invest a total of $50,000. Because of the risk, he will limit his investment in oil leases and stocks to 30% and his investment in oil leases and bonds to 50%. Assuming that inve Let o the amount invested in oil leases, Lets the amount invested in stocks, and Let b the amount invested in bonds Which option (a, b, c, or d) shows the correct objective function and constraints for this application? Objective Function: Maximize Return, R-15%6*o +996*s +596*b Constraints: o+s+b=50,000, o+s<= 30%6*50,000, o+b<= 50%6*50,000, o >= 0, Objective Function: Maximize Return, R=996*o +596*s +1596-b Constraints: o+s+b=50,000,o+s< 30 % 50,000, o+b< 50 % 50,000, o >= 0, O Objective Function: Maximize Return, R=1596*o +996*s +596*b Constraints: o+s+b<50,000,o+s<30% +50,000, o+b< 50 % +50,000, o>- 0, O Objective Function: Maximize Return, R=15%6*o +996 *s +596*b Constraints: o+s+b<50,000, o+s>= 30% +50,000, o+b>50% -50,000, >= 0, s>= 0, b <=0 s>= 0,6 <=0 s>= 0, b <= 0 s>= 0, b <= 0

invest a total of $50,000. Because of the risk, he will limit his investment in oil leases and stocks to 30% and his investment in oil leases and bonds to 50%. Assuming that inve Let o the amount invested in oil leases, Lets the amount invested in stocks, and Let b the amount invested in bonds Which option (a, b, c, or d) shows the correct objective function and constraints for this application? Objective Function: Maximize Return, R-15%6*o +996*s +596*b Constraints: o+s+b=50,000, o+s<= 30%6*50,000, o+b<= 50%6*50,000, o >= 0, Objective Function: Maximize Return, R=996*o +596*s +1596-b Constraints: o+s+b=50,000,o+s< 30 % 50,000, o+b< 50 % 50,000, o >= 0, O Objective Function: Maximize Return, R=1596*o +996*s +596*b Constraints: o+s+b<50,000,o+s<30% +50,000, o+b< 50 % +50,000, o>- 0, O Objective Function: Maximize Return, R=15%6*o +996 *s +596*b Constraints: o+s+b<50,000, o+s>= 30% +50,000, o+b>50% -50,000, >= 0, s>= 0, b <=0 s>= 0,6 <=0 s>= 0, b <= 0 s>= 0, b <= 0

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter4: Linear Programming Models

Section4.7: Financial Models

Problem 38P

Related questions

Question

I need help with this question 9

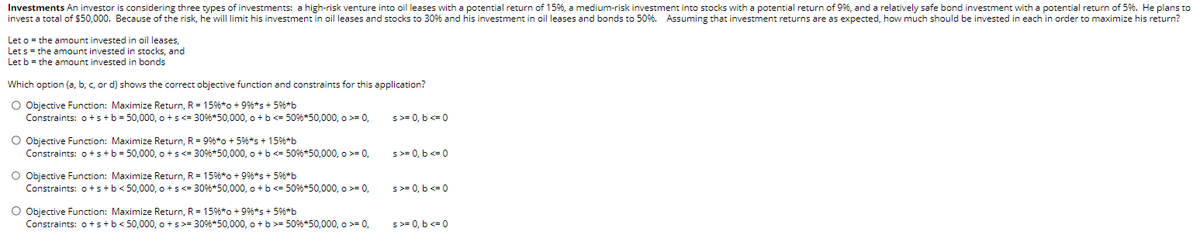

Transcribed Image Text:Investments An investor is considering three types of investments: a high-risk venture into oil leases with a potential return of 15%, a medium-risk investment into stocks with a potential return of 9%, and a relatively safe bond investment with a potential return of 5%. He plans to

invest a total of $50,000. Because of the risk, he will limit his investment in oil leases and stocks to 30% and his investment in oil leases and bonds to 50%. Assuming that investment returns are as expected, how much should be invested in each in order to maximize his return?

Let o = the amount invested in oil leases,

Let s = the amount invested in stocks, and

Let b = the amount invested in bonds

Which option (a, b, c, or d) shows the correct objective function and constraints for this application?

O Objective Function: Maximize Return, R = 15% *o +9%*s + 5%*b

Constraints: o + s + b = 50,000, o+s<= 30% *50,000, o + b <= 50%6*50,000, >= 0,

O Objective Function: Maximize Return, R = 99% *o + 5%*s + 15%*b

Constraints: o+s+ b = 50,000, o+s<= 30% *50,000, o + b <= 50%6*50,000, o >= 0,

O Objective Function: Maximize Return, R = 15%*o +9 %*s + 5%*b

Constraints: o + s + b < 50,000, o+s<= 30% *50,000, o + b <= 50%6*50,000, >= 0,

O Objective Function: Maximize Return, R = 15% *o + 9%*s + 5%*b

Constraints: o+s+b<50,000, o+s>= 30% *50,000, o + b >= 50% *50,000, o >= 0,

s>= 0, b <= 0

s>= 0, b <= 0

s>= 0, b <= 0

s>= 0, b <= 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,