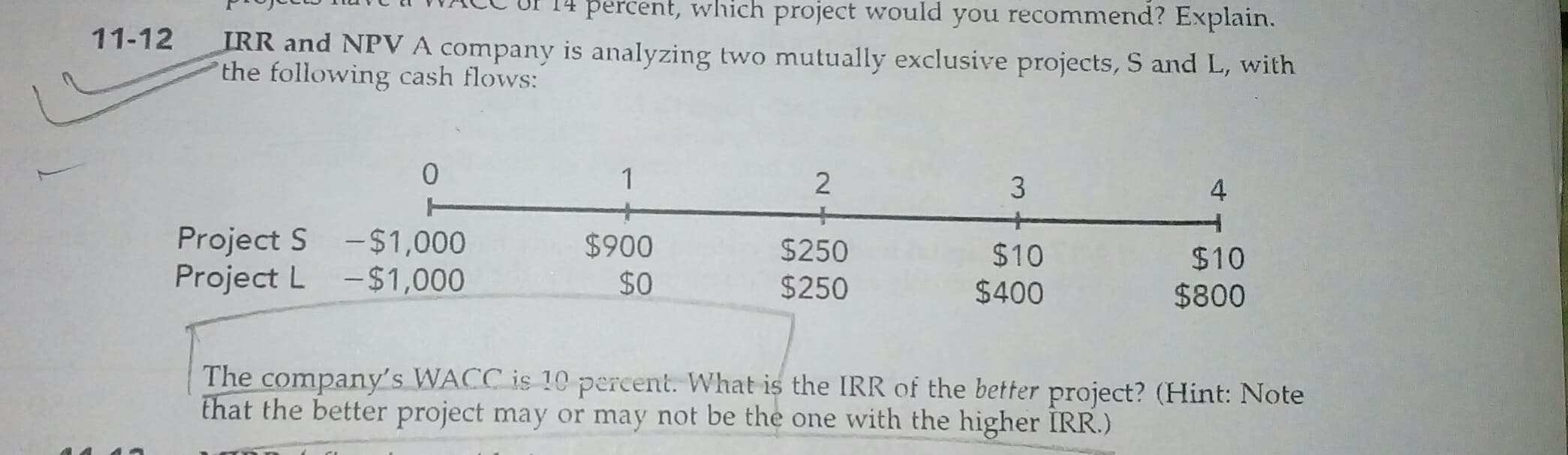

IRR and NPV A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0. 1 3 4 T Project S -$1,000 Project L -$1,000 $900 $0 $250 $10 $10 $800 $250 $400 The company's WACC is 10 percent. What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR.)

IRR and NPV A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0. 1 3 4 T Project S -$1,000 Project L -$1,000 $900 $0 $250 $10 $10 $800 $250 $400 The company's WACC is 10 percent. What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR.)

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter11: The Basics Of Capital Budgeting

Section: Chapter Questions

Problem 11P: CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS Project S requires an initial outlay at t =...

Related questions

Question

??

Transcribed Image Text:IRR and NPV A company is analyzing two mutually exclusive projects, S and L, with

the following cash flows:

0.

1

3

4

T

Project S -$1,000

Project L -$1,000

$900

$0

$250

$10

$10

$800

$250

$400

The company's WACC is 10 percent. What is the IRR of the better project? (Hint: Note

that the better project may or may not be the one with the higher IRR.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub