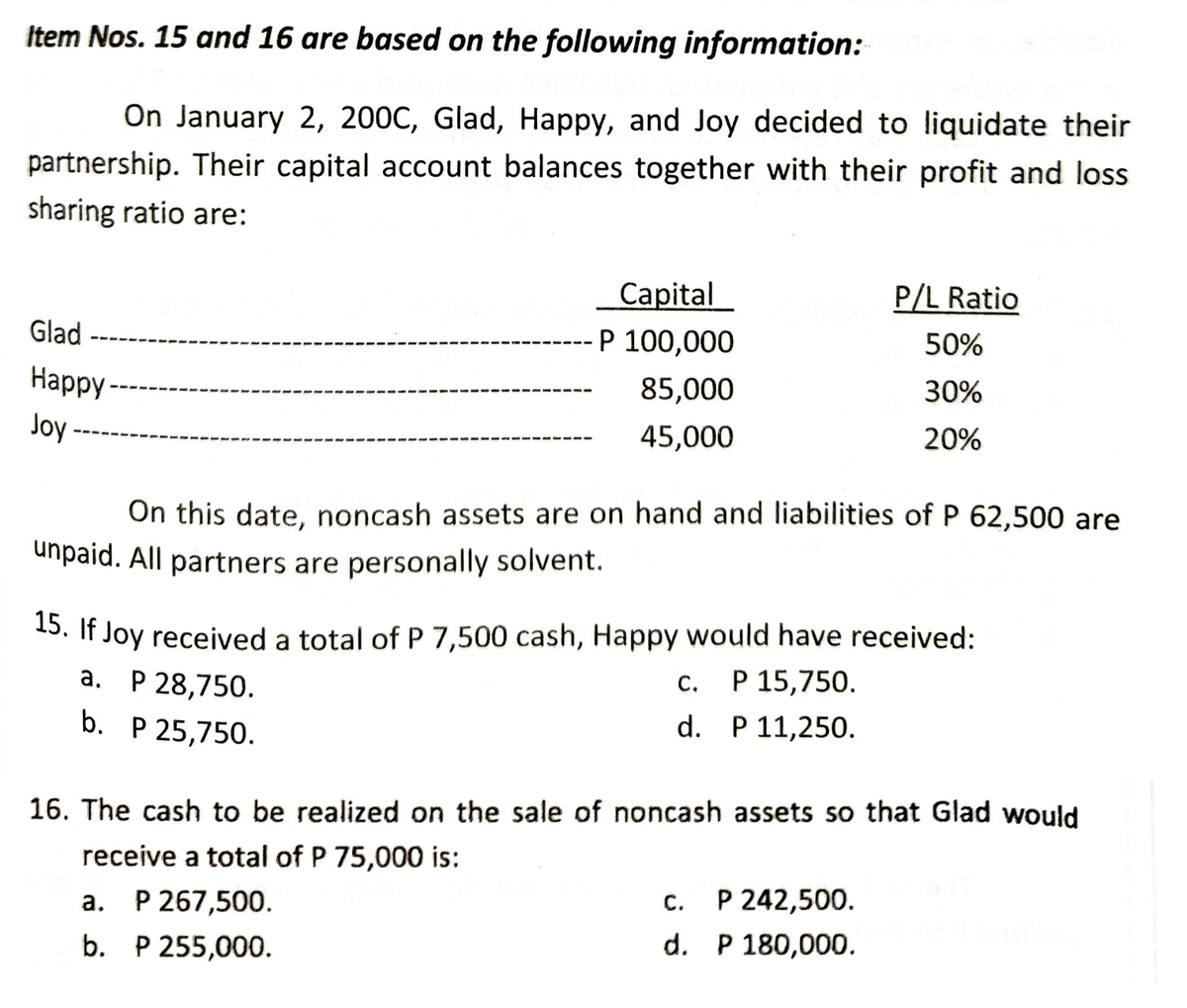

Item Nos. 15 and 16 are based on the following information: On January 2, 200C, Glad, Happy, and Joy decided to liquidate their partnership. Their capital account balances together with their profit and loss sharing ratio are: P/L Ratio Capital P 100,000 Glad 50% Happy- 85,000 30% Joy 45,000 20% On this date, noncash assets are on hand and liabilities of P 62,500 are unpaid. All partners are personally solvent. 15. If Joy received a total of P 7,500 cash, Happy would have received: a. P 28,750. C. P 15,750. b. P 25,750. d. P 11,250. 16. The cash to be realized on the sale of noncash assets so that Glad would receive a total of P 75,000 is: C. P 242,500. a. P 267,500. d. P 180,000. b. P 255,000.

Item Nos. 15 and 16 are based on the following information: On January 2, 200C, Glad, Happy, and Joy decided to liquidate their partnership. Their capital account balances together with their profit and loss sharing ratio are: P/L Ratio Capital P 100,000 Glad 50% Happy- 85,000 30% Joy 45,000 20% On this date, noncash assets are on hand and liabilities of P 62,500 are unpaid. All partners are personally solvent. 15. If Joy received a total of P 7,500 cash, Happy would have received: a. P 28,750. C. P 15,750. b. P 25,750. d. P 11,250. 16. The cash to be realized on the sale of noncash assets so that Glad would receive a total of P 75,000 is: C. P 242,500. a. P 267,500. d. P 180,000. b. P 255,000.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 1BD

Related questions

Question

Transcribed Image Text:Item Nos. 15 and 16 are based on the following information:

On January 2, 200C, Glad, Happy, and Joy decided to liquidate their

partnership. Their capital account balances together with their profit and loss

sharing ratio are:

P/L Ratio

Capital

P 100,000

Glad

50%

Happy

85,000

30%

Joy

45,000

20%

On this date, noncash assets are on hand and liabilities of P 62,500 are

unpaid. All partners are personally solvent.

15. If Joy received a total of P 7,500 cash, Happy would have received:

a. P 28,750.

C.

P 15,750.

b. P 25,750.

d.

P 11,250.

16. The cash to be realized on the sale of noncash assets so that Glad would

receive a total of P 75,000 is:

a. P 267,500.

C.

P 242,500.

d. P 180,000.

b. P 255,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,