1. Discovered that manufacturing equipment was being amortized using a 9% declining balance basis, rather than being amortized over its nine year life according to corporate accounting policy.

1. Discovered that manufacturing equipment was being amortized using a 9% declining balance basis, rather than being amortized over its nine year life according to corporate accounting policy.

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

9

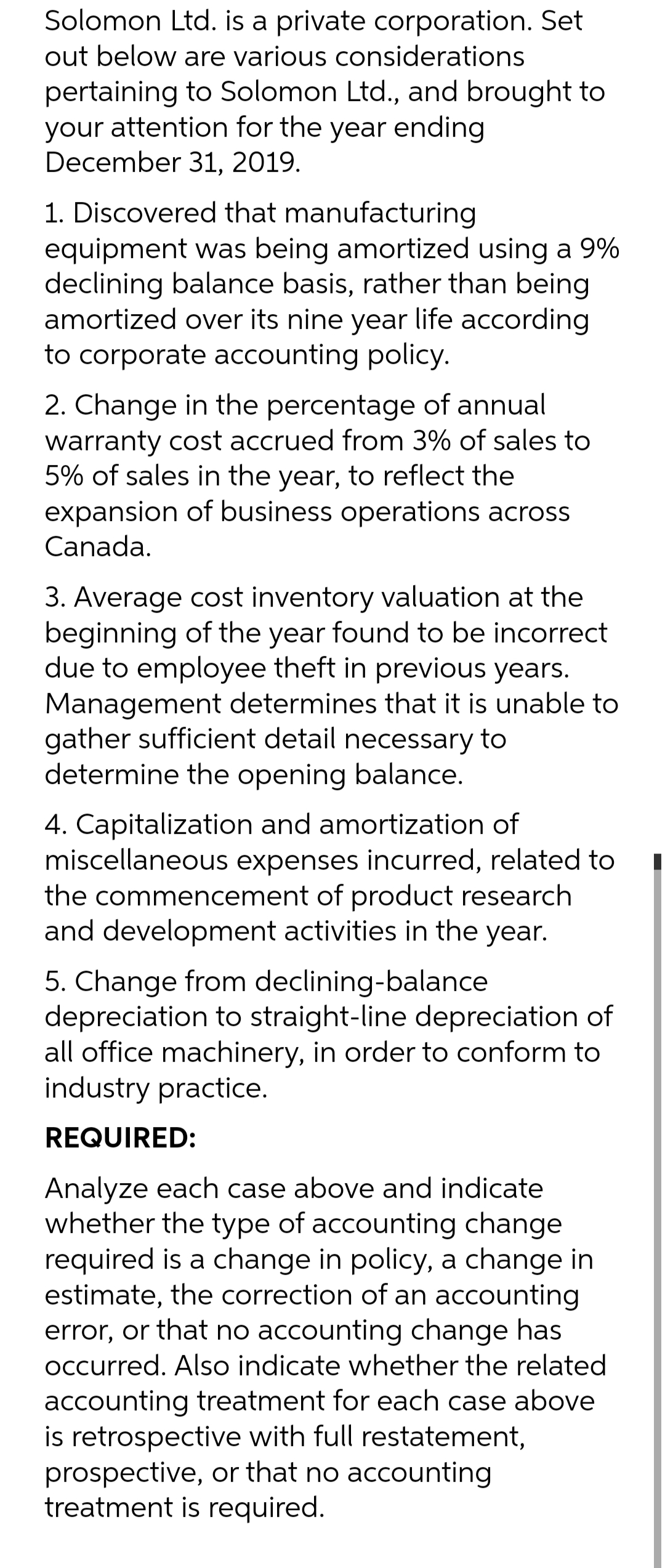

Transcribed Image Text:Solomon Ltd. is a private corporation. Set

out below are various considerations

pertaining to Solomon Ltd., and brought to

your attention for the year ending

December 31, 2019.

1. Discovered that manufacturing

equipment was being amortized using a 9%

declining balance basis, rather than being

amortized over its nine year life according

to corporate accounting policy.

2. Change in the percentage of annual

warranty cost accrued from 3% of sales to

5% of sales in the year, to reflect the

expansion of business operations across

Canada.

3. Average cost inventory valuation at the

beginning of the year found to be incorrect

due to employee theft in previous years.

Management determines that it is unable to

gather sufficient detail necessary to

determine the opening balance.

4. Capitalization and amortization of

miscellaneous expenses incurred, related to

the commencement of product research

and development activities in the year.

5. Change from declining-balance

depreciation to straight-line depreciation of

all office machinery, in order to conform to

industry practice.

REQUIRED:

Analyze each case above and indicate

whether the type of accounting change

required is a change in policy, a change in

estimate, the correction of an accounting

error, or that no accounting change has

occurred. Also indicate whether the related

accounting treatment for each case above

is retrospective with full restatement,

prospective, or that no accounting

treatment is required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning