ISD loan. pac quote

Q: Why officers and employees of the cooperative development Authority are disqualified from being…

A: In this question, we will explain that Why officers and employees of the cooperative development…

Q: Prepare bank Reconciliation statement

A: Answer:

Q: Cash balance per bank $4,500 Outstanding checks $200 Deposits in transit $1,000 Credit memo for…

A: Introduction: Bank reconciliation statement: To reconcile the difference between cash and pass book…

Q: 1. What is the Income before Taxes and Interest? 2. What is the room expense? 3. What is the Room…

A: In accounting, Earnings before interest and tax (EBIT) is the company's net profit margin that…

Q: 10. The following information is for Grimsley Electrical Supplies Inc. payroll for the week ending…

A: Payroll Payroll is considered to be important in the business which can be timely payment is…

Q: Anthony Company uses a perpetual inventory system. It entered into the following purchases and sales…

A: Cost of good available for sale is equal to cost of beginning inventory and total cost of purchases…

Q: Calculate the goodwill /gain on bargain purchase, show your workings. Prepare the journal entries in…

A: Answer:

Q: Prior to 23 October 2027, the share capital account of Fallout Ltd had a balance of $50,000. This…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: What is the production budgeted for the third quarter? Company policy is to have a finished goods…

A: A budget is a statement prepared by the companies, government, and individuals by making an estimate…

Q: Prepare the journal entry for the following transactions (1) Geysler Company sold some old equipment…

A:

Q: On January 1, 20Y6, the controller of Omicron Inc. is planning capital expenditures for the years…

A: A capital expenditure budget is a written plan that details the costs and timing of a company's…

Q: On June 3, 2022, CV. Do Fashion consigned 80 clothes, costingRp500,000 each, to PT. Matabulan Tbk.…

A: Consignment means where the goods has been sent to other person called as consignee , to be sold on…

Q: QUESTION 1 •COGS = $390,000 *GM = 60% •Store size: 20 ft x 25 ft. •2,500 transactions •5,000 units…

A: The correct answer for the above mentioned questions is given in the following steps for your…

Q: Which is true about using a note with stated interest rate vs. a note without stated interest rate…

A:

Q: Common sized balance sheets the following end of the year balance sheets in millions were adapted

A: The balance sheet is given as,

Q: Shaw Incorporated began this period with a budget for 1,000 units of predicted production. The…

A: Controllable variance = Actual total overhead - Standard overhead Volume variance = Budgeted…

Q: On January 1, 20X1, Wooden Company issued 16,000 shares of $2 par value common stock for $120,000.…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: The Corton Company uses a periodic inventory system. For the month of October, the beginning…

A: The question is based on the concept of Cost Accounting.

Q: Last year, YG had P250,000,000 of sales and P100,000,000 of fixed assets, so its FA/Sales ratio was…

A: Sales Revenue: The amount which a company gets from the sale of disposals of their manufactured…

Q: 5. Ericson bought a new motorcycle worth P1.220 million. What is the estimated scrap value of the…

A: Depreciation is the fall in the value of a tangible asset over time due to normal wear and tear,…

Q: Harry is divorced with net income for tax purposes of $50,000. His 21 year old dependent daughter,…

A: In this question, we will calculate Harry’s medical expenses tax credit for 2021, we have to choose…

Q: Age Interval Est. Percentage Uncollectible Balance Not due $63,000 2% 1-30 days past due 7,100 31-60…

A: Formula: Estimated uncollectible amount = Balance amount x Estimated percentage Uncollectible

Q: Skysong Company established a petty cash fund on May 1 for $100. The company reimbursed the fund on…

A: On establishment of petty cash fund the cash will go to petty cash fund.

Q: Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Method The following…

A: The question is based on the concept of Financial Accounting.

Q: Accounts payable S 1,200 Miscellaneous expense S 480 Accounts receivable 12,340 Office expense 440…

A: Formula: Net income = Revenues - Expenses

Q: April Issued 5,000 share of Common Stock, $2 par for $17 per share. Record the journal entry.

A: Journal entries are used to keep track of the financial transactions. To generate a journal entry,…

Q: Chan Company received a bill totaling $3,700 for machine parts used in maintaining factory…

A: Note: Journal entry means recording of financial transactions in an accounting journal that shows a…

Q: Required c. Calculate the ROI for Bowman. d. Franklin has a desired ROI of 13 percent. Headquarters…

A: In accounting, a ratio is used to determine the company's profitability from their business and help…

Q: Muscat company purchased office supplies costing OMR2,000 and debited Office Supplies for the full…

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is…

Q: Kenley wants to open a 100-room hotel. twill cost $8.500,000 to open the property. Sh can come up…

A:

Q: Cash balance per bank $4,500 Outstanding checks $200 Deposits in transit $1,000 Credit memo for…

A: Adjusted cash balance = cash balance as per bank statement + Deposit in transit - Outstanding checks…

Q: Inc. has developed a balanced scorecard with the following performance metrics:• Total sales•…

A: A balanced scorecard seems to be a strategic management evaluation statistic that assists businesses…

Q: Christian Company has budgeted sales of its popular boomerang for the next four months as follows:…

A: A production budget seems to be a budgetary plan that specifies the number of units that will be…

Q: John's Tree Service depreciation for the month is $500. The adjusting journal entry is: O A.…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Marvel Dental Services is part of an HMO that operates in a large metropolitan area. Currently,…

A: Cost accounting refers to the managerial accounting that primarily focuses on the data regarding the…

Q: Question 15 Companies can set transfer prices to shift profits between the buyer and seller…

A: Transfer Price is the price charged by the transferor department to transferee department. It is…

Q: Ali Mamat Enterprise Trial Balance as at 31 December 2019 Particulars Sales Purchases Salaries Motor…

A: Formula: Net income = Total Revenues - Total Expenses

Q: Quick BQtio lor all Years Yeath As Reported Annual Balance Sheet Report Date Scale 2019 2017…

A: Formula: Quick ratio = Quick Assets / current liabilities.

Q: ILLUSTRATION 2: N Stock of Finished Goods January 1st 12,660 December 31st 17,845 Stock of Raw…

A: The trading and P&L Account is a part of the final account that determines the gross and net…

Q: The following selected transactions were completed by Air Systems Company during January of the…

A: Journal is the book of original entry in which all the transactions of the business are recorded…

Q: Discuss three general provisions of the Sarbanes-Oxley Act.

A: Sarbanes-Oxley Act (SOX) is a legal framework that requires corporate chiefs to ensure the precision…

Q: approve a loan that has a total monthly mortgage payment of principal, intere E Click the icon to…

A: Adjusted income is that which is gross income that gets subtracted from adjusted income.

Q: 6. LABAN LANG Company adds materials at the beginning of the process in the AAA Department, which is…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: On December 31, 2020, Sack Port Ventures Inc. borrowed $103,000 by signing a four-year, 8.0%…

A: Installment Notes is an Financial instrument which is used to borrow money from financial…

Q: imited company. What id s downside of incorporation in these circumstances? Perpetual succession. A…

A: A partnership is a legal process for two or more organizations to control and run a business and…

Q: Determine the monthly principal and interest payment for a 20-year mortgage when the amount fr the…

A: In this question we have to calculate the monthly interest and principal payment. Compound interest:…

Q: The responsible use and protection of the natural environment is known as O a) Environmental Rights…

A: Environmental protection seems to be the activity of people, organizations, and governments…

Q: At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three…

A: given Current period labor cost = Total labor cost - Direct labor cost incurred in earlier month

Q: Direction: Use given the ratio compute the Financial Ratio Analysis. The comparative statement of…

A: Financial ratios are the formulas used by the management to make it easy to understand the financial…

Q: How does an investment appraisal technique help companies move in the right direction regarding an…

A: Investment evaluation is significant for brokers since it is a type of principal examination and,…

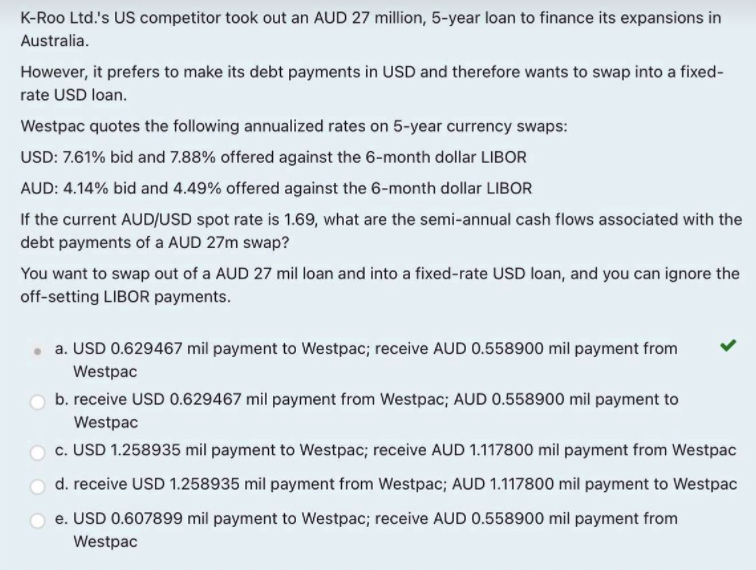

Hi can you please explain how to get this answer. Thank you.

Step by step

Solved in 2 steps

- The nominal yield on 6-month T-bills is 7%, while default-free Japanese bonds that mature in 6 months have a nominal rate of 5.5%. In the spot exchange market, 1 yen equals $0,009. If interest rate parity holds, what is the 6-month forward exchange rate?Dune Ltd. is an Irish company which will pay CAN$609,000 to a supplier in Toronto in three months time. The spot rate of exchange today is CAN$1.45 = €1. In three-month forward contracts, the Canadian dollar is at a discount of CAN$0.05 against the €. Dune Ltd. has decided to hedge its foreign currency risk in relation to the CAN$609,000 payment using a three-month forward contract. How much will Dune Ltd. pay in € to purchase the CAN$609,000 under the forward contract? €406,000 €420,000 €435,000 None of the aboveBusco has a foreign-currency denominated payable, it can hedge by buying the foreign currency payable forward. The company can expect to eliminate the exposure without incurring costs as long as the forward exchange rate is an unbiased predictor of the future spot rate. Bus Co exported an A350 to a UK business, and was billed the sum of £11,000,000 payable in three months. Currently the spot rate is $1.30/£ and the three-month forward rate is $1.26/£.The three-month money market interest rate is 11% per annum in US and 7% per annum in UK.So the management of Busco decided to manage this transaction exposure and use the money market hedge to deal with this pound account payable. (i) Show how Busco can eliminate the exchange rate exposure by computing the dollar cost of meeting the pound obligation. ii)Conduct a cash flow analysis of the money market hedge.

- Incantieri sold a cruise ship to Disney Cruise Line, a U.S. company, and billed $1 billion payable in six months. It is concerned with the euro proceeds from international sales and would like to control exchange risk. The current spot exchange rate is $1.15/€ and six-month forward exchange rate is $1.21/€ at the moment. Incantieri can buy a six-month put option on U.S. dollars with a strike price of €0.85/$ for a premium of €0.02 per U.S. dollar. Currently, the six-month interest rate is 2% in the euro zone and 2.5% in the U.S. If Incantieri decides to hedge using money market instruments, what action does Incantieri need to take? What would be the guaranteed euro proceeds from the American sale in this case? If Incantieri decides to hedge using put options on U.S. dollars, what would be the ‘expected’ euro proceeds from the American sale? Assume that Incantieri regards the current forward exchange rate as an unbiased predictor of the future spot exchange rate. Which method of…Nicantieri sold a cruise ship to MCC Cruise Line, a U.S. company, and billed $1 billion payable in six months. It is concerned with the euro proceeds from international sales and would like to control exchange risk. The current spot exchange rate is $1.15/€ and six-month forward exchange rate is $1.21/€ at the moment. Nicantieri can buy a six-month put option on U.S. dollars with a strike price of €0.85/$ for a premium of €0.02 per U.S. dollar. Currently, the six-month interest rate is 2% in the euro zone and 2.5% in the U.S. Compute the guaranteed euro proceeds from the American sale if Nicantieri decides to hedge using a forward contract. If Nicantieri decides to hedge using money market instruments, what action does Incantieri need to take? What would be the guaranteed euro proceeds from the American sale in this case? If Nicantieri decides to hedge using put options on U.S. dollars, what would be the ‘expected’ euro proceeds from the American sale? Assume that Nicantieri regards…Incantieri sold a cruise ship to Disney Cruise Line, a U.S. company, and billed $1 billion payable in six months. It is concerned with the euro proceeds from international sales and would like to control exchange risk. The current spot exchange rate is $1.15/€ and six-month forward exchange rate is $1.21/€ at the moment. Incantieri can buy a six-month put option on U.S. dollars with a strike price of €0.85/$ for a premium of €0.02 per U.S. dollars. Currently, the six-month interest rate is 2% in the euro zone and 2.5% in the U.S.1. Compute the guaranteed euro proceeds from the American sale if Incantieri decides to hedge using a forward contract.2. If Incantieri decides to hedge using money market instruments, what action does Incantieri need to take? What would be the guaranteed euro proceeds from the American sale in this case?3. If Incantieri decides to hedge using put options on U.S. dollars, what would be the ‘expected’ euro proceeds from the American sale? Assume that Incantieri…

- A U.S. firm, sells merchandise today to a British company for £100,000. The current exchange rate is $1.38/£, the account is payable in three months, and the firm chooses to hedge by borrowing £98,765.43 today and exchanging the proceeds today for dollars; the loan will be paid back with the £100,000 accounts receivable (money market hedge). If Husky converted the borrowed pounds into dollars today and invested that amount at its WACC of 6% (1.5% for 90 days), how much much money in U.S. dollars will Husky Sporting Goods Company have in 90 days?ATZ (US Company) expects to receive a 19 million euros in 90 days from a Australia customer. The current spot rate is S$1.836 per AUD, and the 90 day forward rate is S$1.638 per AUD. In addition, the annualized three-month AUD and USD interest rate 2.81% and 4.03%, respectively. What is the hedged value of the AUD receivable using the forward contract? How does that compare to a situation when the exchange rate remains unchanged at the spot rate?Busco has a foreign-currency denominated payable, itcan hedge by buying the foreign currency payableforward. The company can expect to eliminate theexposure without incurring costs as long as the forwardexchange rate is an unbiased predictor of the future spotrate. Busco exported an A380 to a UK company, and wasbilled the sum of £ 12,000,000 payable in three months.Currently the spot rate is $1.40/£ and the three-monthforward rate is $1.36/£.The three-month money marketinterest rate is 12% per annum in US and 8% per annumin UK.So the management of Busco decided to managethis transaction exposure and use the money markethedge to deal with this pound account payable. 1)Conduct a cash flow analysis of the money market hedge. Answer: Transaction Current cash flow (3-month) Cash flow at maturity 1 Borrow £ =£11,764,705.88 - £12,000,000 2 Buy $ spot with £ = $16, 470,588.24 - £11,764,705.88 0 3 Invest in US - $16, 470,588.24…

- Brexylite plc is due to pay €1,750,000 to its European suppliers in 3 months’ time. The financial manager has decided to hedge the currency risk of this account payable. The following information has been provided by the company’s bank: Spot rate (£ per €): 1·1410 ± 0·0022 3 months forward rate (£ per €): 1·1574 ± 0·0041 6 months forward rate (£ per €) 1.1582 ± 0.0032 Calculate the expected (£) Stirling payment if the 3 months forward market is usedXYZ Corporation, located in the United States, has an accounts payable obligation of ¥750 million payable in one year to a bank in Tokyo. The current spot rate is ¥116/$1.00 and the one year forward rate is ¥109/$1.00. The annual interest rate is 3 percent in Japan and 6 percent in the United States. XYZ can also buy a one-year call option on yen at the strike price of $0.0086 per yen for a premium of 0.012 cent per yen.A British firm will receive $1 million from a U.S. customer in three months. The firm is considering two strategies to eliminate its foreign exchange exposure. The first strategy is to pledge the $1 million as collateral for a three month loan from a U.S. bank at 4 percent interest. The U.K. firm will then convert the proceeds of the loan to pounds at the spot rate. When the loan is due, the firm will pay the $1 million balance due by handing its U.S. receivable over to the bank. This strategy allows the U.K. firm to “monetize” its receivable immediately. The spot exchange rate is 0.6550 pounds per dollar. The second strategy is to enter a forward contract at an exchange rate of 0.6450 pounds per dollar. This ensures that the U.K. firm will receive £645,000 in three months. If the firm wanted to monetize this payment immediately, it could take out a three-month loan from a U.K. bank at 8 percent, pledging the proceeds of the forward contract as collateral. Which of…