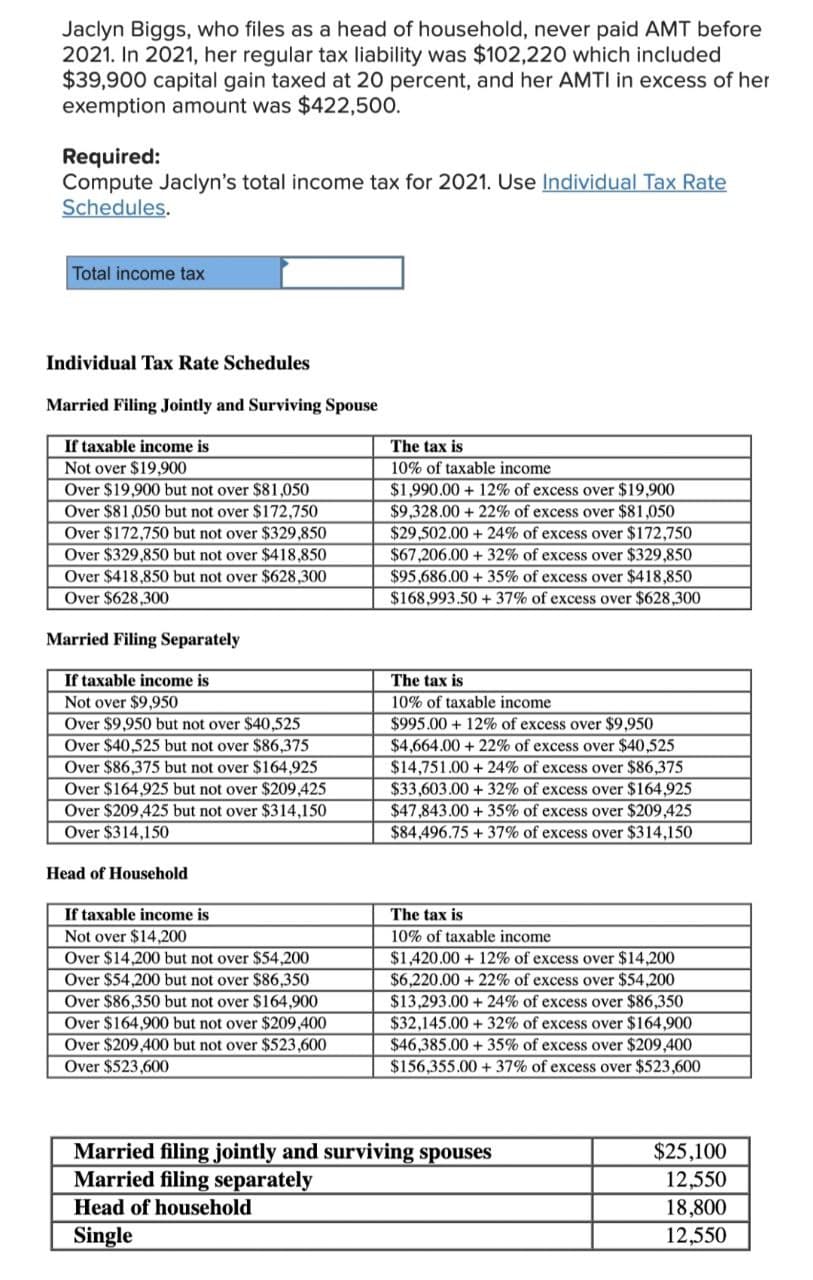

Jaclyn Biggs, who files as a head of household, never paid AMT before 2021. In 2021, her regular tax liability was $102,220 which included $39,900 capital gain taxed at 20 percent, and her AMTI in excess of her exemption amount was $422,500. Required: Compute Jaclyn's total income tax for 2021. Use Individual Tax Rate Schedules. Total income tax

Jaclyn Biggs, who files as a head of household, never paid AMT before 2021. In 2021, her regular tax liability was $102,220 which included $39,900 capital gain taxed at 20 percent, and her AMTI in excess of her exemption amount was $422,500. Required: Compute Jaclyn's total income tax for 2021. Use Individual Tax Rate Schedules. Total income tax

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter9: Individuals As Taxpayers

Section: Chapter Questions

Problem 4CE

Related questions

Question

Transcribed Image Text:Jaclyn Biggs, who files as a head of household, never paid AMT before

2021. In 2021, her regular tax liability was $102,220 which included

$39,900 capital gain taxed at 20 percent, and her AMTI in excess of her

exemption amount was $422,500.

Required:

Compute Jaclyn's total income tax for 2021. Use Individual Tax Rate

Schedules.

Total income tax

Individual Tax Rate Schedules

Married Filing Jointly and Surviving Spouse

If taxable income is

Not over $19,900

Over $19,900 but not over $81,050

Over $81,050 but not over $172,750

Over $172,750 but not over $329,850

Over $329,850 but not over $418,850

Over $418,850 but not over $628,300

Over $628,300

Married Filing Separately

If taxable income is

Not over $9,950

Over $9,950 but not over $40,525

Over $40,525 but not over $86,375

Over $86,375 but not over $164,925

Over $164,925 but not over $209,425

Over $209,425 but not over $314,150

Over $314,150

Head of Household

If taxable income is

Not over $14,200

Over $14,200 but not over $54,200

Over $54,200 but not over $86,350

Over $86,350 but not over $164,900

Over $164,900 but not over $209,400

Over $209,400 but not over $523,600

Over $523,600

The tax is

10% of taxable income

$1,990.00+ 12% of excess over $19,900

$9,328.00 +22% of excess over $81,050

$29,502.00 +24% of excess over $172,750

$67,206.00+32% of excess over $329,850

$95,686.00+ 35% of excess over $418,850

$168,993.50 +37% of excess over $628,300

The tax is

10% of taxable income

$995.00+12% of excess over $9,950

$4,664.00 +22% of excess over $40,525

$14,751.00 +24% of excess over $86,375

$33,603.00 +32% of excess over $164,925

$47,843.00 +35% of excess over $209,425

$84,496.75 +37% of excess over $314,150

The tax is

10% of taxable income

$1,420.00+ 12% of excess over $14,200

$6,220.00+22% of excess over $54,200

$13,293.00 +24% of excess over $86,350

$32,145.00+ 32% of excess over $164,900

$46,385.00+ 35% of excess over $209,400

$156,355.00+ 37% of excess over $523,600

Married filing jointly and surviving spouses

Married filing separately

Head of household

Single

$25,100

12,550

18,800

12,550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT