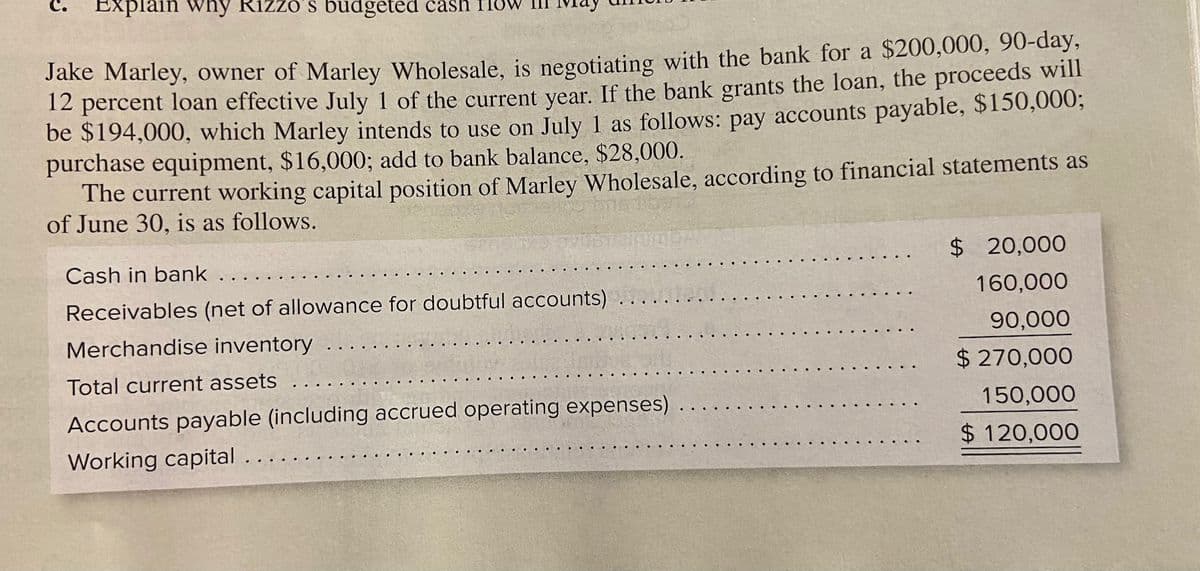

Jake Marley, owner of Marley Wholesale, is negotiating with the bank for a $200,000, 90-day, 12 percent loan effective July 1 of the current vear. If the bank grants the loan, the proceeds will be $194,000, which Marley intends to use on July 1 as follows: pay accounts payable, $150,000; purchase equipment, $16,000; add to bank balance, $28,000. The current working capital position of Marley Wholesale, according to financial statements as of June 30, is as follows. Cash in bank $ 20,000 Receivables (net of allowance for doubtful accounts) 160,000 Merchandise inventory 90,000 Total current assets $ 270,000 Accounts payable (including accrued operating expenses) 150,000 Working capital. $ 120,000

Jake Marley, owner of Marley Wholesale, is negotiating with the bank for a $200,000, 90-day, 12 percent loan effective July 1 of the current vear. If the bank grants the loan, the proceeds will be $194,000, which Marley intends to use on July 1 as follows: pay accounts payable, $150,000; purchase equipment, $16,000; add to bank balance, $28,000. The current working capital position of Marley Wholesale, according to financial statements as of June 30, is as follows. Cash in bank $ 20,000 Receivables (net of allowance for doubtful accounts) 160,000 Merchandise inventory 90,000 Total current assets $ 270,000 Accounts payable (including accrued operating expenses) 150,000 Working capital. $ 120,000

Chapter8: Budgets And Bank Reconciliations

Section: Chapter Questions

Problem 1.3C

Related questions

Question

23.6A

Transcribed Image Text:Explain why Rizzo's budgeted cash Ile

Jake Marley, owner of Marley Wholesale, is negotiating with the bank for a $200,000, 90-day,

12 percent loan effective July 1 of the current vear. If the bank grants the loan, the proceeds will

be $194,000, which Marley intends to use on July 1 as follows: pay accounts payable, $150,000;

purchase equipment, $16,000; add to bank balance, $28,000.

The current working capital position of Marley Wholesale, according to financial statements as

of June 30, is as follows.

Cash in bank

$ 20,000

Receivables (net of allowance for doubtful accounts)

160,000

Merchandise inventory

90,000

$ 270,000

Total current assets

Accounts payable (including accrued operating expenses)

150,000

Working capital ....

$ 120,000

Transcribed Image Text:Chapter 23 Operational Budgeting

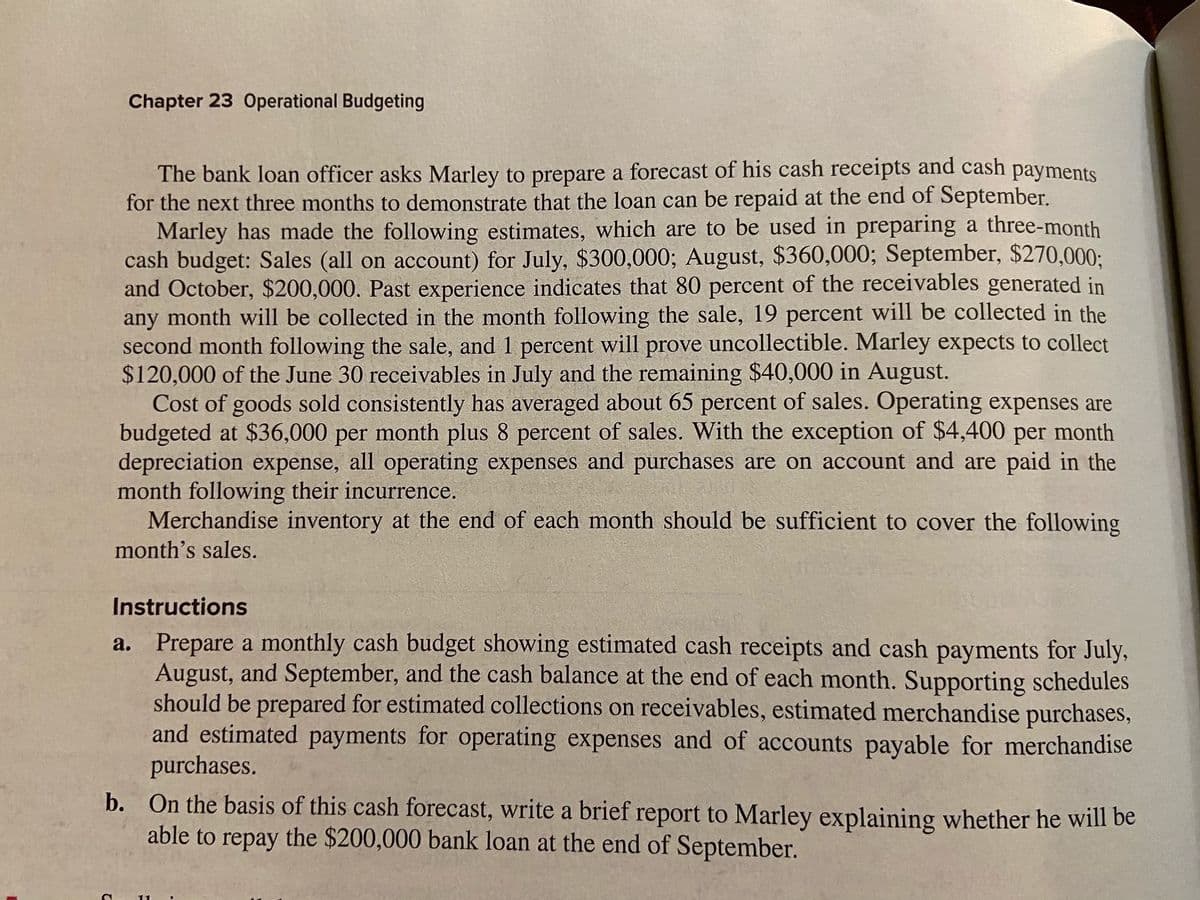

The bank loan officer asks Marley to prepare a forecast of his cash receipts and cash payments

for the next three months to demonstrate that the loan can be repaid at the end of September.

Marley has made the following estimates, which are to be used in preparing a three-month

cash budget: Sales (all on account) for July, $300,000; August, $360,000; September, $270,000:

and October, $200,000. Past experience indicates that 80 percent of the receivables generated in

any month will be collected in the month following the sale, 19 percent will be collected in the

second month following the sale, and 1 percent will prove uncollectible. Marley expects to collect

$120,000 of the June 30 receivables in July and the remaining $40,000 in August.

Cost of goods sold consistently has averaged about 65 percent of sales. Operating expenses are

budgeted at $36,000 per month plus 8 percent of sales. With the exception of $4,400 per month

depreciation expense, all operating expenses and purchases are on account and are paid in the

month following their incurrence.

Merchandise inventory at the end of each month should be sufficient to cover the following

month's sales.

Instructions

a. Prepare a monthly cash budget showing estimated cash receipts and cash payments for July,

August, and September, and the cash balance at the end of each month. Supporting schedules

should be prepared for estimated collections on receivables, estimated merchandise purchases,

and estimated payments for operating expenses and of accounts payable for merchandise

purchases.

b. On the basis of this cash forecast, write a brief report to Marley explaining whether he will be

able to repay the $200,000 bank loan at the end of September.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College