A. Interest income of a resident alien from an B. Marriage fees, baptismal offerings received by a clergyman, evangelist or religious workers for services rendered expanded foreign currency deposit C. Dividend income by an individual from a non-resident foreign corporation D. Share of an individual taxpayer from the distributable net income of a general professional partnership.

Q: Compare and contrast common stocks and preferred stocks

A: Stocks are securities issued by the companies to procure funds from outsiders. The two types of…

Q: Thomas Martin receives an hourly wage rate of $25, with time and a half for all hours worked in…

A: Introduction: A tax rate is the proportion of income that is taxed on a person or company. The…

Q: A bidders disclosure statement under the Williams Amendment must be submitted when the bidder:…

A: William Amendment is there to protect the shareholders who might become target of hostile takeover.…

Q: Which of the following items are included in the computation of a sole proprietorship's taxable…

A: Taxable income of a Sole proprietor is calculated after taking into account all income earned,…

Q: 4. A stopwatch used for Time and Motion Study has a selling price of P1,500. If its selling price is…

A: Assets are the rights and resources being held by the business. Assets face depreciation or…

Q: Marilyn sells 200 shares of General Motors stock for $80 per share. She pays a $100 commission on…

A: Introduction:- The following basic information as follows under:- Marilyn sells 200 shares of…

Q: During the current year, Sokowski Manufacturing earned income of $327,600 from total sales of…

A: Sales margin means profit earned from the revenue generated from the sale of the goods or services.…

Q: The Data Company employs John and Jesse. John has worked for Data for 4 years, whereas Jesse has…

A: Pension plan is a sort of retirement benefit available in US. Qualified pension plan sets forth some…

Q: The income tax rate is 30%. 1. Basic earnings per share Amaze Company reported the following…

A: The following formulas are used:- EPS=Net Income-Preference DividedendWeighted Average shares…

Q: NOPAT 8250000 EBITDA 17725000 Net Income 5050000 Capital Expenditures 6820000 After tax capital…

A: Formula: Economic value added (EVA) = Net operating profit after tax - Total invested capital x WACC…

Q: Salt Corporation's contribution margin ratio is 75% and its fixed monthly expenses are $55,000.…

A: Formula: Net operating income = Contribution margin value - Fixed expenses. Deduction of fixed…

Q: Question Content Area The balance sheets at the end of each of the first 2 years of operations…

A: Earnings per share is the measure of value of the company for its shareholders. This is calculated…

Q: Limited liability refers to an owner's liability for which of the following? I. The amount invested…

A: Under limited liability company the shareholders liability is limited only to the extent of nominal…

Q: On the first day of the fiscal year, a company issues a $967,000, 8%, 10-year bond that pays…

A: A journal entry is used to record a business transaction in an organization's accounting records. A…

Q: During the current year, Jimmy incorporates his data processing business. Jimmy is the sole…

A: Option E is correct answer

Q: he x% compounded semi-annually on a nominal rate of 9% compounded conti

A: The more is compounding more is effective interest rate and less is compounding less is effective…

Q: Project Y requires a $345,000 investment for new machinery with a six-year life and no salvage…

A: Payback period : Payback period is calculated to determine that how much time it will take to…

Q: "If a single deposit of $500,000 is made today, earning 8% interest, compounded QUARTERLY, how much…

A: In the given question, $ 500,000 are invested at 8% compounded quarterly for 10 years. Since…

Q: Prepare the journal entries to record the exchange on the books of both companies. Assume that the…

A: Journal entries should not be used to record routine transactions such as customer billings and…

Q: Oakdale Fashions, Inc.’s, 2021 income statement is reported below. Oakdale Fashions, Inc.,…

A: Tax liability = EBT (Earning before tax) x Tax rate Tax liability, 2021 = $165,000 x 21% = $34,650…

Q: Oriole Dairy leases its milking equipment from Waterway Finance Company under the following lease…

A: Minimum Lease Payment: It is the rental payments over the lease term. It includes amount of any…

Q: Rockhill Corporation operates a women's dlothing boutique. Its taxable income for the current year…

A: Income tax is a tax levied on the income of an individual or a corporation. Income tax is the…

Q: Problem 1 bond discount. Prepare the journal entries to record these events: 1. The issuance of the…

A: A journal entry is used to document a business transaction in a company's accounting records. A…

Q: GreenGo Company leased equipment to RedStop Company on May 1, 2020. The lease expires on May 1,…

A: Lease expenses It is the rental costs of the Company and its Subsidiaries during such period under…

Q: North Company designs and manufactures machines that facilitate DNA sequencing. Depending on the…

A: Introduction Activity based costing approach is used to assign factory overheads to the product by…

Q: A. True or False: ________ 1. Depreciation is the decline in the market value of tangible fixed…

A: Introduction:- Depreciation is a non cash expenditure. It is charged on fixed assets over estimated…

Q: Camiguin Company reported the following information at year-end: Ordinary share capital Convertible…

A: Basic earnings per share = Net income available to ordinary shareholders / Weighted average number…

Q: Use the information below provided by Angel Baby Angel Company: Sales 8,250,000.00 Operating…

A: Solution:- 1)Calculation of Times interest earned ratio as follows under:- Times interest earned…

Q: Data table Static budget variable overhead 7,800 Static budget fixed overhead %24 3,900 Static…

A: Variance analysis involves computing of the deviations by comparing the actual and estimate data and…

Q: Nathan had a car that he acquired for $45,000 5 years ago. It was stolen in the current tax year,…

A: given Nathan had a car that he acquired for $45,000 5 years ago. It was stolen in the current tax…

Q: On January 1, 2021, Simple Company pre information. 10,000,000 Ordinary share capital, P100, 100,000…

A: Earning Per Share: Net profit divided by the number of common shares issued and outstanding is the…

Q: Problem 3: A certain machine costs P 40,000, has a life of 4 years and salvage value of P 5,000. The…

A: Formula: Depreciation per unit = ( Asset cost - Salvage value ) / Total estimated Units. Deduction…

Q: A fire destroyed Jimmy's Teeshirt Shop. The business had an adjusted basis of $500,000 and a fair…

A: In the case of reporting gain or loss related to damage of insured property, the issue of recording…

Q: P8.6 (LO 3) (Compute FIFO, LIFO, Average-Cost—Periodic and Perpetual) Ehlo Company is a multi…

A: Periodic inventory system means where day to day in or out of goods is not recorded and value of…

Q: Security deposits, which are refundable to the lessee upon lease termination, are treated as prepaid…

A: Leases is an agreement or contract between two parties under which one party provides it's asset for…

Q: Accounts receivable turnover and days' sales in receivables OBJ.8 The Campbell Soup Company…

A: Accounts Receivables Turonver Ratio is calculated with the help of following formula Account…

Q: Inna is an hourly worker whose employer uses the quarter-hour method. During a one-week perlod, she…

A: Introduction: Employers can round employee start and stop times to the closest 5-minute interval,…

Q: 24

A: A taxpayer's taxable income is equal to his or her gross income less any permitted tax deductions. A…

Q: Exercise E Analysis of Hair Care Company's citrus hair conditioner reveals that it is losing $5,000…

A: The gap between revenues and expenses is referred to as net income. This number, together with gross…

Q: QUESTION 6. Plants Ltd operates garden centres but would like to raise some finance to fund their…

A: Dividend is the distribution of profit amongst the shareholders. Financing is required for the…

Q: . Use the information below provided by Angel Baby Angel Company: Sales 8,250,000.00…

A: Solution:- 1)Calculation of Economic value added as follows under:- Economic value added gives true…

Q: Charleston Company has elected to use the dollar-value LIFO retail method to value its inventory.…

A: The ending inventory is the inventory left in stock at year end and assumed to be sold during next…

Q: On December 31, 2021, an entity has a building with cost of Rp500 million and accumulated…

A: Disclaimer: Since you have asked multiple questions we only answer the first question for you to…

Q: Kaagapay2 Company has the following information for the month of November: Started in process units,…

A: First in, first out (FIFO) is indeed a wealth management and pricing strategy in which the assets…

Q: ven the following information for Franklin Jewelers, by how much did the gross profit percentage go…

A:

Q: 8. The Art Institute of Chicago received a contribution of art from a wealthy citizen of Chicago in…

A: Answer:- Accounting policy definition:- Accounting policies can be defined as the precise rules and…

Q: E7.9 (LO 3) (Computing Bad Debts and Preparing Journal Entries) The trial balance before adjustment…

A: Allowance for doubtful accounts means where we expect some debts to become bad in near future then…

Q: B-1 Organic Food Company (*B-1") engages in the business of selling organic food on-line. The…

A: Journal entries: These are the entries prepared to record the business transactions in the books of…

Q: El1.5 (LO 2) The following section is taken from Ohlman Ltd.'s. statement of financial positi…

A: Introduction:- Journal entries used to record monetary or business transactions. which plays vital…

Q: Greenway Corporation Tral Balance December 31.2022 $ 300 522 82 180 4,000 Cash Accounts Receivable…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is…

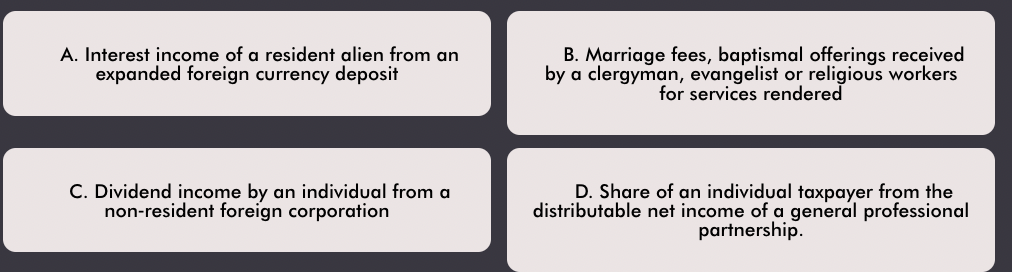

What is subject to final tax?

Step by step

Solved in 2 steps

- Which of the following taxpayers cannot claim deductions from gross income? General professional partnership Domestic corporation Resident foreign corporation Non-resident foreign corporationOne of following is taxed on gross income nonresident foreign corporation non-profit cemetery domestic corporation resident foreign corporationWhich of the following income derived from within the Philippines by a resident individual is not subject to the rates in Section 24(a) of the NIRC? a. Salary received by a managing director of a general professional partnership. b. A passive income in the form of a prize win in a raffle amounting to P4,000.00. c. A gain from sale of his personal motor vehicle as another income of a taxpayer who is a compensation earner. d. A gain on sale of a real property for private use of the family of the taxpayer.

- 1. Which of the following is required to file an income tax return? A. An employee covered by the substituted filing system. B. A taxpayer deriving purely passive income subject to final tax. C. A special alien with respect to his compensation income. D. A non-resident citizen who derives his entire income form sources outside the Philippines. 2. The taxable income of a mixed income earner is the : A. Net income from business less personal exemption B. Net income from business C. Taxable compensation income D. Taxable compensation income plus net income from business.Which of the following income derived from within the Philippines by a resident individual is not subject to the rates in Section 24(A) of the NIRC? Which of the following income derived from within the Philippines by a resident individual is not subject to the rates in Section 24(A) of the NIRC? a. A gain from sale of a motor vehicle as another income of a taxpayer who is a compensation income earner b. A passive income in the form of prize won in a raffle amounting to PHP 4,000 c. Salary received by a managing partner of a general professional partnership d. A gain on sale of a real property for private use of the family of the taxpayerWhich of the following should not be claimed as deductions from gross income? A. Interest payment on loans for the purchase of machinery and equipment used in business. B. Salaries and bonuses paid to employees. C. Discounts given to senior citizens on certain goods and services D. Advertising expense to maintain some form of goodwill for the taxpayer’s business. Which of the following is NOT income tax exempt?* A. BOI-registered enterprise enjoying tax holiday B. Forex transaction income of a Foreign Currency Depositary Unit from another Foreign Currency Depositary Unit C. Forex income in the Philippines of an Offshore Banking Unit D. Regional area headquarter of a multinational company E. None of the Above A resident corporation is one that is: A. Organized under the laws of a foreign country that engages in business in Makati City,Philippines. B. Organized under the laws of the Philippines that…

- Which of the following may be exempt from Canadian withholding tax when paid to a non-resident? a. dividends b. interest paid to an arm's-length party c. Pension benefits d. Registered retirement income fund paymentsThe following individuals are required to file an income tax return, except: a. Non-resident aliens not engaged in trade or business b. Resident Citizen c. Non-resident alien engaged in trade or business d. Non-resident citizenWhich of the following statements are correct? i. A tax resident is normally liable to tax on their worldwide, profits, income, and gains, whether received. ii. Non-residents are generally liable to tax on certain income and profits generated from sources within the country. iii. A domiciled taxpayer is normally liable to tax on their worldwide, profits, income, and gains, whether received. iv. Tax is imposed on certain sources of income, such as interest, dividends, royalties, and fees, by way of withholding tax. a. i, ii and iv b. i only c. All of the above d. i, iii and iv

- A _____________________________ is a means of ensuring that the expatriate’s after-tax income in the host country is similar to what the person’s after-tax income would be in the home country A) International tax management system B) HRM system C) Nucor sytem D) Tax deduction system E) Tax equalization systemCompute the income tax due if Sandbox Corporation which is an MSME domestic corporation reported the following gross income and expenses in 2021: A.Using the same data in the previous question, what is the income tax due if Sandbox is a resident foreign corporation? B.Using the same data in the previous question, what is the income tax due if Sandbox is a non-resident foreign corporation? C.Using the same data in the previous question, what is the income tax due if Sandbox is a private proprietary educational institution?Which corporate taxpayer is not subject to regular income tax? Resident foreign corporation Domestic corporation Non-resident foreign corporation Business partnership