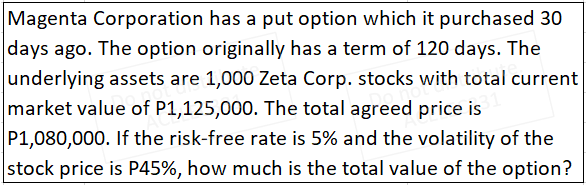

Magenta Corporation has a put option which it purchased 30 days ago. The option originally has a term of 120 days. The underlying assets are 1,000 Zeta Corp. stocks with total current market value of P1,125,000. The total agreed price is P1,080,000. If the risk-free rate is 5% and the volatility of the stock price is P45%, how much is the total value of the option?

Q: (a) (Write the parameters you use in TVM-Solver.) What quarterly payment will Mike be required to ma...

A: Loan amortization refers to a schedule which is prepared to shows the periodic loan payments, amount...

Q: Estimate the costs of different capital components—debt, preferred stock, retained earnings, and com...

A: Debt is something that one party borrows from another, usually money. Debt is used to make large pur...

Q: What is the price of Thera Corpn's zero coupon bond with 10 years to maturity? The bond was original...

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type]) Rat...

Q: Antonio Sy started working for the ABC Corporation on his 25th Birthday. Each month P30 was withheld...

A: Here,

Q: An asphalt road requires no repairs until the end of 2 years. At the end of 3rd year, P90,000 will b...

A: Here, Here, From Year 1 to Year 2, Repair cost is P0 From Year 3 to Year 7, Repair Cost is P90,000 ...

Q: Determine the following: 1. Total present amount of the obligations. 2. Total future amount of the o...

A: Present value can be defined as the amount of money that have to be invested today to earn a require...

Q: Below is the Income Statement of Company A for 2020-2021 in KWD. 2021 2020 Sales Revenue 1,000,000 1...

A: Solution:- Common size percentage means the ratio of items of income statement to a common base, gen...

Q: A firm has just paid (the moment before valuation) a dividend of 88C and is expected to exhibit a gr...

A: Price of stock can be found from variable growth rate of dividend discount model and value can be fo...

Q: QUESTION 12 THIS IS A MANDATORY SUBMISSION Calculate the number of compounding periods for an ordina...

A: Since, specifically Question 12 is asked, so the following solution is for Question 12 only. Solutio...

Q: alculate the recovery period of the item, detail its result in years, months and days. Year Amont ...

A: The recovery period is the set of time required to recover the cost of outlay.

Q: The balance on Taylor's credit card is $2000. It has an interest rate of 12.5%. She wants to compare...

A: Interest refers to the amount paid by the borrower to bank on the amount borrowed at a fixed or fluc...

Q: A $50 million face value bond carrying a 4.83 % coupon with 25 years until maturity is issued. The b...

A: Bond carry the interest payments to be paid each period and face value is to be paid on the maturity...

Q: Assume Highline Company has just paid an annual dividend of $0.98. Analysts are predicting an 11.2% ...

A: Answer - Computation of Value of Highline's stock - Year Dividend PV @ 9.2% Present Value ...

Q: John has been asked to evaluate whether it would be better to lease an asset or to borrow money from...

A: Net Present Value is the difference between the present value of cash inflows and present value of c...

Q: Please answer the following question according to the figure below. 1. How does increase in debt aff...

A: Debt and equity financing Each source of financing has its own advantages and disadvantages. For exa...

Q: A call option for a P5,000,000-face value bond has a strike price of 101. If the market value of the...

A: Market value = P 5.3 million Strike price = 1.01 * P 5 million = P 5.05 million

Q: If the interest rate is 12% per year compounded annually, a) what is the equivalent present worth of...

A: The present worth analysis is an analysis which takes into account the present worth of the benefits...

Q: Refuse, Inc. just paid a dividend of $2. Refuse expects dividends to grow at 4% indefinitely The etu...

A: Share price Share price is the current market price of the share. It is the price of the share at wh...

Q: Purple Corporation just purchased a call option for 10,000 Red Corp. ordinary shares at a strike pri...

A: Market value per share us P534 Volatility is 10% Risk free rate is 3% Strikr price is P489 Time peri...

Q: Amanda is going to invest to help with a down payment on a home. How much would she have to invest t...

A: The concept of the time value of money states that the same amount of money has more value now than ...

Q: An investor has a stock investment with a beta of 1.25. He was expecting to have the return on his s...

A: We need to use CAPM equation to calculate new expected rate of return. The equation is Expected rat...

Q: Bond valuation Bond X is noncallable and has 20 years to maturity, a 7% annual coupon, and a $1,000...

A: Hi! Thank you for the question , As per the Honor code , we are allowed to answer the one question i...

Q: a. Discuss two technical points that can affect short selling. b. Do your own research on ASX. What ...

A: a) Short selling occurs when an investor borrows a security and sells it on the open market with the...

Q: Suppose Acap Corporation will pay a dividend of $2.89 per share at the end of this year and $2.93 pe...

A: Stock price is defined as the maximum price that an investor is ready to pay for a stock. It is calc...

Q: Question: based on the above information, calculate the Motorway CO's leading price to earnings (P/E...

A: The relation between a company's current share price and earnings per share is known as the price ea...

Q: A tenter with $ 1189.08 has a one year lease. The landlord is willing to accept two payment options....

A: Present value of annuity due = $1189.08 Monthly payment (M) = $100 Let r = Monthly interest rate n =...

Q: We are considering the purchase of a $760,000 computed based inventory management system. It is in c...

A: Given in this question , Purchase = $760,000 CCA rate = 30 % Tax rate = 28%. The required return =1...

Q: Determine the number of days from Actual time to Approximate Time Loan Date- Feb. 5, 2021 End date...

A: In actual time, actual days in a month are considered. In approximate time, every month's days are 3...

Q: Mary Joy Dela PAz purchased a house worth 188,686 with a down payment of 36,866 and monthly payments...

A: Given: Particulars Amount Cost of house 188686 Down payment 36866 Years 15 Interest rate ...

Q: t 14.4.1. This conspiracy to raise prices violates the anti combine law because

A: This conspirancy to raise prices viloates the anti combine law because Here Price is changes , re...

Q: Barlae Auto Repair, Inc. is evaluating a project to purchase equipment that will not only expand the...

A: Here, Initial Investment is $200,000 Increase in Net Profit per year is $14,000 Increase in Cash flo...

Q: Big Rock has several investment portfolios with a local mutual fund company. One of the company's di...

A: Risk and return are the two different factors of an investment. Different investors have different l...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: Cost of equity can be calculated by using this equation Cost of equity =(Dividend/current stock pric...

Q: Hadji wants to find the equivalent annual cash flow for 9 years with interest rate of 15% compounded...

A: Year 1 payment (P1) = $2800 Every payment after this increases by $120 n = 9 years r = 15% Let A = A...

Q: ared borrowed Charging 3.6 070 cONpornded Monthly interest.

A: Loans are paid by equal monthly payments that carry the payment of principal amount and payment of i...

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return...

A: Here, Details of Bonds: Details of Equity Shares: Details of Preference Shares:

Q: Tom plans to save $2,000 for each of the next ten years, starting tonight when he will write his fin...

A: The account value at end of 10 years can be calculated with the help of future value of annuity due ...

Q: What are Finances?

A: Finances: It contains leverage/debt, banking, capital markets, investments, credit, and the creatio...

Q: Jarett & Sons' common stock currently trades at $25.00 a share. It is expected to pay an annual divi...

A: Cost of equity is the rate of return demanded by the common stock holders of a company. Out of all s...

Q: If you invest your P3,000 every year at 4% interest rate, how many months does it take to be worth P...

A: Future Value: The future value is the amount that will be received at the end of a certain period. T...

Q: Joshua inherited six parcels of land. He sold one parcel to secure funds for his school expenses. Jo...

A: A contract is a legally enforceable promise or set of promises that provides access to remedies for ...

Q: If an individual stock's beta is higher than 1, that stock is riskier than the market

A: If individual stocks beta greater than 1 has risker than market and more volatile. CAPM cost of equ...

Q: Mr. Sanchez's new machine has been installed. Based on the contract and warranty, there will be no m...

A: Here, Life of Machine is 16 years Maintenance Cost for first 2 years is $0 Maintenance Cost from 3rd...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: The cost of equity is the return that an investor requires for investing his money in an entity. The...

Q: You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: which of the following entities would relative valuation be appropriate? a.) a cooperative b.) a p...

A: To assess a firm's financial worth, a relative valuation model compares its value to that of its riv...

Q: Clark Industries has 200 million shares outstanding, a current share price of $30, and no debt. Clar...

A: Total Number of shares outstanding are 200 million Share price is $30 Cash in hand or distributable ...

Q: Emily Dao, 27, just received a promotion at work that increased her annual salary to $37,000. She is...

A: Concept. Present value is calculated by formula Pv = Fv ÷[ ( 1+ r) n ] Where Pv = present value Fv ...

Q: a. What price would you be willing to pay for a share of Acap stock today. you planned to hold the s...

A: Dividend discount model refers to a stock valuation model which is used by the company for estimatin...

Q: 18. A man will deposit 200 with a savings bank at the beginning of each 3 months for 9 years. If the...

A: Question 18 pertains to annuity due. Annuity due is that annuity in which payments are made at the b...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $50per share for months, and you believe it is going to stay in that range for the next 3 months. Theprice of a 3-month put option with an exercise price of $50 is $4.a. If the risk-free interest rate is 10% per year, what must be the price of a 3-month call optionon C.A.L.L. stock at an exercise price of $50 if it is at the money? (The stock pays nodividends.)b. What would be a simple options strategy using a put and a call to exploit your convictionabout the stock price’s future movement? What is the most money you can make on thisposition? How far can the stock price move in either direction before you lose money?c. How can you create a position involving a put, a call, and riskless lending that would havethe same payoff structure as the stock at expiration? What is the net cost of establishing thatposition now?Assume that the current stock price is $50 per share, that call options can be purchased with an exercise price of $60 per share, that bank loans can be obtained for a 10 percent nominal rate, and that at expiration of the option in three months, the stock will either be valued at $30 or $70. Show that it is possible to replicate the stock payoff by borrowing and buying a call option.). Suppose the call option of Tesla company has an exercise price of $200 and expires in 90 days. Assume the current price of Tesla stock is $240, with a standard deviation of 40% per year. The risk-free interest rate is 6.18% per year. First, using the Black-Scholes formula, compute the price of the call. And then use put-call parity to compute the price of the put with the same strike and expiration date. Based on put-call parity, what should be the put option price? a. $ 2.65 b. $ 1.78 c. $ 3.69 d. $ 4.22 e. None of the above

- Suppose the call option of Tesla company has an exercise price of $200 and expires in 90 days. Assume the current price of Tesla stock is $240, with a standard deviation of 40% per year. The risk-free interest rate is 6.18% per year. First, using the Black-Scholes formula, compute the price of the call. And then use put-call parity to compute the price of the put with the same strike and expiration date. Based on put-call parity, what should be the put option price? $ 2.65 $ 1.78 $ 3.69 $ 4.22 None of the aboveThe common stock of the C.A.L.L. Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next 6 months. The price of a 6-month put option with an exercise price of $40 is $8.49. Required: If the semiannual risk-free interest rate is 3%, what must be the price of a 6-month call option on C.A.L.L. stock at an exercise price of $40 if it is at the money? (The stock pays no dividends.) What would be a simple options strategy using a put and a call to exploit your conviction about the stock price’s future movement? What is the most money you can make on this position? How far can the stock price move in either direction before you lose money? How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration? What is the net cost of establishing that position now?The stock of Bedrock Solutions is currently trading at $20.00 per share. The 1-month put option with strike price of 22.62 is currently selling for $4.38. What's the time value of this put option?

- ABC stock is currently trading at R70 per share. A dividend of R1 is expected after three monthsand another one of R1 after six months. A European call option on ABC stock has a strike priceof R65 and 8 months to maturity. Given that the risk-free rate is 10% and the volatility is 32%,compute the price of the option.The stock of Bedrock Solutions is currently trading at $15.00 per share. The 1-month call option with strike price of 25.50 is currently selling for $3.14. What's the time value of this call option?TreeOlivia's stock price is $180 and could halve or double in each six-month period. The interest rate is 12% a year. What is the value of a six-month call option on TreeOlivia with an exercise price of $120? What is the option delta for the six-month call with an exercise of $120? The payoffs of the six-month call option can be replicated by buying shares of stock and borrowing. What amount should be invested in stock and what amount must be borrowed? Assume the exercise price is $120. What is the value of the one-year call option on TreeOlivia with an exercise of $150? (Hint: use the two-step binominal tree) What is the value of the one-year put option on TreeOlivia with an exercise of $150?

- The price of Cilantro, Inc., stock will be either $70 or $90 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 6 percent. a. Suppose the current price of the company’s stock is $80. What is the value of the call option if the exercise price is $60 per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Suppose the current price of the company’s stock is $80. What is the value of the call option if the exercise price is $75 per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)The stocks of Cee Mobile Limited is currently trading at $73 each. The call option on the company’s stock has an exercise price of $70, with fifty (50) days remaining to expiration. It is assumed that the yield on treasury bills is currently 2%, while the volatility of the stock price is estimated as being 35%. a. Using the Black-Scholes-Merton (BSM) model, calculate the value of the Call option, given the above parameters. Show all relevant workings. b. Of the value computed, how much is the intrinsic value and the time value of the Call option? c. Using the BSM model and the information given above, calculate the value of the Put option on the stock, with a similar strike price and days to expiration.The stocks of Cee Mobile Limited is currently trading at $73 each. The call option on the company’s stock has an exercise price of $70, with fifty (50) days remaining to expiration. It is assumed that the yield on treasury bills is currently 2%, while the volatility of the stock price is estimated as being 35%. Required: i. Using the Black-Scholes-Merton (BSM) model, calculate the value of the Call option, given the above parameters. Show all relevant workings.