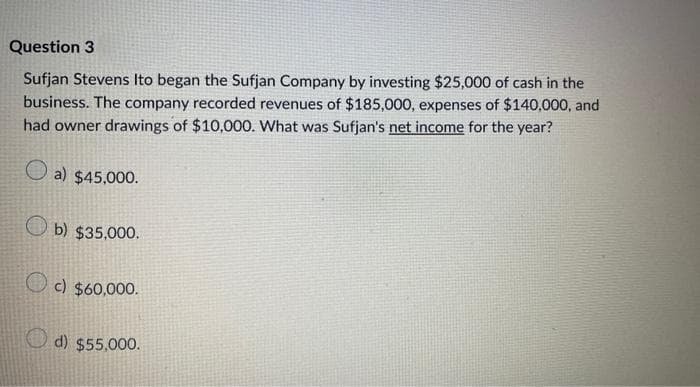

Question 3 Sufjan Stevens Ito began the Sufjan Company by investing $25,000 of cash in the business. The company recorded revenues of $185,000, expenses of $140,000, and had owner drawings of $10,000. What was Sufjan's net income for the year? a) $45,000. b) $35,000. c) $60,000. d) $55,000.

Q: Is depreciation expense closed? If so, is it closed to income summary like the other expense…

A: Depreciation Expenses It's crucial to think about how long assets will keep worth as well as how to…

Q: Inventories January 1 December 31 Materials $433,530 $546,250 Work in process 780,350 742,900…

A: Business organizations determine the cost of goods manufactured so as to know the production costs…

Q: Why is the balance sheet the most important instead of the cashflow sheet and the income statement?

A: The income statement, balance sheet, and statement of cash flows are the three primary types of…

Q: If the Gross profit is Rs. 5,000 and the net profit is 25% of the Gross profit. The ?expenses must…

A: Gross profit is sales revenue minus cost of goods sold. Net profit is gross profit minus expenses.…

Q: Matching concept Prudence Continuity Entity concept Accrual accounting Cash accounting Accounting…

A: Accounting concepts are the basic rules of an organization. It's like an accountant's guide. . It…

Q: It is now your second week working at Easy Laptops Pty Ltd, the large laptop manufacturer. You…

A: Costing systems are defined as the methods that an entity opts to measure and control its…

Q: Enumerate and explain five (5) powers of the BIR.

A: BIR stands for Bureau of Internal Revenue which is compulsory through law to assess as well as…

Q: On July 1, 20Y7, Pat Glenn established Half Moon Realty. Pat completed the following transactions…

A: The accounting equation states that assets equal to sum of liabilities and equity. The transactions…

Q: 1 Build the unadjusted trial balance columns from the given information. Only input amounts for…

A:

Q: 1. Prepare the journal entry to record Tamas Company’s issuance of 5,900 shares of $100 par value,…

A: Preferred stock is a kind of shares which are issued by the entity when it doesn't want to dilute…

Q: The Tayler Hiro Merchandising has the following trial balance as of January 1, 2019. Account Titles…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: The Jones Tire Company assembles two types of tires (truck tires, and car tires). Separate assembly…

A: The costs are classified as direct and indirect costs or variable and fixed cost. The direct costs…

Q: Calculate the missing information for the purchase. (Round your answers to the nearest cent.) Item…

A: Sales tax and excise tax are indirect taxes. Indirect taxes are indirectly collected from consumers.…

Q: At 1 July 2020, Flamingo Ltd acquired computer equipment at a cost of $900,000. The expected useful…

A: Depreciation expense for the period 1 July 2020 to 30 June 2021 = $900,000 - 05 years = $180,000…

Q: how do you get from 1,334,100 to 1,000,575

A: Solution: Payroll cost related to manufacturing is included in product cost, therefore same is…

Q: When the market rate of interest was 12%, Halprin Corporation issued $701,000, 11%, 10-year bonds…

A: One of the source used by the business organization in order to raise the funds is issue of bonds.…

Q: PROBLEM 7 Miyose Corporation, a manufacturing company, has provided the following data for the month…

A:

Q: Consider two hypothetical companies: A and B. At the beginning of year 1, each company buys an…

A: Answer:- Straight-line method depreciation meaning:- An asset is expensed over a long period of…

Q: On January 1, Year 1, Martin Mowing Company paid $64,000 to purchase a truck. The truck was expected…

A: Depreciation is the expense which is non-cash in nature and it is reported on the income statement…

Q: Month July August September October November December Planned amount $1,250,000 1,500,000 1,850,000…

A: According to the given question, we are required to prepare the cash budget for the last half of the…

Q: On 31 December 2017, Snow Lake Pty Ltd purchased computers on credit for $60,000 plus GST. It has an…

A: Depreciation :— The decreasing value of Assets due to Wear, Tear & Obsolescence. Depreciation…

Q: XYZ Company's accounting records reported the following account balances as of December 31, 2024:…

A: Lets understand the basics. For calculating the missing figures, we need to first calculate net…

Q: Mary Company collected cash from an account receivable. Which of the following financial statements…

A: The transactions and events which can be measured in monetary terms are reported in the books…

Q: Which of the following is true about plan assets? Any excess return on plan assets are earned to…

A: Plan assets refer to the form of assets that are held onto by the owner for long-term employee…

Q: 4. Thom J.A.M. Company has P80,000 to invest and is considering two different projects, Vlogging and…

A: Compute the net present value of project blogging as follows: Particulars Period Project…

Q: Mar. 22) The company received $6,200 cash as partial payment for the work completed on March 9.…

A: According to the given question, we are required to prepare a journal entry. Journal entry: The…

Q: d. What is the percentage cost of trade credit to customers who do not take the discount and pay in…

A: Accounts receivables are the current assets which allows the customers of an entity to take some…

Q: Required: g. Adjusting entry on December 31, 2020, to estimate uncollectible accounts based on a…

A: Accounts Receivable are the current assets, to whom credit is provided so that they can pay the…

Q: Prepare the Financial Statements includes the Statement of cash flow thank you

A: Financial statements are those statements which are prepared at the end of financial period for…

Q: Balance Sheet

A: From the available info we will prepare balance sheet as per given…

Q: You have been asked by the proprietor of the SANDOVAL CO. to verify the accountability of the…

A: Hi, as you have posted more than three sub parts but as per the bartleby policy we are only able to…

Q: Problem 1. Mala Inse Corporation is contemplating to buy P2,000,000 par value bonds at an effective…

A: Explanation of Concept Bond is that debt instrument which is used by the organization to finance…

Q: Shamrock Ranch & Farm is a distributor of ranch and farm equipment. Its products range from small…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Which of the following choices accurately reflects how the recording of accrued salary expense…

A: Accrued Salary Expense is an expense that is accrued but yet to be paid. Hence, it is a liability.

Q: Required: Complete the table using additions and subtractions to show the dollar effects of the…

A: Accounting Equation :— The accounting equation, also known as the basic accounting equation or…

Q: Problem 5 Dividends per share The Ted Williams Corporation has the following stock outstanding:…

A: Dividends are payments made to shareholders in exchange for their ownership of stock in a firm.…

Q: You are assigned to the petty cash count for the KURDAPIA COMPANY at December 31, 2021. The contents…

A: Petty cash fund refers to the fund which is used for paying off the little or small expenses of the…

Q: TRANSACTION: Short-term borrowings Retained earnings Property, plant & equipment Trade and other…

A: A statement of financial position is a document prepared at the end of the period to check what the…

Q: Additional information at 31 March 2020: 1 2 3 Inventory on hand was valued at N$10 920 Rent prepaid…

A: Financial statements are those statements which are prepared at the end of accounting period for the…

Q: Data Sales $12,000 Variable costs: Cost of goods sold $6,000 Variable selling $600…

A: Income Statement is the part of financial statement which shows the income earned and expenditure…

Q: Please answer questions with solution

A: You have asked multiple questions but due to our protocol we provide solution to the one question or…

Q: Bag Teeth manufactures dental supplies & equipment. Bag Teeth Act's Total sales for year 2022 is…

A: 1. The direct labour to be calculated as multiplication of number of assembly employees with wages…

Q: Revenue on account amounted to $5,000. Cash collections of accounts receivable amounted to $4,700.…

A: The portion of a company's cash flow statement titled "cash flow from operations" shows how much…

Q: On November 1, Year 1, Falloch, Incorporated paid $3,600 cash for a contract allowing the company to…

A: Cash flow from operating activities is a part of the cash flow statement and it includes transection…

Q: Income Statement for a Manufacturing Company Two items are omitted from each of the following three…

A: The income statement shows the net income or net loss that is calculated by deducting the expenses…

Q: Allen Company received $12,000 cash from Gerry Corporation for cleaning services that Allen agrees…

A: Date Particulars Debit Amount Credit Amount June 1, Year 1 Bank A/c ......................Dr…

Q: You have just been appointed as financial manager of Slow-Moving-Stock Limited. One of your main…

A: Inventory Turn Over ratio :— The inventory turnover ratio formula is equal to the cost of goods sold…

Q: A businessman loaned P500,000 from a local bank that charges an interest rate of 12% compounded…

A: Time value of money :— According to this concept, value of present money is greater than value of…

Q: 2. Data for two alternatives are as follows: Alternative A Investment P 35,000 Annual Benefits…

A: The IRR help in evaluating the profitability of the potential investment. It provides insight into…

Q: Explain and evaluate the effects of capitalizing versus expensing costs in the period in which they…

A: Capitalization : When a company incurs any expense, benefit of which will be available for more than…

Step by step

Solved in 3 steps

- Brief Exercise 1-24 The Accounting Equation Financial information for three independent cases is as follows: The liabilities of Dent Company are $82,000, and its stockholders' equity is $120,000. What is the amount of Dents total assets? The total assets of Wayne Inc. are $55,000, and its stockholders' equity is $22,500. What is the amount of Waynes total liabilities? Gordon Companys total assets increased by $60,000 during the year, and its liabilities decreased by $35,000. Did Gordons stockholders' equity increase or decrease? By how much? Required: Determine the missing amount for each case.Brief Exercise 3-28 Accrual- and Cash-Basis Accounting The following are several transactions for Halpin Advertising Company. Purchased $1,000 of supplies. 0Sold $5,000 of advertising services, on account, to customers. Used $250 of supplies. Collected $3,000 from customers in payment of their accounts. Purchased equipment for $10,000 cash. Recorded $500 depreciation on the equipment for the current period. Required: Identify the effect, if any, that each of the above transactions would have on net income under cash-basis accounting and accrual-basis accounting.Problem 2-56A Analyzing Transactions Luis Madero, after working for several years with a large public accounting firm decided to open his own accounting service. The business is operated as a corporation under the name Madero Accounting Services. The following captions and amounts summarize Maderos balance sheet at July 31, 2019. The following events occurred during August 2019. Issued common stock to Ms. Garriz in exchange for $15,000 cash. Paid $850 for first months rent on office space. Purchased supplies of $2,250 on credit. Borrowed $8,000 from the bank. Paid $1,080 on account for supplies purchased earlier on credit. Paid secretarys salary for August of $2,150. Performed amounting services for clients who paid cash upon completion of the service in the total amount of $4,700. Used $3,180 of the supplies on hand. Perfumed accounting services for clients on credit in the total amount of $1,920. Purchased $500 in supplies for cash. Collected $1,290 cash from clients for whom services were performed on credit. Paid $1,000 dividend to stockholders. Required: Record the effects of the transactions listed above on the accounting equation. Use the format given in the problem, starting with the totals at July 31, 20l9. Prepare the trial balance at August 31, 2019.

- Net income and dividends The income statement of a corporation for the month of February indicates a net income of $32,000. During the same period, $40,000 in cash dividends were paid. Would it be correct to say that the business Incurred a net loss of $8000 during the month? Discuss.Question 9 On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $83,010 in assets to launch the business. On October 31, the company’s records show the following items and amounts. Cash $ 14,890 Cash withdrawals by owner $ 930 Accounts receivable 12,820 Consulting revenue 12,820 Office supplies 2,290 Rent expense 2,530 Land 45,960 Salaries expense 5,780 Office equipment 16,900 Telephone expense 790 Accounts payable 7,670 Miscellaneous expenses 610 Owner investments 83,010Accounting 1.Larry invested $80,000 in the business January 1 exchanging shares of common stock in the company. 2. Beginning of Jan 1 Larry purchase a truck for $30,000 as cash use for five year 3. Begin Jan 1 , larry purchase equipment for $20,000 in cash 4. Larry company buy parts and supply inventory of total $71,000 on account 5. Total sale of year is $300,000 , and $100,000 sale on account , $50,000 were cash , $150,000 were credit card , credit card charge 2% for each sale 6. parts and supplies inventory used was $62,500 7. Rent $1000 per year and paid as cash 8. Insurance year = $1200 as cash 9. All employee earned 185,000 in salaries and wage , with 180,000 paycheck and $5000 for paycheck 9. A customer went bankruptcy and don’t wanna paid $3,000 total of $22,000 10. Remaining operating expense $7,000 all paid with cash 11 OCT 1, larry company borrowed $25,000 from bank , the loan is 12% interest rate, payable annually on oct 1 12, Larry company still owed supplier…

- 1. Record the effect of the following transactions on the accounting equation using a table similar tothe example.a. Owen inherited $20,000 and invested the cash in the business.b. Performed services for a client and received cash of $700.c. Purchased supplies on account, $1,000d. Invested personal cash of $1,000 in the business.Prepare Income Statement and Balance Sheet. (Ans: Net profit= $2,100 Balance = $22,300)QUESTION 1 Please indicate the effect / impact of each transaction on the relevant accounts . Please follow the example shown EXAMPLE : ( 1 ) Owner invested £ 20,000 cash in the business ANSWER : ( 1 ) Cash increased by £ 20,000 . Owner capital increased by £ 20,000 . Transactions ( 1 ) Purchased £ 1,000 of supplies on credit . ( 2 ) Purchased £ 15,000 equipment for £ 10,000 cash and £ 5,000 note . ( 3 ) Received £ 25,000 cash for consulting service to be performed next month ( 4 ) At 31 December , the company paid £ 12,000 cash for December's rent . ( 5 ) Received £ 14,000 cash for 4,000 consulting service and 10,000 rental(Question 2) The Desk Company manufactures office desks in Toronto, Ontario. The company has raised $1,000,000 from an issue of common shares. The company paid off a long-term bank loan of $200,000. The company then purchased property for $1.5 million and borrowed $500,000 by way of a Bank mortgage that is to be repaid in 10 years. The company sold surplus property that was not being used for $200,000. Required a) Calculate the cash used or cash from investingactivities. Explain the reasoning why a company may prefer financing by way of issuing common shares versus by borrowing from a Bank. Please explain fully with all calculations and table.

- 2Exercise 2Consider the following data for Binda Company.1)The owner, Mike Derby, invests $35,000 in cash in starting a real estate office operating as a sole proprietorship. 2)Purchased $400 of office supplies on credit. 3)Purchased office equipment for $8,000, paying $2,000 in cash and signed a 30-day, $6,000, note payable. 4)Real estate commissions billed to clients amount to $4,000. 5)Paid $700 in cash for the current month's rent. 6)Paid $200 cash on account for office supplies purchased in transaction 2. 7)Received a bill for $600 for advertising for the current month. 8)Paid $2,200 cash for office salaries. 9)Derby withdrew $1,200 from the business for living expenses. 10)Received a checkfor $3,000 from a client in payment on account for commissions billed in transaction 4.Instruction:a)Journalize the above transactions in general journal formand post the entries to ledger accounts. Identify each transaction by number. You may omit explanations of the transactions.b)Prepare…21. The beginning capital balance shown on a statement of owner's equity is $64,000. Net income for the period is $23,000 and the owner withdrew $30,000 cash from the business and made no additional investments during the period. The owner's capital balance at the end of the period is Multiple Choice $117,000. $64,000. $71,000. $57,000.Question 1:Uno Pizza Store started the year with total assets of $150,000 and total liabilities of $85,000. During the year, the business recorded $175,000 in revenues, $90,000 in expenses, and dividends of $10,000. The net income reported by Uno Pizza for the year wasa. $75,000b. $85,000c. $65,000d. $175,000Question 2: If the beginning balance in the retained earnings was $30,000, what will the ending balance of the retained earning be? Question 3: What was the total capital stock at the beginning of the year? Question 4:What will the amount of the total assets be at the end of the year?Question 5: Fatima Company compiled the following financial information as of December 31, 2013:Revenues $140,000Common Stock 45,000Equipment 40,000Accumulated depreciation on equipment 15,000Expenses 60,000Cash 35,000Dividends 20,000Supplies 5,000Accounts payable 20,000Accounts receivable 15,000Retained earnings, 1/1/13 50,000Fatima’s stockholders’ equity on December 31,2013 is:a. $105,000b.…