(iv) Find the discounted paybacks for Projects L and S. According to the payback criterion, which project(s) should be accepted if the firm's maximum acceptable payback is 2 years, if Projects L and S are independent, if Projects L and S are mutually exclusive?

(iv) Find the discounted paybacks for Projects L and S. According to the payback criterion, which project(s) should be accepted if the firm's maximum acceptable payback is 2 years, if Projects L and S are independent, if Projects L and S are mutually exclusive?

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1mM

Related questions

Question

ONLY NEED ANSWER OF PART (IV)

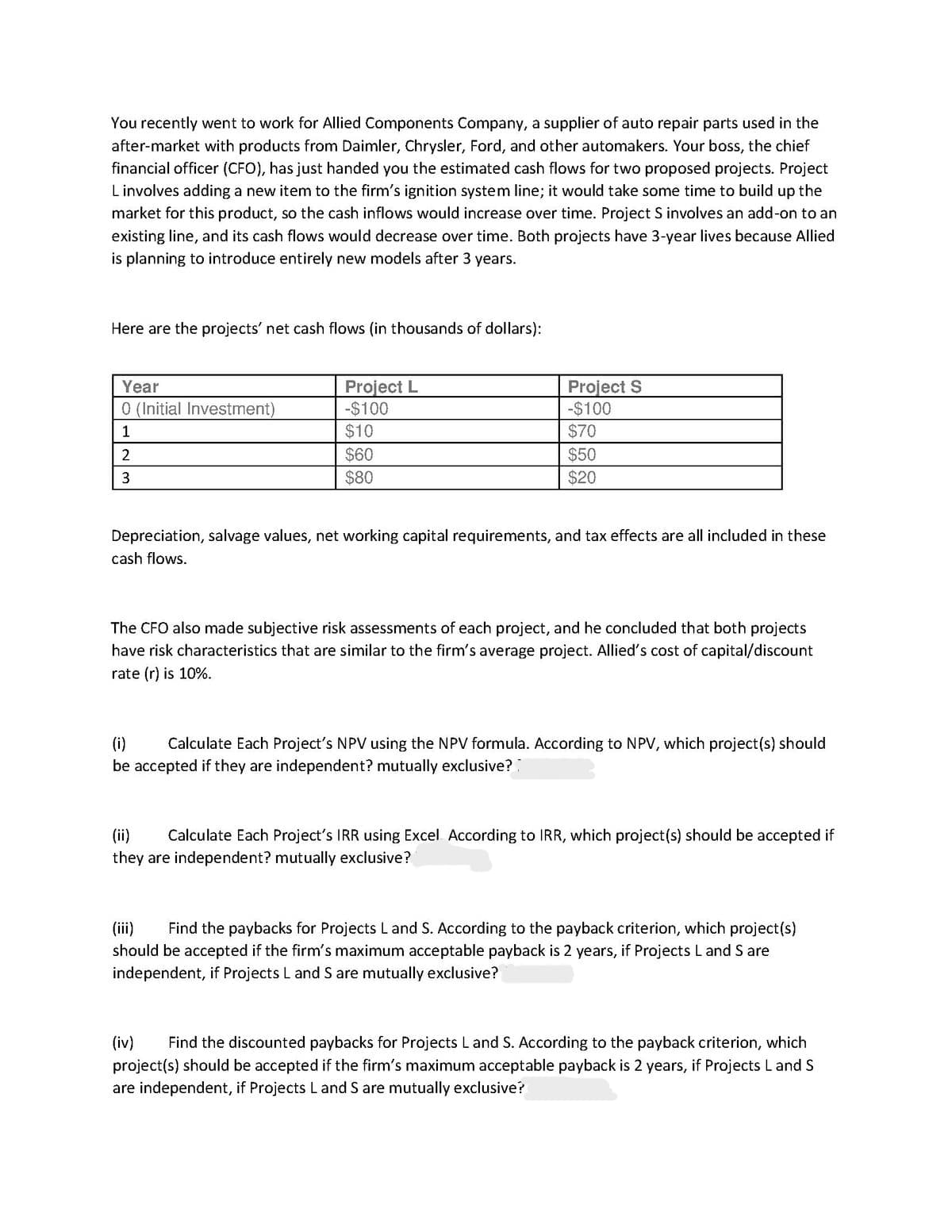

Transcribed Image Text:You recently went to work for Allied Components Company, a supplier of auto repair parts used in the

after-market with products from Daimler, Chrysler, Ford, and other automakers. Your boss, the chief

financial officer (CFO), has just handed you the estimated cash flows for two proposed projects. Project

Linvolves adding a new item to the firm's ignition system line; it would take some time to build up the

market for this product, so the cash inflows would increase over time. Project S involves an add-on to an

existing line, and its cash flows would decrease over time. Both projects have 3-year lives because Allied

is planning to introduce entirely new models after 3 years.

Here are the projects' net cash flows (in thousands of dollars):

Project L

-$100

$10

Project S

-$100

$70

Year

0 (Initial Investment)

1

2

$60

$50

$80

$20

Depreciation, salvage values, net working capital requirements, and tax effects are all included in these

cash flows.

The CFO also made subjective risk assessments of each project, and he concluded that both projects

have risk characteristics that are similar to the firm's average project. Allied's cost of capital/discount

rate (r) is 10%.

(i)

Calculate Each Project's NPV using the NPV formula. According to NPV, which project(s) should

be accepted if they are independent? mutually exclusive?

(ii)

Calculate Each Project's IRR using Excel According to IRR, which project(s) should be accepted if

they are independent? mutually exclusive?

(iii)

should be accepted if the firm's maximum acceptable payback is 2 years, if Projects L and S are

independent, if Projects L and S are mutually exclusive?

Find the paybacks for Projects L and S. According to the payback criterion, which project(s)

(iv)

Find the discounted paybacks for Projects L and S. According to the payback criterion, which

project(s) should be accepted if the firm's maximum acceptable payback is 2 years, if Projects Land S

are independent, if Projects L and S are mutually exclusive?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning