Question 21 What is the January Sales Revenue related to Job 3? Question 21 options: $380,000 $540,000 $500,000 $450,000 $100,000 Question 22 What is the January Cost of Goods Sold (CGS) related to Job 1? Question 22 options: $148,000 $180,000 $200,000 $218,000 $44,000 Question 23 What is the January Cost of Goods Sold (CGS) related to Job 2? Question 23 options: $180,000 $218,000 $44,000 $148,000 $200,000 Question 24 What is the January Cost of Goods Sold (CGS) related to Job 3? Question 24 options: $218,000 $44,000 $180,000

Question 21 What is the January Sales Revenue related to Job 3? Question 21 options: $380,000 $540,000 $500,000 $450,000 $100,000 Question 22 What is the January Cost of Goods Sold (CGS) related to Job 1? Question 22 options: $148,000 $180,000 $200,000 $218,000 $44,000 Question 23 What is the January Cost of Goods Sold (CGS) related to Job 2? Question 23 options: $180,000 $218,000 $44,000 $148,000 $200,000 Question 24 What is the January Cost of Goods Sold (CGS) related to Job 3? Question 24 options: $218,000 $44,000 $180,000

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 6E: Foamy Inc. manufactures shaving cream and uses the weighted average cost method. In November,...

Related questions

Question

Question 21

What is the January Sales Revenue related to Job 3?

|

|

$380,000 |

|

|

$540,000 |

|

|

$500,000 |

|

|

$450,000 |

|

|

$100,000 |

Question 22

What is the January Cost of Goods Sold (CGS) related to Job 1?

|

|

$148,000 |

|

|

$180,000 |

|

|

$200,000 |

|

|

$218,000 |

|

|

$44,000 |

Question 23

What is the January Cost of Goods Sold (CGS) related to Job 2?

|

|

$180,000 |

|

|

$218,000 |

|

|

$44,000 |

|

|

$148,000 |

|

|

$200,000 |

Question 24

What is the January Cost of Goods Sold (CGS) related to Job 3?

|

|

$218,000 |

|

|

$44,000 |

|

|

$180,000 |

|

|

$200,000 |

|

|

$148,000 |

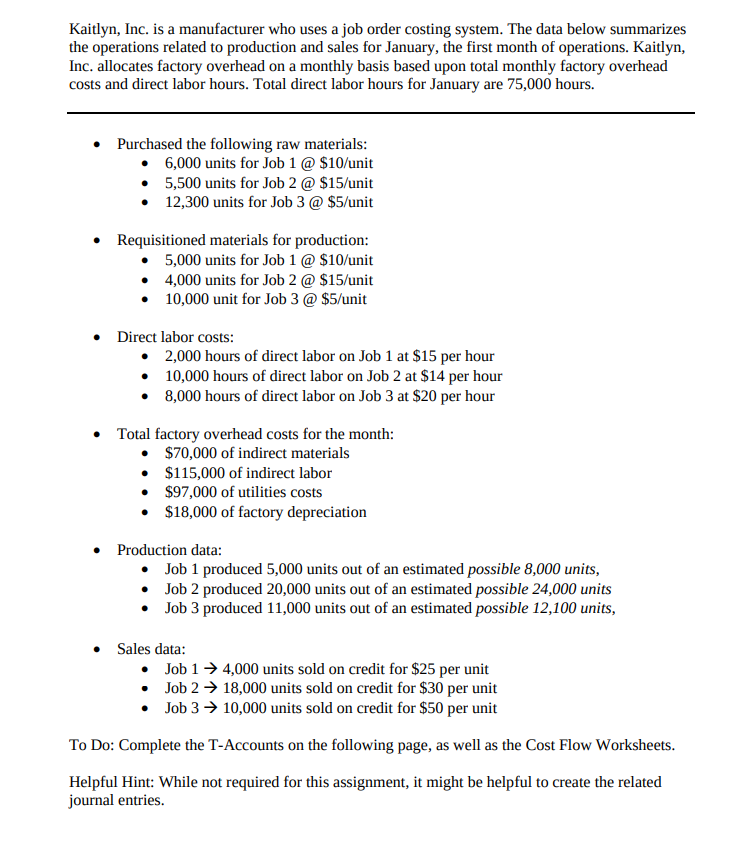

Transcribed Image Text:Kaitlyn, Inc. is a manufacturer who uses a job order costing system. The data below summarizes

the operations related to production and sales for January, the first month of operations. Kaitlyn,

Inc. allocates factory overhead on a monthly basis based upon total monthly factory overhead

costs and direct labor hours. Total direct labor hours for January are 75,000 hours.

Purchased the following raw materials:

• 6,000 units for Job 1 @ $10/unit

• 5,500 units for Job 2 @ $15/unit

• 12,300 units for Job 3 @ $5/unit

Requisitioned materials for production:

• 5,000 units for Job 1 @ $10/unit

• 4,000 units for Job 2 @ $15/unit

• 10,000 unit for Job 3 @ $5/unit

• Direct labor costs:

• 2,000 hours of direct labor on Job 1 at $15 per hour

• 10,000 hours of direct labor on Job 2 at $14 per hour

• 8,000 hours of direct labor on Job 3 at $20 per hour

• Total factory overhead costs for the month:

• $70,000 of indirect materials

• $115,000 of indirect labor

• $97,000 of utilities costs

• $18,000 of factory depreciation

• Production data:

• Job 1 produced 5,000 units out of an estimated possible 8,000 units,

• Job 2 produced 20,000 units out of an estimated possible 24,000 units

• Job 3 produced 11,000 units out of an estimated possible 12,100 units,

Sales data:

• Job 1→ 4,000 units sold on credit for $25 per unit

• Job 2 → 18,000 units sold on credit for $30 per unit

• Job 3 → 10,000 units sold on credit for $50 per unit

To Do: Complete the T-Accounts on the following page, as well as the Cost Flow Worksheets.

Helpful Hint: While not required for this assignment, it might be helpful to create the related

journal entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,