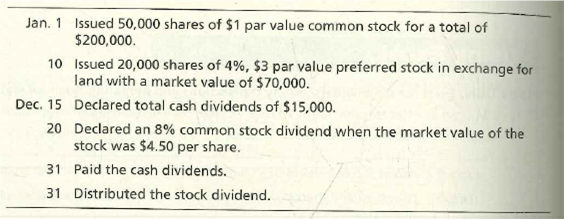

Jan. 1 Issued 50,000 shares of $1 par value common stock for a total of $200,000. 10 Issued 20,000 shares of 4%, $3 par value preferred stock in exchange for land with a market value of $70,000. Dec. 15 Declared total cash dividends of $15,000. 20 Declared an 8% common stock dividend when the market value of the stock was $4.50 per share. 31 Paid the cash dividends. 31 Distributed the stock dividend.

Journalizing stock issuances, cash dividends, and stock dividends; preparing

This problem continues the Canyon Canoe Company situation from Chapter 12. After looking into debt financing through notes, mortgage, and bonds payable, Canyon Canoe Company derides to raise additional capital for the planned business expansion. The company will be able to acquire cash as well as land adjacent to its current business location. Before the following transactions, the balance in Common Stock on January 1, 2021, was $136,000 and included 136,000 shares of common stock issued and outstanding. (There was no Paid-In Capital in Excess of Par—Common.)

Canyon Canoe Company had the following transactions in 2021:

Requirements

- Journalize the transactions.

- Calculate the balance in

Retained Earnings on December 31, 2021. Assume the balance on January 1, 2021 was $4,250 and net income for the year was $417,000. - Prepare the stockholders’ equity section of the balance sheet as of December 31, 2021. There was no

preferred stock issued prior to the 2021 transactions.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images