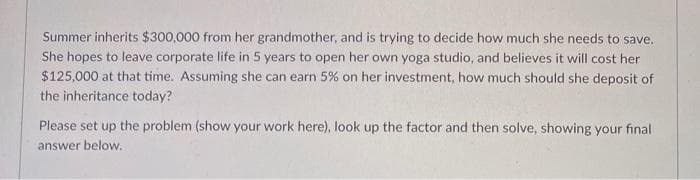

Summer inherits $300,000 from her grandmother, and is trying to decide how much she needs to save. She hopes to leave corporate life in 5 years to open her own yoga studio, and believes it will cost her $125,000 at that time. Assuming she can earn 5% on her investment, how much should she deposit of the inheritance today? Please set up the problem (show your work here), look up the factor and then solve, showing your final answer below.

Summer inherits $300,000 from her grandmother, and is trying to decide how much she needs to save. She hopes to leave corporate life in 5 years to open her own yoga studio, and believes it will cost her $125,000 at that time. Assuming she can earn 5% on her investment, how much should she deposit of the inheritance today? Please set up the problem (show your work here), look up the factor and then solve, showing your final answer below.

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:Summer inherits $300,000 from her grandmother, and is trying to decide how much she needs to save.

She hopes to leave corporate life in 5 years to open her own yoga studio, and believes it will cost her

$125,000 at that time. Assuming she can earn 5% on her investment, how much should she deposit of

the inheritance today?

Please set up the problem (show your work here), look up the factor and then solve, showing your final

answer below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning