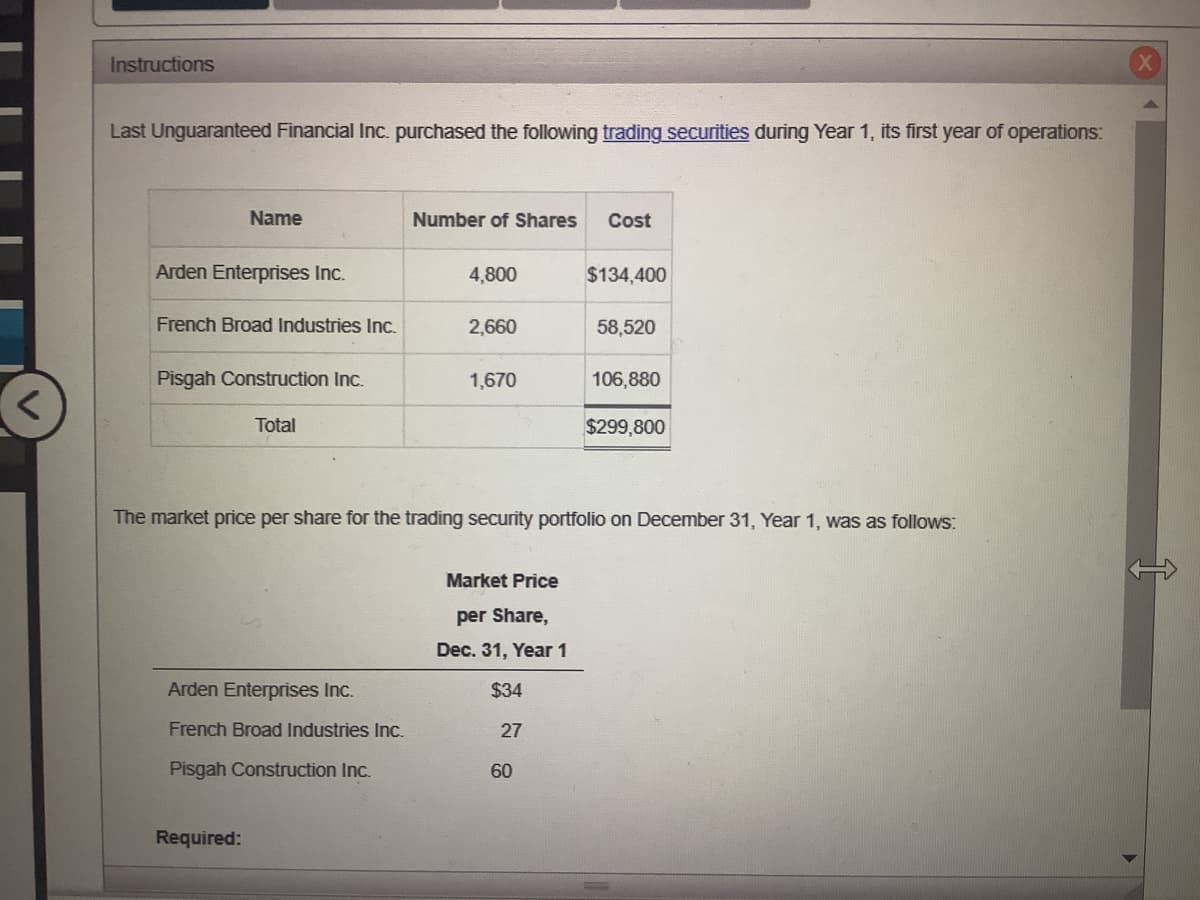

Last Unguaranteed Financial Inc. purchased the following trading securities during Year 1, its first year of operations:

Name

Arden Enterprises Inc.

French Broad Industries Inc.

Pisgah Construction Inc.

Total

Arden Enterprises Inc.

French Broad Industries Inc.

Pisgah Construction Inc.

Required:

Number of Shares Cost

4,800

2,660

1,670

The market price per share for the trading security portfolio on December 31, Year 1, was as follows:

Market Price

per Share,

Dec. 31, Year 1

$34

27

$134,400

60

58,520

106,880

$299,800

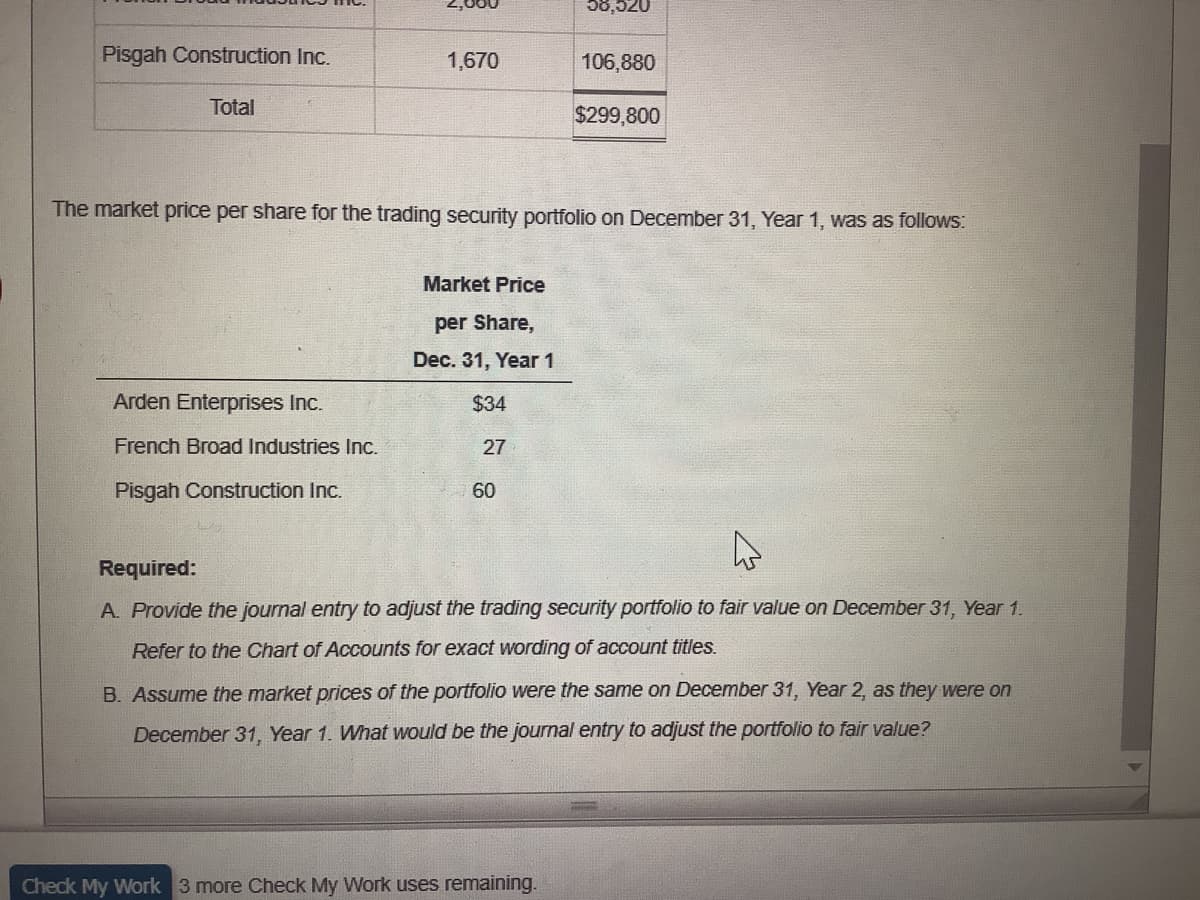

Transcribed Image Text:Pisgah Construction Inc.

Total

1,670

Arden Enterprises Inc.

French Broad Industries Inc.

Pisgah Construction Inc.

Market Price

per Share,

Dec. 31, Year 1

$34

27

The market price per share for the trading security portfolio on December 31, Year 1, was as follows:

60

58,520

106,880

$299,800

Check My Work 3 more Check My Work uses remaining.

Required:

A. Provide the journal entry to adjust the trading security portfolio to fair value on December 31, Year 1.

Refer to the Chart of Accounts for exact wording of account titles.

B. Assume the market prices of the portfolio were the same on December 31, Year 2, as they were on

December 31, Year 1. What would be the journal entry to adjust the portfolio to fair value?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning