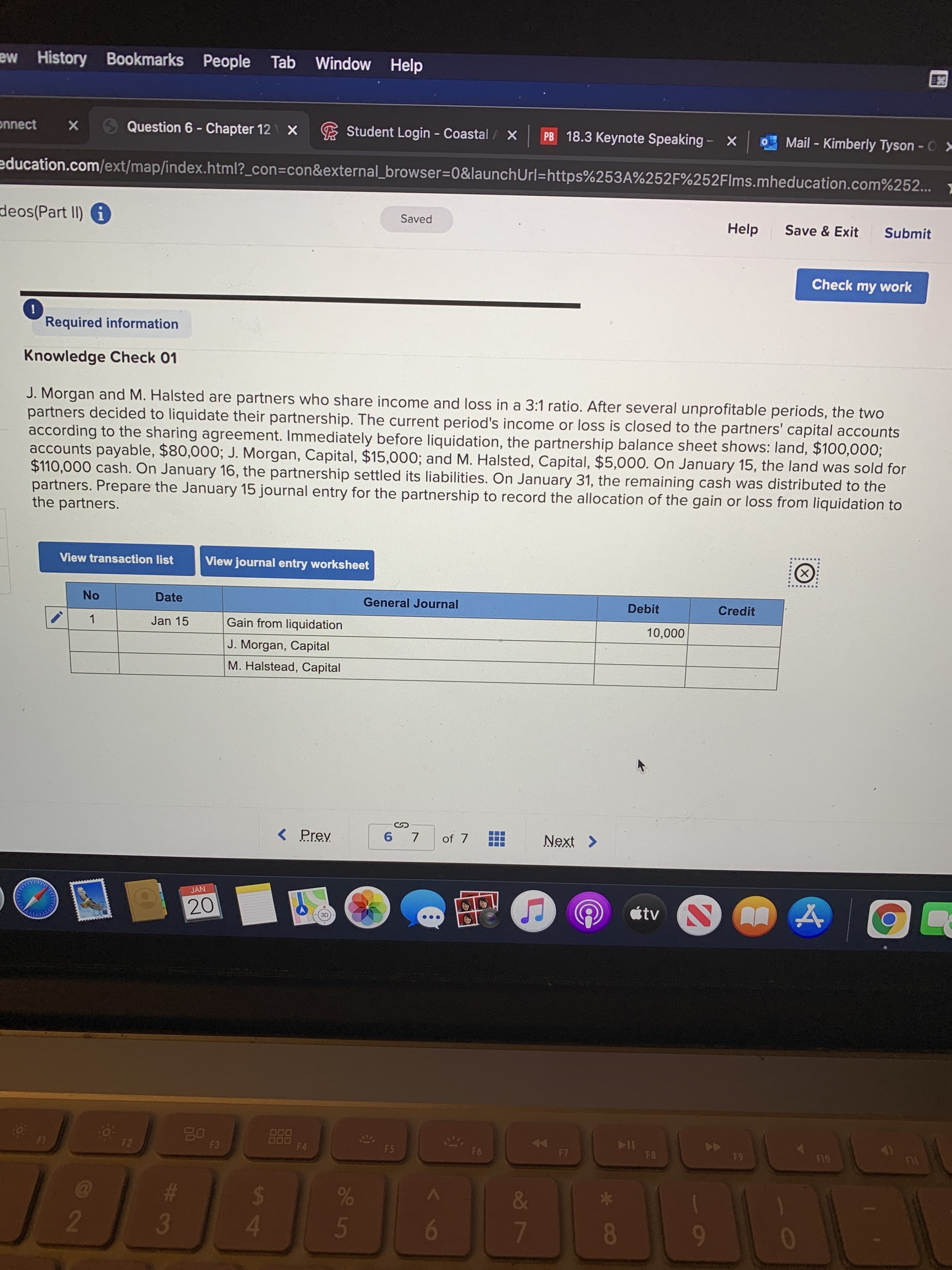

J. Morgan and M. Halsted are partners who share income and loss in a 3:1 ratio. After several unprofitable periods, the two partners decided to liquidate their partnership. The current period's income or loss is closed to the partners' capital accounts according to the sharing agreement. Immediately before liquidation, the partnership balance sheet shows: land, $100,000; accounts payable, $80,000; J. Morgan, Capital, $15,000; and M. Halsted, Capital, $5,000. On January 15, the land was sold for $110,000 cash. On January 16, the partnership settled its liabilities. On January 31, the remaining cash was distributed to the partners. Prepare the January 15 journal entry for the partnership to record the allocation of the gain or loss from liquidation to the partners. .....Y View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Jan 15 Gain from liquidation 10,000 J. Morgan, Capital M. Halstead, Capital

J. Morgan and M. Halsted are partners who share income and loss in a 3:1 ratio. After several unprofitable periods, the two partners decided to liquidate their partnership. The current period's income or loss is closed to the partners' capital accounts according to the sharing agreement. Immediately before liquidation, the partnership balance sheet shows: land, $100,000; accounts payable, $80,000; J. Morgan, Capital, $15,000; and M. Halsted, Capital, $5,000. On January 15, the land was sold for $110,000 cash. On January 16, the partnership settled its liabilities. On January 31, the remaining cash was distributed to the partners. Prepare the January 15 journal entry for the partnership to record the allocation of the gain or loss from liquidation to the partners. .....Y View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Jan 15 Gain from liquidation 10,000 J. Morgan, Capital M. Halstead, Capital

Chapter21: Partnerships

Section: Chapter Questions

Problem 11BCRQ

Related questions

Question

I need help on finding this answer I have tried every scenario I can think of and everytime the answer is wrong

Transcribed Image Text:J. Morgan and M. Halsted are partners who share income and loss in a 3:1 ratio. After several unprofitable periods, the two

partners decided to liquidate their partnership. The current period's income or loss is closed to the partners' capital accounts

according to the sharing agreement. Immediately before liquidation, the partnership balance sheet shows: land, $100,000;

accounts payable, $80,000; J. Morgan, Capital, $15,000; and M. Halsted, Capital, $5,000. On January 15, the land was sold for

$110,000 cash. On January 16, the partnership settled its liabilities. On January 31, the remaining cash was distributed to the

partners. Prepare the January 15 journal entry for the partnership to record the allocation of the gain or loss from liquidation to

the partners.

.....Y

View transaction list

View journal entry worksheet

No

Date

General Journal

Debit

Credit

1

Jan 15

Gain from liquidation

10,000

J. Morgan, Capital

M. Halstead, Capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning