is earned in the previous year 2020-21. (1) Salary received from Govt. of India (He lived in America for thre

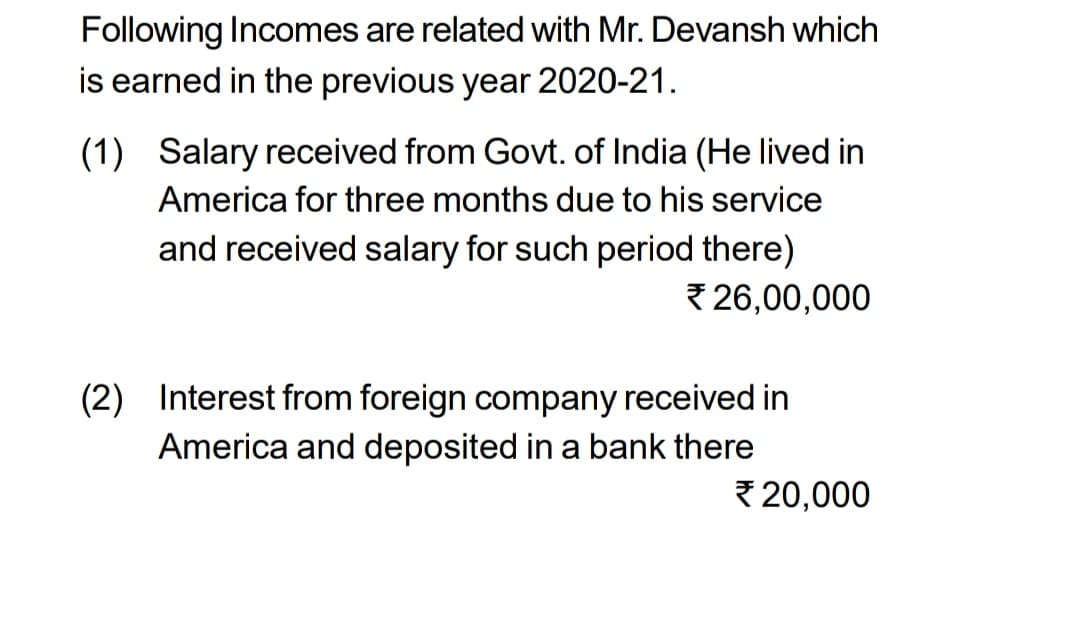

Following Incomes are related with Mr. Devansh which

is earned in the previous year 2020-21.

(1) Salary received from Govt. of India (He lived in

America for three months due to his service

and received salary for such period there)

`26,00,000

(2) Interest from foreign company received in

America and deposited in a bank there

`20,000

P.T.O.

[4]

F- 3053

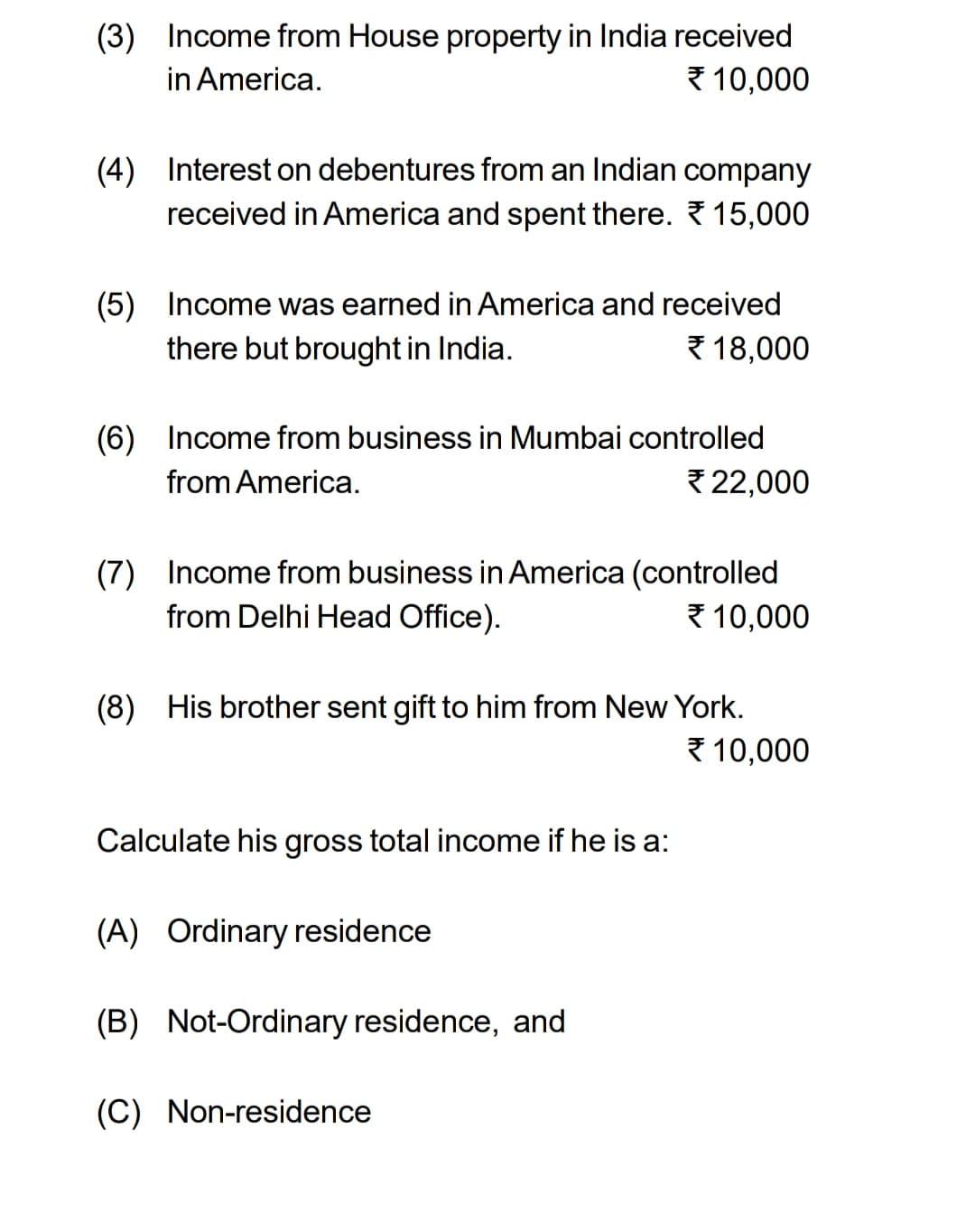

(3) Income from House property in India received

in America. `10,000

(4) Interest on debentures from an Indian company

received in America and spent there. `15,000

(5) Income was earned in America and received

there but brought in India. `18,000

(6) Income from business in Mumbai controlled

from America. `22,000

(7) Income from business in America (controlled

from Delhi Head Office). `10,000

(8) His brother sent gift to him from New York.

`10,000

Calculate his gross total income if he is a:

(A) Ordinary residence

(B) Not-Ordinary residence, and

(C) Non-residence

Step by step

Solved in 2 steps