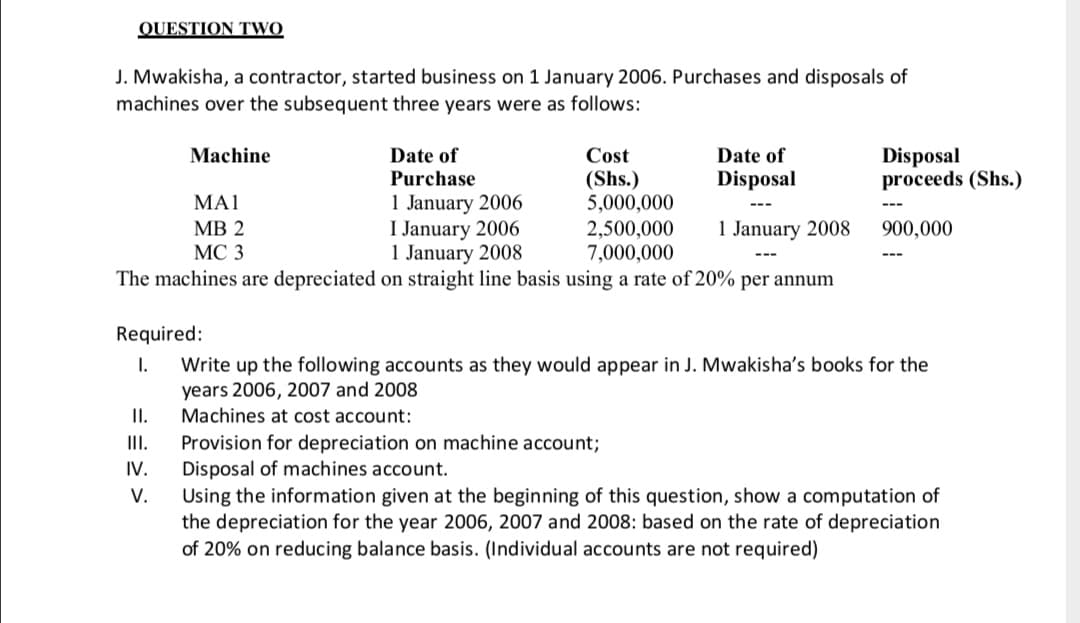

J. Mwakisha, a contractor, started business on 1 January 2006. Purchases and disposals of machines over the subsequent three years were as follows: Date of Purchase Cost (Shs.) 5,000,000 2,500,000 7,000,000 Machine Date of Disposal proceeds (Shs.) Disposal 1 January 2006 I January 2006 1 January 2008 The machines are depreciated on straight line basis using a rate of 20% per annum MAI --- --- MB 2 1 January 2008 900,000 МС 3 --- --- Required: I. Write up the following accounts as they would appear in J. Mwakisha's books for the years 2006, 2007 and 2008 Machines at cost account: II. Provision for depreciation on machine account; IV. III. Disposal of machines account. Using the information given at the beginning of this question, show a computation of the depreciation for the year 2006, 2007 and 2008: based on the rate of depreciation of 20% on reducing balance basis. (Individual accounts are not required) V.

J. Mwakisha, a contractor, started business on 1 January 2006. Purchases and disposals of machines over the subsequent three years were as follows: Date of Purchase Cost (Shs.) 5,000,000 2,500,000 7,000,000 Machine Date of Disposal proceeds (Shs.) Disposal 1 January 2006 I January 2006 1 January 2008 The machines are depreciated on straight line basis using a rate of 20% per annum MAI --- --- MB 2 1 January 2008 900,000 МС 3 --- --- Required: I. Write up the following accounts as they would appear in J. Mwakisha's books for the years 2006, 2007 and 2008 Machines at cost account: II. Provision for depreciation on machine account; IV. III. Disposal of machines account. Using the information given at the beginning of this question, show a computation of the depreciation for the year 2006, 2007 and 2008: based on the rate of depreciation of 20% on reducing balance basis. (Individual accounts are not required) V.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.6E

Related questions

Question

Transcribed Image Text:QUESTION TWO

J. Mwakisha, a contractor, started business on 1 January 2006. Purchases and disposals of

machines over the subsequent three years were as follows:

Machine

Cost

(Shs.)

5,000,000

2,500,000

7,000,000

Date of

Date of

Disposal

proceeds (Shs.)

Purchase

Disposal

1 January 2006

I January 2006

1 January 2008

The machines are depreciated on straight line basis using a rate of 20% per annum

MAI

---

MB 2

1 January 2008

900,000

МС 3

---

---

Required:

Write up the following accounts as they would appear in J. Mwakisha's books for the

years 2006, 2007 and 2008

Machines at cost account:

I.

I.

Provision for depreciation on machine account;

Disposal of machines account.

Using the information given at the beginning of this question, show a computation of

the depreciation for the year 2006, 2007 and 2008: based on the rate of depreciation

of 20% on reducing balance basis. (Individual accounts are not required)

III.

IV.

V.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage