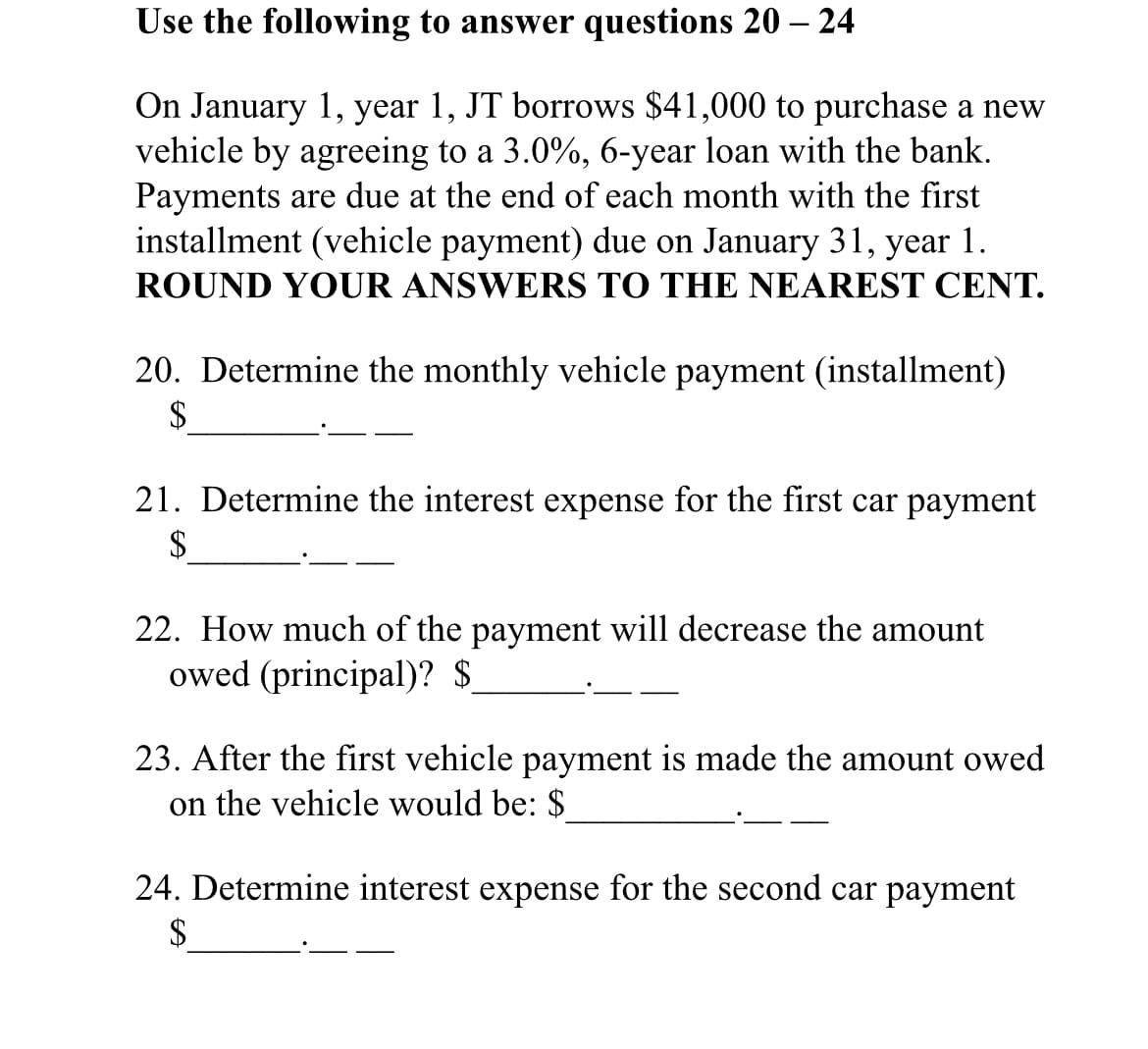

Use the following to answer questions 20 – 24 On January 1, year 1, JT borrows $41,000 to purchase a new vehicle by agreeing to a 3.0%, 6-year loan with the bank. Payments are due at the end of each month with the first installment (vehicle payment) due on January 31, year 1. ROUND YOUR ANSWERS TO THE NEAREST CENT. 20. Determine the monthly vehicle payment (installment) $ 21. Determine the interest expense for the first car payment $ 22. How much of the payment will decrease the amount owed (principal)? $. 23. After the first vehicle payment is made the amount owed on the vehicle would be: $ 24. Determine interest expense for the second car payment $

Use the following to answer questions 20 – 24 On January 1, year 1, JT borrows $41,000 to purchase a new vehicle by agreeing to a 3.0%, 6-year loan with the bank. Payments are due at the end of each month with the first installment (vehicle payment) due on January 31, year 1. ROUND YOUR ANSWERS TO THE NEAREST CENT. 20. Determine the monthly vehicle payment (installment) $ 21. Determine the interest expense for the first car payment $ 22. How much of the payment will decrease the amount owed (principal)? $. 23. After the first vehicle payment is made the amount owed on the vehicle would be: $ 24. Determine interest expense for the second car payment $

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.3E: Issue Price The following terms relate to independent bond issues: 500 bonds; $1,000 face value; 8%...

Related questions

Question

What the answer for 12, 16,22

12. It’s not 40,447.70

16. It’s not 100,775.94

22. It’s not 44,851.73

Transcribed Image Text:Use the following to answer questions 20 – 24

On January 1, year 1, JT borrows $41,000 to purchase a new

vehicle by agreeing to a 3.0%, 6-year loan with the bank.

Payments are due at the end of each month with the first

installment (vehicle payment) due on January 31, year 1.

ROUND YOUR ANSWERS TO THE NEAREST CENT.

20. Determine the monthly vehicle payment (installment)

$

21. Determine the interest expense for the first car payment

$

22. How much of the payment will decrease the amount

owed (principal)? $

23. After the first vehicle payment is made the amount owed

on the vehicle would be: $

24. Determine interest expense for the second car payment

$

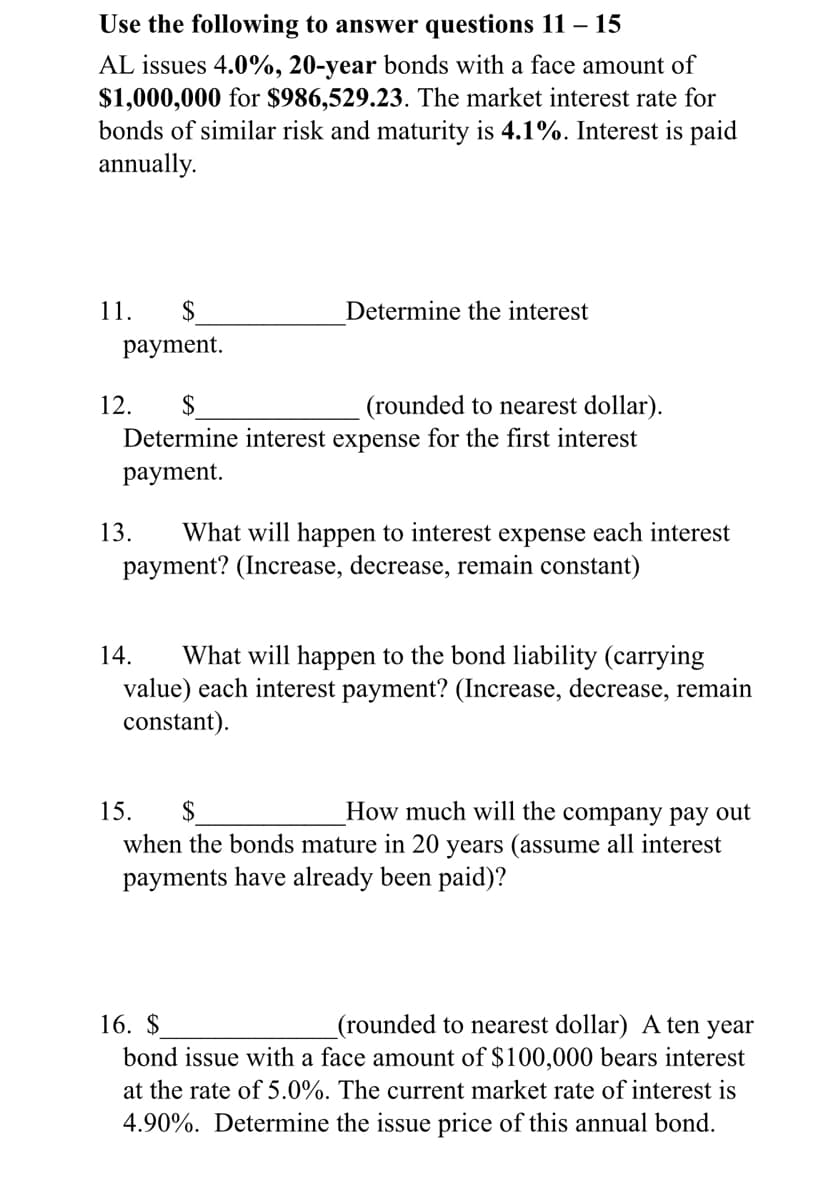

Transcribed Image Text:Use the following to answer questions 11 – 15

AL issues 4.0%, 20-year bonds with a face amount of

$1,000,000 for $986,529.23. The market interest rate for

bonds of similar risk and maturity is 4.1%. Interest is paid

annually.

11.

$

Determine the interest

раyment.

12.

$

(rounded to nearest dollar).

Determine interest expense for the first interest

раyment.

13.

What will happen to interest expense each interest

payment? (Increase, decrease, remain constant)

What will happen to the bond liability (carrying

value) each interest payment? (Increase, decrease, remain

constant).

14.

15.

$

How much will the company pay out

when the bonds mature in 20 years (assume all interest

payments have already been paid)?

16. $

(rounded to nearest dollar) A ten year

bond issue with a face amount of $100,000 bears interest

at the rate of 5.0%. The current market rate of interest is

4.90%. Determine the issue price of this annual bond.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,