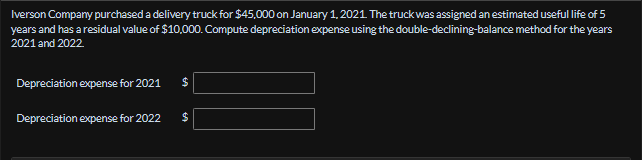

Iverson Company purchased a delivery truck for $45,000 on January 1, 2021. The truck was assigned an estimated useful life of 5 years and has a residual value of $10,000. Compute depreciation expense using the double-declining-balance method for the years 2021 and 2022 Depreciation expense for 2021 Depreciation expense for 2022 $

Q: No explanation needed

A: Step 1: First, we need to compute for the depreciation rate. Since this is the double declining…

Q: answer in proper format or skip answer with explanation , computation , narrations for each entry…

A: Step 1: Payment terms Purchase discount is different from trade discount.Trade discount is not…

Q: Question B-Equity Huntless Lia has me tallowing items is accounting records for the current year…

A: The objective of the question is to prepare journal entries for the given transactions and to…

Q: The company pays for its purchases within 10 days of purchase, so assume that one-third of the…

A: Information provided:The company pays for purchases within 10 days.Merchandise cost: $10 per…

Q: 6. If Northern Vale was able to produce all of its annual capacity incurring a direct labor hours of…

A: Variance analysisThe process of analyzing the actual performance with the budgeted values is called…

Q: explain the direct allocation method.

A: The objective of this question is to understand the concept of the direct allocation method in…

Q: Please do not give solution in image format thanku

A: Inventory turnover is used to measure the company's efficiency in using or selling its inventory. It…

Q: Question 8 - Equity Huntless Ltd has the following items in its accounting records for the current…

A: The journal entries for Huntless Ltd's equity transactions detail the issuance of 50,000 shares at…

Q: Denger

A: Break Down the Provided DataPreferred Stock: $5,900,000Common Stock: $29,000,000Additional Paid-in…

Q: On December 31, 2024, Shamrock Corporation signed a 5-year, non-cancelable lease for a machine. The…

A: The objective of the question is to calculate the present value of the lease payments for Shamrock…

Q: Indicate whether each of the following expenditures should be classified as land, land improvements,…

A: Step 1: Step 2: Step 3: Step 4:

Q: Piscataway Plastics Company manufactures a highly specialized plastic that is used extensively in…

A: Piscataway Plastics Company - Process Costing (Weighted Average)The provided information allows us…

Q: The following information is available for Reagan Company: Allowance for doubtful accounts at…

A: The objective of the question is to calculate the bad debt expense for Reagan Company for the year…

Q: Use the following information for the next three questions Dolan Corporation adopted the…

A: To compute the cost of ending inventory, December 31, 2018 Cost of ending inventory, 2018 = $241,400…

Q: Don't give answer in image

A: Randolph Company - Variances for July1. Materials Variances:Actual Cost: $42,300Standard Cost:…

Q: 1 Problem 14-18 (Algo) Net Present Value Analysis [LO14-2] Print Oakmont Company has an opportunity…

A: Determine the initial cash outflow, which includes the cost of equipment and the working capital…

Q: Replace Equipment A machine with a book value of $250,700 has an estimated remaining life of 6…

A: The objective of the question is to prepare a differential analysis to decide whether to continue…

Q: None

A: The B/C (benefit-cost) ratio is a financial metric used to evaluate the economic feasibility of a…

Q: Bilboa Freightlines, S.A., of Panama, has a small truck that it uses for intracity deliveries. The…

A: Step 1:1 Now12345Keep the old truck: Overhaul needed now-16000 Annual operating costs…

Q: None

A: After-Tax Income for Manny: December vs. January BillSince Manny uses the cash method of accounting,…

Q: Jackson Company manufactures computer keyboards. The budgeted sales price is $60 per keyboard, the…

A: Step 1: Meaning of Operating IncomeOperating income is the income which is earned in the ordinary…

Q: A non-resident Australian, married, died and left the following proeprties: Philippines Australia…

A: Income tax: The income tax refers to the amount that is paid by the taxpayer to the tax authority of…

Q: Exercise > On December 1, 20xx the incorporators of Kilo Corporation made the following subscription…

A: Shares The capital of the company divided into small units is called a Share. Each share is given a…

Q: Labor quantity variance cut off at bottom. Please anwser question in full

A: (a) Total labor variance:Subtract the actual labor cost from the standard labor cost to get the…

Q: Q1C) AI Zahraa Company for Drinks invested in a new production line that has the information shown…

A: Part 2: Explanation:Step 1: Calculating the depreciation rate is crucial for determining the annual…

Q: Rahul

A: Journal Entries for Disposal of Hydrotherapy Tub System (CC9-1, Part 2)Scenario: NGS sold the…

Q: Plessings Company leased a piece of machinery to Banana, Inc. on January 1, 2023. The lease is…

A: Calculating the Implicit Rate in Plessings' Sales-Type LeaseWe can find the implicit rate using the…

Q: Temptation Food Products Ltd is an established processed foods company specialising in latest…

A: Let's take a closer look at each financial metric:1. Cash Flow: A key financial indicator, cash flow…

Q: For all payroll calculations, use the following tax rates and round amounts to the nearest cent.…

A: Detailed explanation:1. Journal entry for Ricardo's expenses for employee benefits and for…

Q: Domestic

A: a. Goodwill impairment calculation:Fair value of Sellers reporting unit: $1,028Fair value of…

Q: Three identical units of merchandise were purchased during July, as follows: Date Product Basic H…

A: a) First-In, First-Out (FIFO)Under this the first goods purchased are the first to be sold.COGS :-…

Q: Consider the following statement about the performance reports: 1. Performance reports provide…

A: Performance reports are indispensable tools for managers, offering critical insights into…

Q: Dinesh Bhai

A: Approach to solving the question: Detailed explanation: Examples: Key references: Financial…

Q: AM. 119.

A: The objective of the question is to calculate the new return on investment (ROI) if expenses are…

Q: Arial ▼ 10 Α Α = = = ab Paste BIU Open recovered workbooks? Your recent changes were saved. Do you…

A: The objective of the question is to journalize the transactions for Cedar Springs Company for the…

Q: A quantity of steel in the amount of $423,000.0 is needed for a project, payment due (from…

A: A short-term line of credit is an arrangement between a bank and a customer in which the bank offers…

Q: a1

A: Step 1:a) Computation of Accumulated Earning tax as follows :…

Q: give an answer as per introduction i want correct answer

A: Step 1: To prepare a selling and administrative expense budget, we need to separate the variable and…

Q: S Required information Exercise 7-7A (Static) Effect of recognizing uncollectible accounts on the…

A: The objective of the question is to prepare the financial statements for Leach Incorporated for Year…

Q: × A 10% stock dividend will increase the number of shares issued by 12800 (128000 × 10%). At a…

A: Step 1:Answer is ------->Option C : Retained Earnings will decrease by $ 384000 and total paid…

Q: Question 18 0/5 points A local dental practice decides to run a Groupon campaign. The campaign…

A: Step 1: Total Revenue from Groupon Coupons Sold Total coupons sold = 245 Price per coupon = $150…

Q: Match each of the below items into one of the following balance sheet categories: Cash Receivables…

A: The objective of this question is to categorize various items into appropriate balance sheet…

Q: A. Prepare the necessary journal entries at December 31, 2021, to record the above information. B.…

A: Journal entry:The monetary transaction of the business is recorded in the books of accounts called…

Q: P16.1 (LO 1) (Debt Securities) Presented below is an amortization schedule related to Spangler…

A: Approach to solving the question: Detailed explanation: Examples: Key references: Financial…

Q: Check my work mode: This shows what is correct or incorrect for the work you have completed so far.…

A: Let's dig more profound into each necessity: Req 1: Shockingly, you haven't given the points of…

Q: olicoeur Ltd produces and markets a single product. Following budgeted information is available from…

A: The objective of the question is to prepare the profit and loss statement for the months of March…

Q: Exercise 23-2 Make or buy LO P1 Gelb Company currently manufactures 55,500 units per year of a key…

A: Step 1: Costs to make : Incremental Costs to make Relevant amount per unitRelevant fixed costs Total…

Q: The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a…

A: To calculate the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes,…

Q: Which of the following will affect net income? O O Writing off an Account Receivable. Estimating bad…

A: The objective of the question is to identify which of the given transactions will have an impact on…

Q: Don't give solution in image format..

A: Journal Entry to Transfer Goods from Cutting to StitchingHere's the journal entry to record the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.

- On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?Chapman Inc. purchased a piece of equipment in 2018. Chapman depreciated the equipment on a straight-line basis over a useful life of 10 years and used a residual value of $12,000. Chapmans depreciation expense for 2019 was $11,000. What was the original cost of the building? a. $98,000 b. $110,000 c. $122,000 d. $134,000

- Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.Albany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.

- Revision of Depreciation On January 1, 2017, Blizzards-R-Us purchased a snow-blowing machine for $125,000. The machine was expected to have a residual value of $12,000 at the end of its 5-year useful life. On January 1, 2019, Blizzards-R-Us concluded that the machine would have a remaining useful life of 6 years with a residual value of $3,600. Required: 1. Determine the revised annual depreciation expense for 2019 using the straight-line method. 2. CONCEPTUAL CONNECTION How does the revision in depreciation affect the Blizzards-R-Us financial statements?Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.