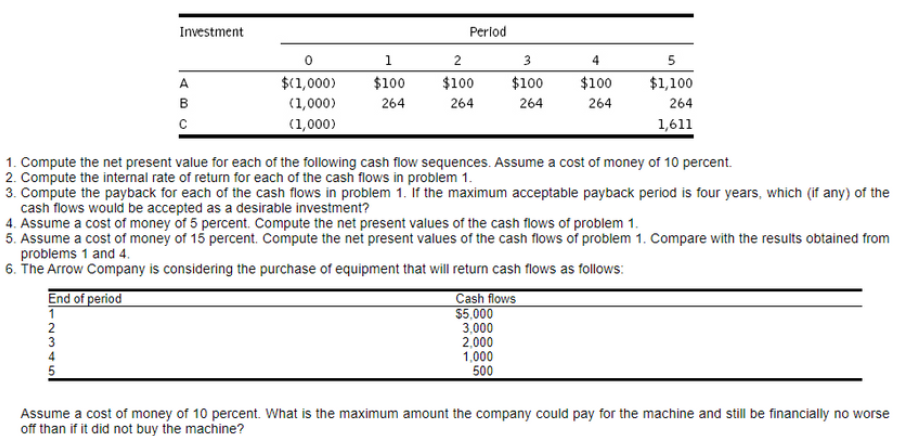

Investment Perlod 1 2 3 4 5 $(1,000) $100 264 A $100 $100 $100 $1,100 в (1,000) 264 264 264 264 (1,000) 1,611 1. Compute the net present value for each of the following cash flow sequences. Assume a cost of money of 10 percent. 3. Compute the payback for each of the cash flows in problem 1. If the maximum acceptable payback period is four years, which (if any) of the cash flows would be accepted as a desirable investment? 4. Assume a cost of money of 5 percent. Compute the net present values of the cash flows of problem 1. 5. Assume a cost of money of 15 percent. Compute the net present values of the cash flows of problem 1. Compare with the results obtained from problems 1 and 4. 6. The Arrow Company is considering the purchase of equipment that will return cash flows as follows: End of period Cash flows $5,000 2 3 3,000 2,000 1,000 500 5 Assume a cost of money of 10 percent. What is the maximum amount the company could pay for the machine and still be financially no worse off than if it did not buy the machine?

Investment Perlod 1 2 3 4 5 $(1,000) $100 264 A $100 $100 $100 $1,100 в (1,000) 264 264 264 264 (1,000) 1,611 1. Compute the net present value for each of the following cash flow sequences. Assume a cost of money of 10 percent. 3. Compute the payback for each of the cash flows in problem 1. If the maximum acceptable payback period is four years, which (if any) of the cash flows would be accepted as a desirable investment? 4. Assume a cost of money of 5 percent. Compute the net present values of the cash flows of problem 1. 5. Assume a cost of money of 15 percent. Compute the net present values of the cash flows of problem 1. Compare with the results obtained from problems 1 and 4. 6. The Arrow Company is considering the purchase of equipment that will return cash flows as follows: End of period Cash flows $5,000 2 3 3,000 2,000 1,000 500 5 Assume a cost of money of 10 percent. What is the maximum amount the company could pay for the machine and still be financially no worse off than if it did not buy the machine?

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 23SP

Related questions

Question

Transcribed Image Text:Investment

Perlod

1

2

3

4

5

$(1,000)

$100

264

A

$100

$100

$100

$1,100

в

(1,000)

264

264

264

264

(1,000)

1,611

1. Compute the net present value for each of the following cash flow sequences. Assume a cost of money of 10 percent.

3. Compute the payback for each of the cash flows in problem 1. If the maximum acceptable payback period is four years, which (if any) of the

cash flows would be accepted as a desirable investment?

4. Assume a cost of money of 5 percent. Compute the net present values of the cash flows of problem 1.

5. Assume a cost of money of 15 percent. Compute the net present values of the cash flows of problem 1. Compare with the results obtained from

problems 1 and 4.

6. The Arrow Company is considering the purchase of equipment that will return cash flows as follows:

End of period

Cash flows

$5,000

2

3

3,000

2,000

1,000

500

5

Assume a cost of money of 10 percent. What is the maximum amount the company could pay for the machine and still be financially no worse

off than if it did not buy the machine?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning