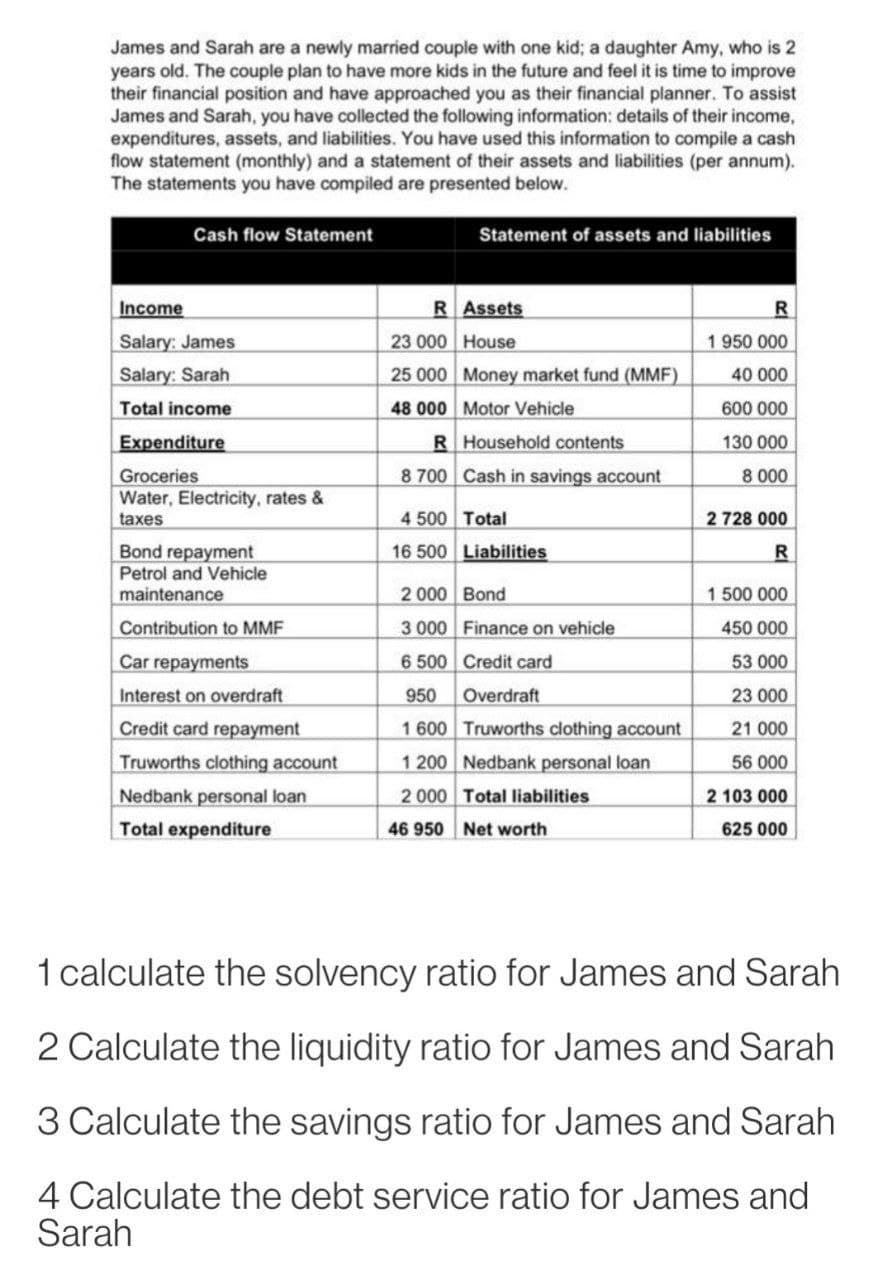

James and Sarah are a newly married couple with one kid; a daughter Amy, who is 2 years old. The couple plan to have more kids in the future and feel it is time to improve their financial position and have approached you as their financial planner. To assist James and Sarah, you have collected the following information: details of their income, expenditures, assets, and liabilities. You have used this information to compile a cash flow statement (monthly) and a statement of their assets and liabilities (per annum). The statements you have compiled are presented below.

James and Sarah are a newly married couple with one kid; a daughter Amy, who is 2 years old. The couple plan to have more kids in the future and feel it is time to improve their financial position and have approached you as their financial planner. To assist James and Sarah, you have collected the following information: details of their income, expenditures, assets, and liabilities. You have used this information to compile a cash flow statement (monthly) and a statement of their assets and liabilities (per annum). The statements you have compiled are presented below.

Chapter6: Building And Maintaining Good Credit

Section: Chapter Questions

Problem 1FPC

Related questions

Question

i need the answer quickly

Transcribed Image Text:James and Sarah are a newly married couple with one kid; a daughter Amy, who is 2

years old. The couple plan to have more kids in the future and feel it is time to improve

their financial position and have approached you as their financial planner. To assist

James and Sarah, you have collected the following information: details of their income,

expenditures, assets, and liabilities. You have used this information to compile a cash

flow statement (monthly) and a statement of their assets and liabilities (per annum).

The statements you have compiled are presented below.

Cash flow Statement

Statement of assets and liabilities

Income

R Assets

Salary: James

Salary: Sarah

23 000 House

1 950 000

25 000 Money market fund (MMF)

40 000

Total income

48 000 Motor Vehicle

600 000

Expenditure

RHousehold contents

130 000

Groceries

8 700 Cash in savings account

8 000

Water, Electricity, rates &

taxes

4 500 Total

2 728 000

Bond repayment

Petrol and Vehicle

maintenance

16 500 Liabilities

2 000 Bond

1 500 000

Contribution to MMF

3 000 Finance on vehicle

450 000

Car repayments

6 500 Credit card

53 000

Interest on overdraft

950

Overdraft

23 000

Credit card repayment

1 600 Truworths clothing account

21 000

Truworths clothing account

1 200 Nedbank personal loan

56 000

Nedbank personal loan

2 000 Total liabilities

2 103 000

Total expenditure

46 950 Net worth

625 000

1 calculate the solvency ratio for James and Sarah

2 Calculate the liquidity ratio for James and Sarah

3 Calculate the savings ratio for James and Sarah

4 Calculate the debt service ratio for James and

Sarah

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT