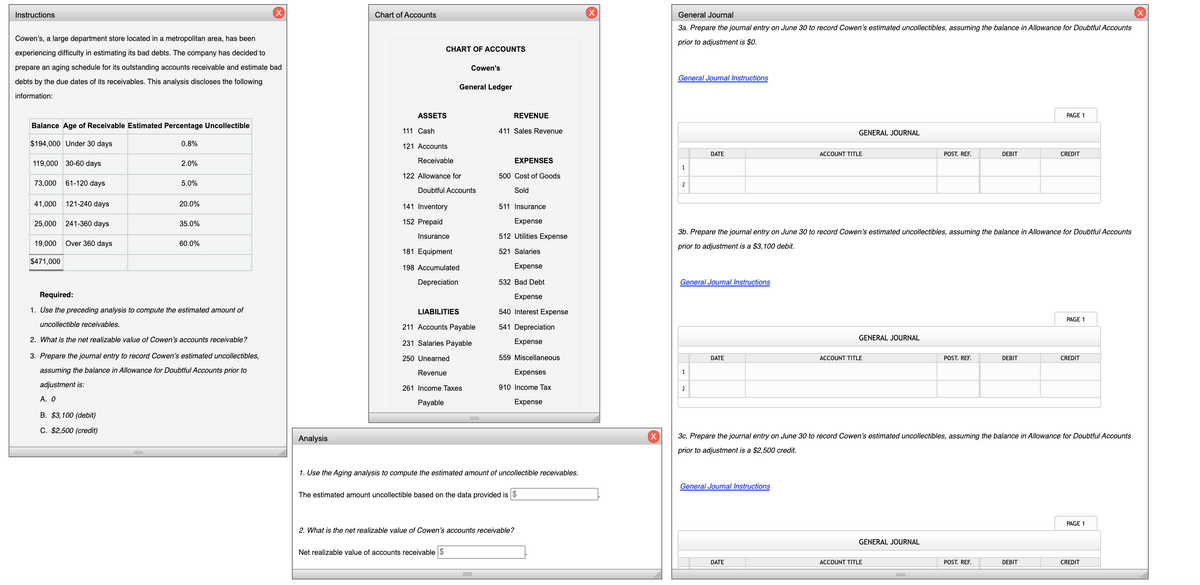

Instructions X. Cowen's, a large department store located in a metropolitan area, has been experiencing difficulty in estimating its bad debts. The company has decided to prepare an aging schedule for its outstanding accounts receivable and estimate bad debts by the due dates of its receivables. This analysis discloses the following information: Balance Age of Receivable Estimated Percentage Uncollectible $194,000 Under 30 days 0.8% 119,000 30-60 days 2.0% 73,000 61-120 days 5.0% 41,000 121-240 days 20.0% 25,000 241-360 days 35.0% 19,000 Over 360 days 60.0% $471,000 Required: 1. Use the preceding analysis to compute the estimated amount of uncollectible receivables. 2. What is the net realizable value of Cowen's accounts receivable? 3. Prepare the joumal entry to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts prior to adjustment is: A. O B. $3, 100 (debit) C. S2.500 (credit)

Instructions X. Cowen's, a large department store located in a metropolitan area, has been experiencing difficulty in estimating its bad debts. The company has decided to prepare an aging schedule for its outstanding accounts receivable and estimate bad debts by the due dates of its receivables. This analysis discloses the following information: Balance Age of Receivable Estimated Percentage Uncollectible $194,000 Under 30 days 0.8% 119,000 30-60 days 2.0% 73,000 61-120 days 5.0% 41,000 121-240 days 20.0% 25,000 241-360 days 35.0% 19,000 Over 360 days 60.0% $471,000 Required: 1. Use the preceding analysis to compute the estimated amount of uncollectible receivables. 2. What is the net realizable value of Cowen's accounts receivable? 3. Prepare the joumal entry to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts prior to adjustment is: A. O B. $3, 100 (debit) C. S2.500 (credit)

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter9: Receivables

Section: Chapter Questions

Problem 12E: Using the data in Exercise 9-11, assume that the allowance for doubtful accounts for Selbys Bike Co....

Related questions

Question

Transcribed Image Text:Instructions

(X)

Chart of Accounts

(X)

General Journal

3a. Prepare the journal entry on June 30 to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts

Cowen's, a large department store located in a metropolitan area, has been

prior to adjustment is $0.

CHART OF ACCOUNTS

experiencing difficulty in estimating its bad debts. The company has decided to

prepare an aging schedule for its outstanding accounts receivable and estimate bad

Cowen's

General Journal Instructions

debts by the due dates of its receivables. This analysis discloses the following

General Ledger

information:

ASSETS

REVENUE

PAGE 1

Balance Age of Receivable Estimated Percentage Uncollectible

111 Cash

411 Sales Revenue

GENERAL JOURNAL

$194,000 Under 30 days

0.8%

121 Accounts

DATE

ACCOUNT TITLE

POST. REF.

DEBIT

CREDIT

Receivable

EXPENSES

119,000 30-60 days

2.0%

1

122 Allowance for

500 Cost of Goods

73,000

61-120 days

5.0%

2

Doubtful Accounts

Sold

41,000

121-240 days

20.0%

141 Inventory

511 Insurance

25,000

241-360 days

35.0%

152 Prepaid

Expense

3b. Prepare the journal entry on June 30 to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts

Insurance

512 Utilities Expense

19,000

Over 360 days

60.0%

prior to adjustment is a $3,100 debit.

181 Equipment

521 Salaries

$471,000

198 Accumulated

Expense

Depreciation

532 Bad Debt

General Journal Instructions

Required:

Expense

1. Use the preceding analysis to compute the estimated amount of

LIABILITIES

540 Interest Expense

PAGE 1

uncollectible receivables.

211 Accounts Payable

541 Depreciation

2. What is the net realizable value of Cowen's accounts receivable?

GENERAL JOURNAL

231 Salaries Payable

Expense

3. Prepare the journal entry to record Cowen's estimated uncollectibles,

250 Unearned

559 Miscellaneous

DATE

ACCOUNT TITLE

POST. REF.

DEBIT

CREDIT

assuming the balance in Allowance for Doubtful Accounts prior to

Revenue

Expenses

adjustment is:

910 Income Tax

261 Income Taxes

2

A. O

Payable

Expense

В. $3,100 (debit)

C. $2,500 (credit)

Analysis

3c. Prepare the journal entry on June 30 to record Cowen's estimated uncollectibles, assuming the balance in Allowance for Doubtful Accounts

prior to adjustment is a $2,500 credit.

1. Use the Aging analysis to compute the estimated amount of uncollectible receivables.

General Journal Instructions

The estimated amount uncollectible based on the data provided is $

PAGE 1

2. What is the net realizable value of Cowen's accounts receivable?

GENERAL JOURNAL

Net realizable value of accounts receivable $

DATE

ACCOUNT TITLE

POST. REF.

DEBIT

CREDIT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College