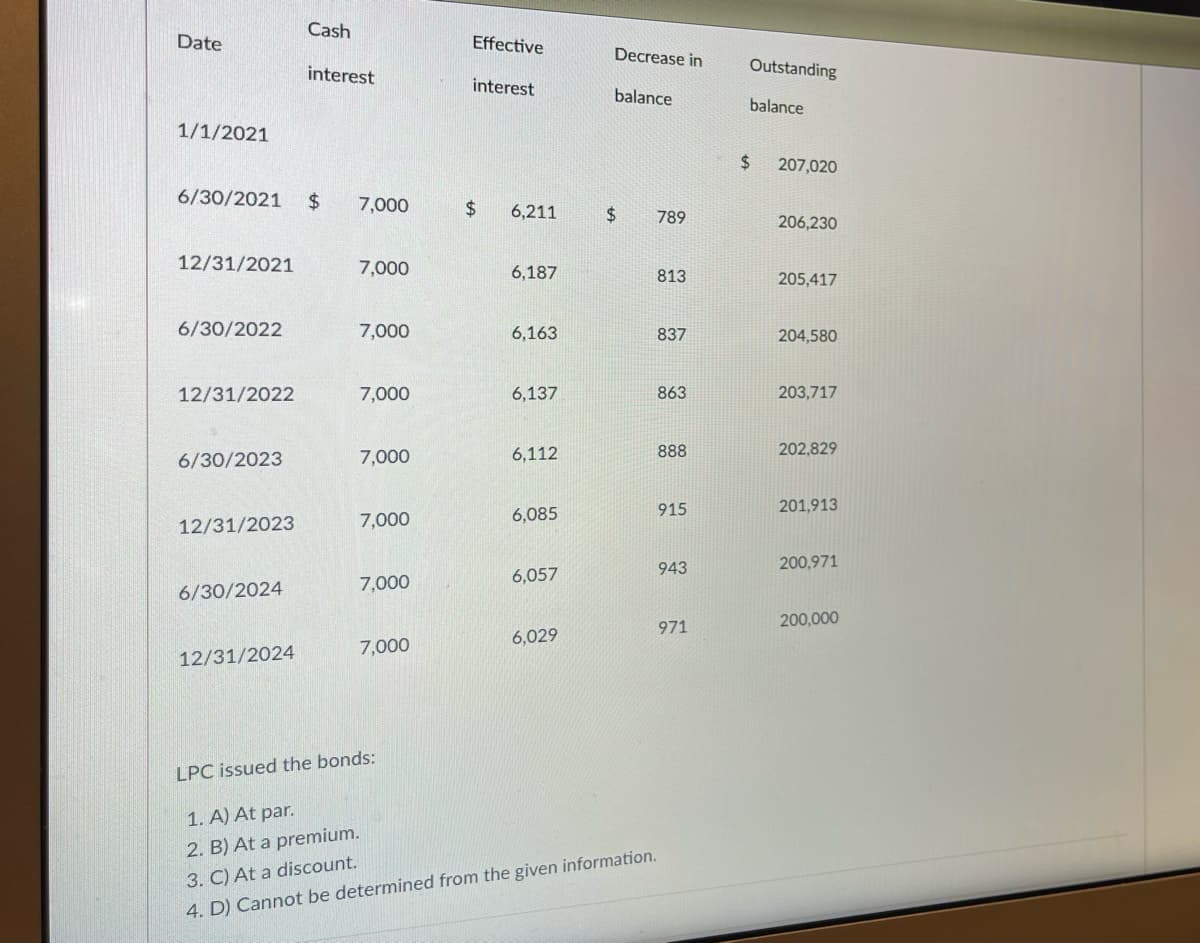

interest balance balance 1/1/2021 24 207,020 6/30/2021 7,000 24 6,211 789 206,230 12/31/2021 7,000 6,187 813 205,417 6/30/2022 7,000 6,163 837 204,580 12/31/2022 7,000 6,137 863 203,717 6/30/2023 7,000 6,112 888 202,829 915 201,913 7,000 6,085 12/31/2023 943 200,971 7,000 6,057 6/30/2024 971 200,000 6,029 7,000 12/31/2024 LPC issued the bonds: 1. A) At par. ium %24

interest balance balance 1/1/2021 24 207,020 6/30/2021 7,000 24 6,211 789 206,230 12/31/2021 7,000 6,187 813 205,417 6/30/2022 7,000 6,163 837 204,580 12/31/2022 7,000 6,137 863 203,717 6/30/2023 7,000 6,112 888 202,829 915 201,913 7,000 6,085 12/31/2023 943 200,971 7,000 6,057 6/30/2024 971 200,000 6,029 7,000 12/31/2024 LPC issued the bonds: 1. A) At par. ium %24

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:Cash

Date

Effective

Decrease in

interest

Outstanding

interest

balance

balance

1/1/2021

24

207,020

6/30/2021

24

7,000

24

6,211

24

789

206,230

12/31/2021

7,000

6,187

813

205,417

6/30/2022

7,000

6,163

837

204,580

12/31/2022

7,000

6,137

863

203,717

6/30/2023

7,000

6,112

888

202,829

915

201,913

7,000

6,085

12/31/2023

943

200,971

7,000

6,057

6/30/2024

200,000

971

6,029

7,000

12/31/2024

LPC issued the bonds:

1. A) At par.

2. B) At a premium.

3. C) At a discount.

4. D) Cannot be determined from the given information.

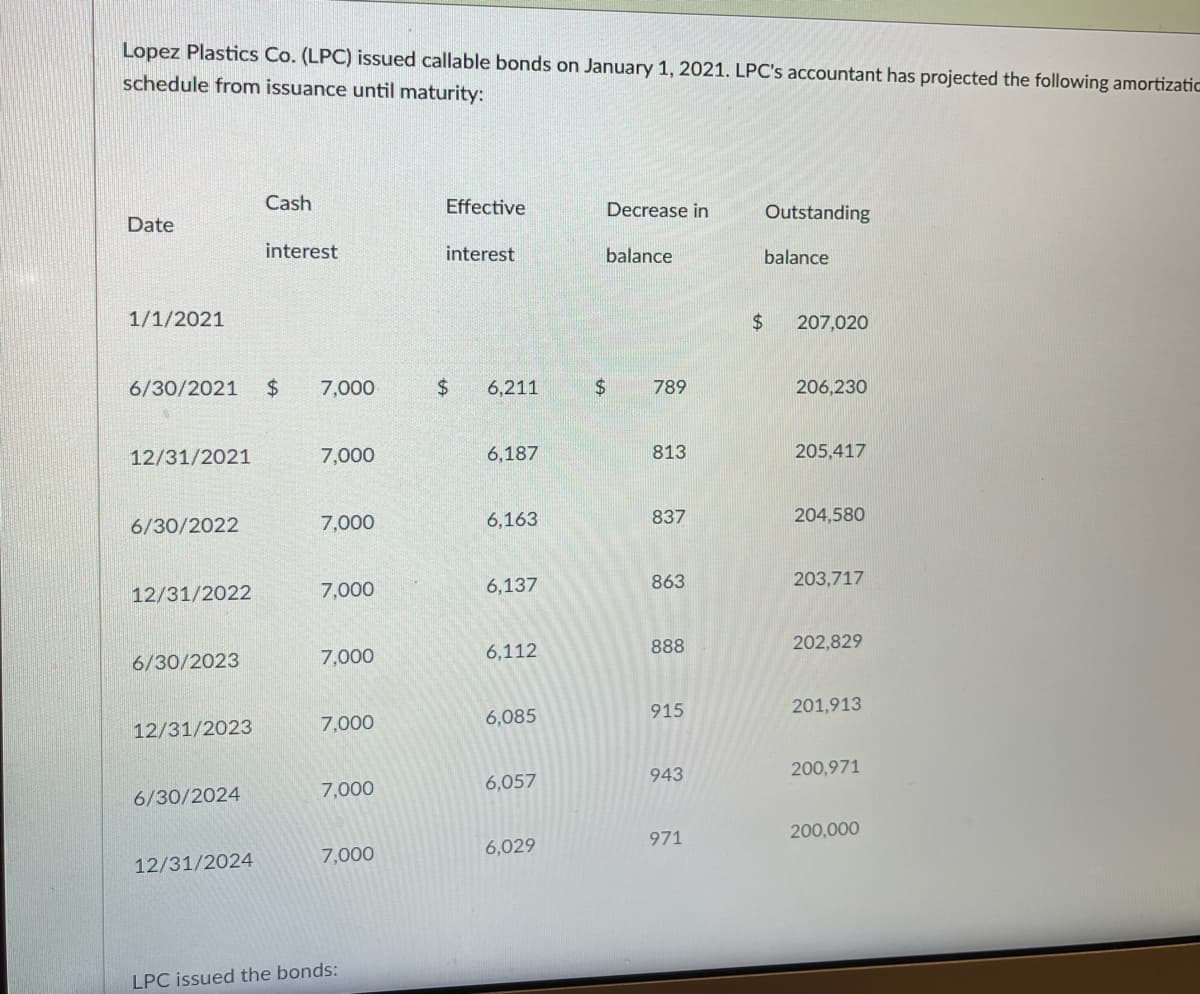

Transcribed Image Text:Lopez Plastics Co. (LPC) issued callable bonds on January 1, 2021. LPC's accountant has projected the following amortizatic

schedule from issuance until maturity:

Cash

Effective

Decrease in

Date

Outstanding

interest

interest

balance

balance

1/1/2021

24

207,020

6/30/2021

2$

7,000

$4

6,211

24

789

206,230

12/31/2021

7,000

6,187

813

205,417

6/30/2022

7,000

6,163

837

204,580

12/31/2022

7,000

6,137

863

203,717

6/30/2023

7,000

6,112

888

202,829

12/31/2023

7,000

6,085

915

201,913

943

200,971

6/30/2024

7,000

6,057

971

200,000

7,000

6,029

12/31/2024

LPC issued the bonds:

Expert Solution

Step 1

The Bonds are a source of financial which can be issued at par, at discount or at premium. When the issue price is higher than face value then that means bonds are issued at premium.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning