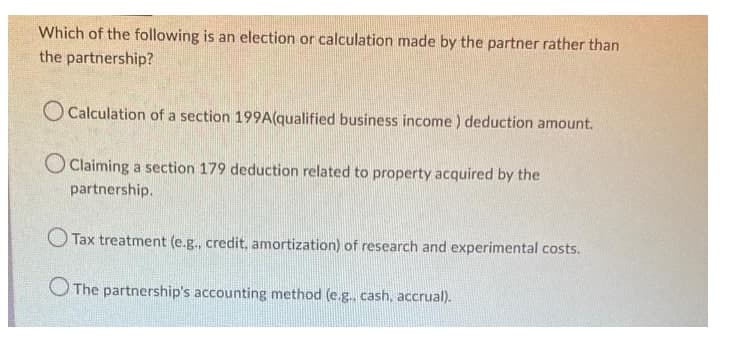

Which of the following is an election or calculation made by the partner rather than the partnership? Calculation of a section 199A(qualified business income) deduction amount. Claiming a section 179 deduction related to property acquired by the partnership. Tax treatment (e.g., credit, amortization) of research and experimental costs. The partnership's accounting method (e.g., cash, accrual).

Which of the following is an election or calculation made by the partner rather than the partnership? Calculation of a section 199A(qualified business income) deduction amount. Claiming a section 179 deduction related to property acquired by the partnership. Tax treatment (e.g., credit, amortization) of research and experimental costs. The partnership's accounting method (e.g., cash, accrual).

Chapter10: Partnership Taxation

Section: Chapter Questions

Problem 23MCQ

Related questions

Question

Transcribed Image Text:Which of the following is an election or calculation made by the partner rather than

the partnership?

Calculation of a section 199A(qualified business income) deduction amount.

Claiming a section 179 deduction related to property acquired by the

partnership.

Tax treatment (e.g., credit, amortization) of research and experimental costs.

The partnership's accounting method (e.g.. cash, accrual).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you