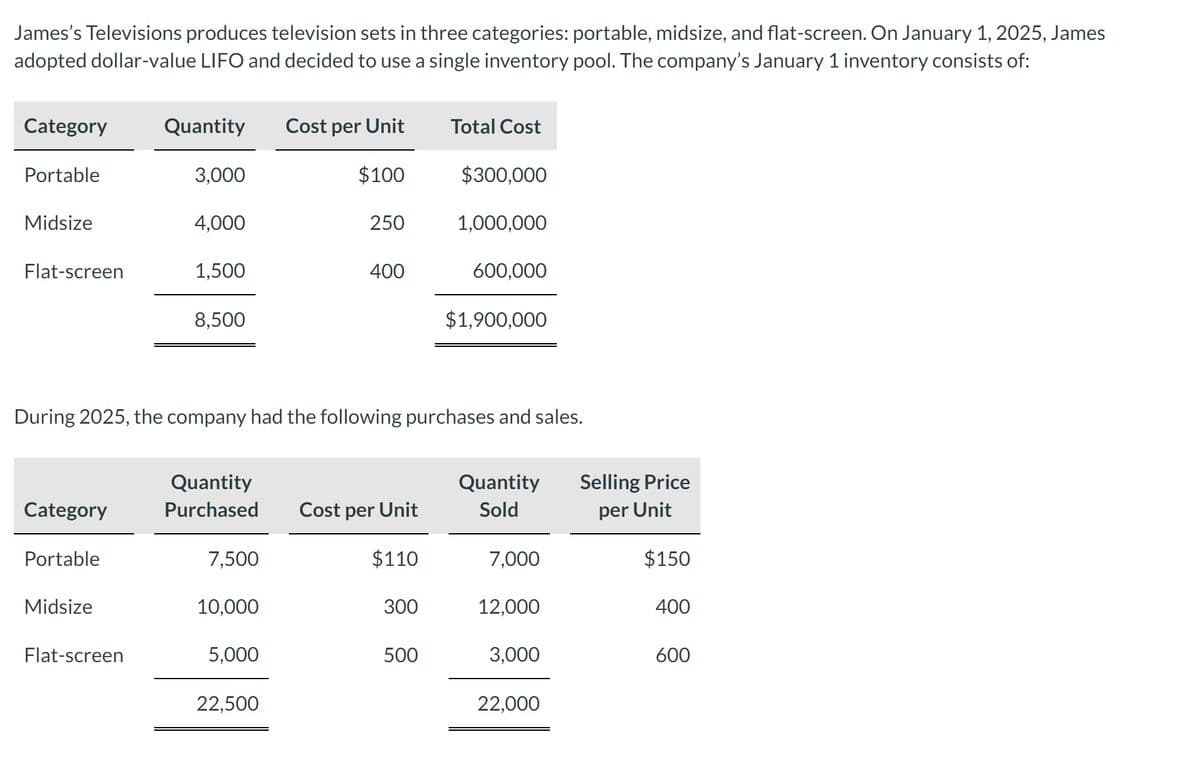

James's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of: Category Portable Midsize Flat-screen Category Portable Midsize Quantity Flat-screen 3,000 4,000 1,500 8,500 Quantity Purchased 7,500 10,000 5,000 Cost per Unit During 2025, the company had the following purchases and sales. 22,500 $100 250 400 Cost per Unit $110 300 Total Cost 500 $300,000 1,000,000 600,000 $1,900,000 Quantity Sold 7,000 12,000 3,000 22,000 Selling Price per Unit $150 400 600

James's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of: Category Portable Midsize Flat-screen Category Portable Midsize Quantity Flat-screen 3,000 4,000 1,500 8,500 Quantity Purchased 7,500 10,000 5,000 Cost per Unit During 2025, the company had the following purchases and sales. 22,500 $100 250 400 Cost per Unit $110 300 Total Cost 500 $300,000 1,000,000 600,000 $1,900,000 Quantity Sold 7,000 12,000 3,000 22,000 Selling Price per Unit $150 400 600

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 13P: Webster Company adopted do liar-value LIFO on January 1, 2019. Webster produces three products: X,...

Related questions

Question

Transcribed Image Text:James's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James

adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of:

Category

Portable

Midsize

Flat-screen

Category

Portable

Midsize

Quantity Cost per Unit

$100

Flat-screen

3,000

4,000

1,500

8,500

Quantity

Purchased

7,500

During 2025, the company had the following purchases and sales.

10,000

5,000

250

22,500

400

Cost per Unit

$110

300

Total Cost

500

$300,000

1,000,000

600,000

$1,900,000

Quantity

Sold

7,000

12,000

3,000

22,000

Selling Price

per Unit

$150

400

600

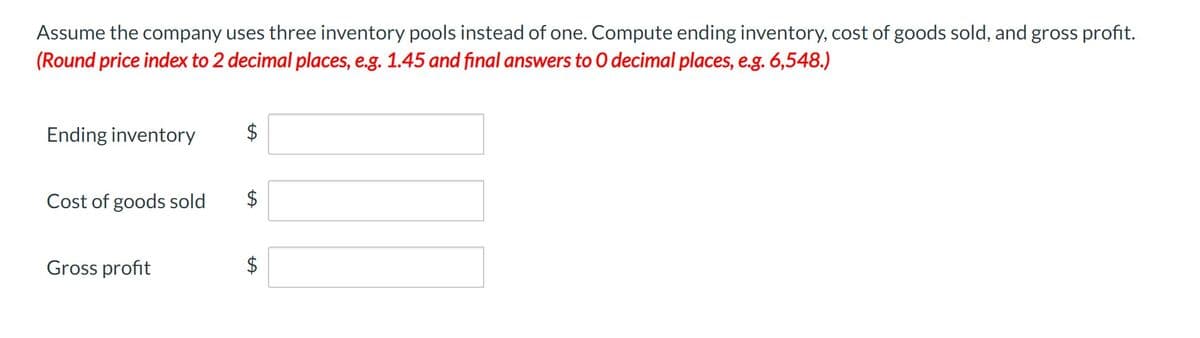

Transcribed Image Text:Assume the company uses three inventory pools instead of one. Compute ending inventory, cost of goods sold, and gross profit.

(Round price index to 2 decimal places, e.g. 1.45 and final answers to O decimal places, e.g. 6,548.)

Ending inventory

Cost of goods sold

Gross profit

$

LA

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT