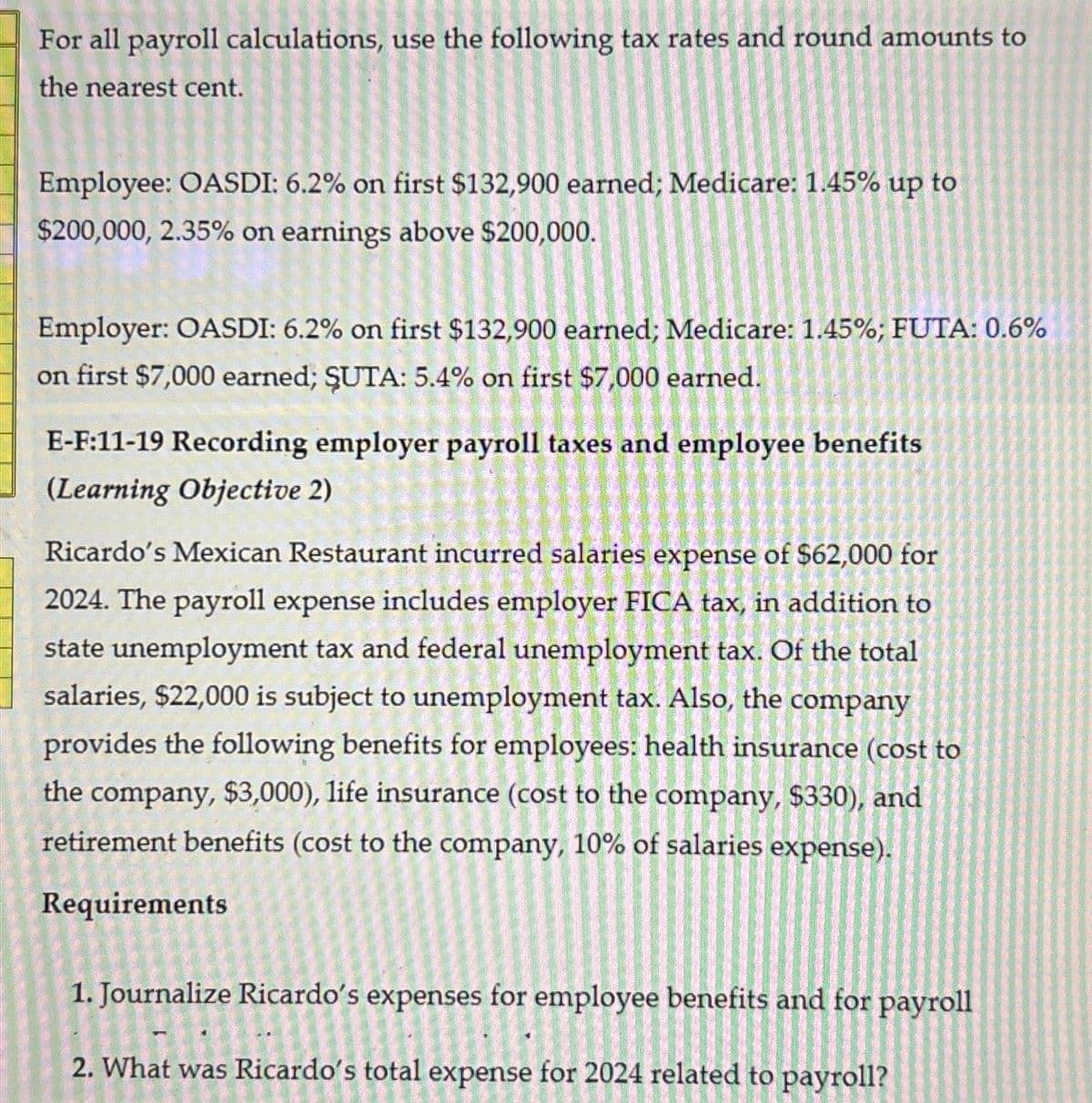

For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; ŞUTA: 5.4% on first $7,000 earned. E-F:11-19 Recording employer payroll taxes and employee benefits (Learning Objective 2) Ricardo's Mexican Restaurant incurred salaries expense of $62,000 for 2024. The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, $22,000 is subject to unemployment tax. Also, the company provides the following benefits for employees: health insurance (cost to the company, $3,000), life insurance (cost to the company, $330), and retirement benefits (cost to the company, 10% of salaries expense). Requirements 1. Journalize Ricardo's expenses for employee benefits and for payroll 2. What was Ricardo's total expense for 2024 related to payroll?

For all payroll calculations, use the following tax rates and round amounts to the nearest cent. Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; ŞUTA: 5.4% on first $7,000 earned. E-F:11-19 Recording employer payroll taxes and employee benefits (Learning Objective 2) Ricardo's Mexican Restaurant incurred salaries expense of $62,000 for 2024. The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, $22,000 is subject to unemployment tax. Also, the company provides the following benefits for employees: health insurance (cost to the company, $3,000), life insurance (cost to the company, $330), and retirement benefits (cost to the company, 10% of salaries expense). Requirements 1. Journalize Ricardo's expenses for employee benefits and for payroll 2. What was Ricardo's total expense for 2024 related to payroll?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:For all payroll calculations, use the following tax rates and round amounts to

the nearest cent.

Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to

$200,000, 2.35% on earnings above $200,000.

Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6%

on first $7,000 earned; ŞUTA: 5.4% on first $7,000 earned.

E-F:11-19 Recording employer payroll taxes and employee benefits

(Learning Objective 2)

Ricardo's Mexican Restaurant incurred salaries expense of $62,000 for

2024. The payroll expense includes employer FICA tax, in addition to

state unemployment tax and federal unemployment tax. Of the total

salaries, $22,000 is subject to unemployment tax. Also, the company

provides the following benefits for employees: health insurance (cost to

the company, $3,000), life insurance (cost to the company, $330), and

retirement benefits (cost to the company, 10% of salaries expense).

Requirements

1. Journalize Ricardo's expenses for employee benefits and for payroll

2. What was Ricardo's total expense for 2024 related to payroll?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage