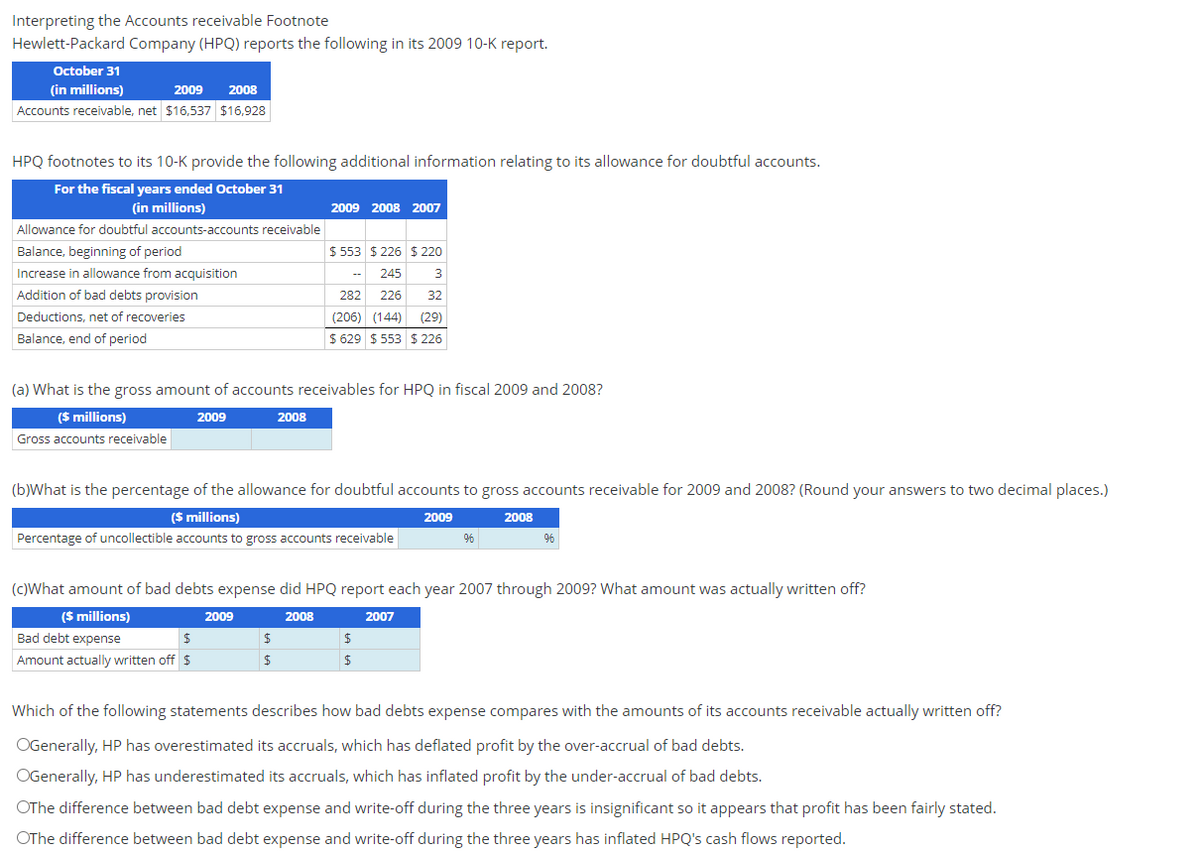

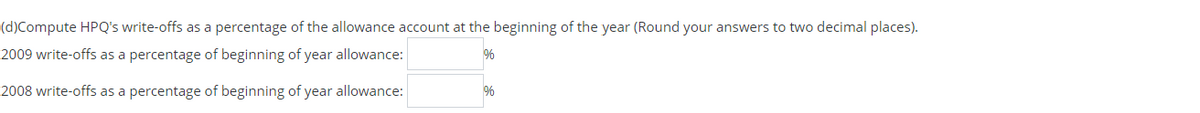

Interpreting the Accounts receivable Footnote Hewlett-Packard Company (HPQ) reports the following in its 2009 10-K report. October 31 (in millions) 2009 2008 Accounts receivable, net $16,537 $16,928 HPQ footnotes to its 10-K provide the following additional information relating to its allowance for doubtful accounts. For the fiscal years ended October 31 (in millions) Allowance for doubtful accounts-accounts receivable Balance, beginning of period Increase in allowance from acquisition Addition of bad debts provision Deductions, net of recoveries Balance, end of period (a) What is the gross amount of accounts receivables for HPQ in fiscal 2009 and 2008? ($ millions) 2009 Gross accounts receivable 2009 2008 2007 2008 2009 $ 553 $226 $ 220 245 3 282 226 32 (206) (144) (29) $ 629 $553 $ 226 (b)What is the percentage of the allowance for doubtful accounts to gross accounts receivable for 2009 and 2008? (Round your answers to two decimal places.) ($ millions) 2009 Percentage of uncollectible accounts to gross accounts receivable $ $ 96 (c)What amount of bad debts expense did HPQ report each year 2007 through 2009? What amount was actually written off? ($ millions) 2008 2007 Bad debt expense Amount actually written off $ $ $ 2008 96 Which of the following statements describes how bad debts expense compares with the amounts of its accounts receivable actually written off? OGenerally, HP has overestimated its accruals, which has deflated profit by the over-accrual of bad debts. OGenerally, HP has underestimated its accruals, which has inflated profit by the under-accrual of bad debts. OThe difference between bad debt expense and write-off during the three years is insignificant so it appears that profit has been fairly stated. OThe difference between bad debt expense and write-off during the three years has inflated HPO's cash flows reported.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps