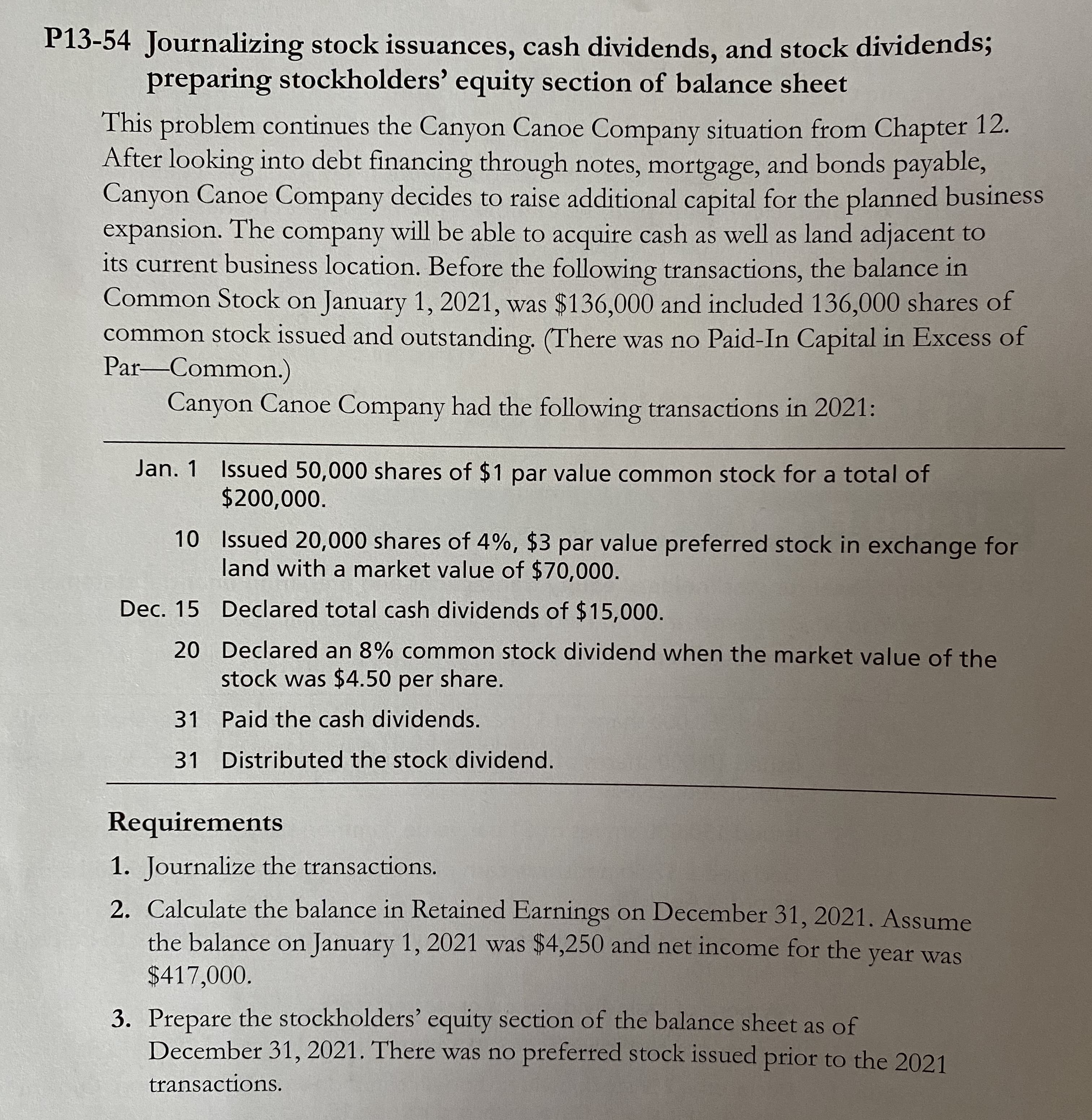

P13-54 Journalizing stock issuances, cash dividends, and stock dividends; preparing stockholders' equity section of balance sheet This problem continues the Canyon Canoe Company situation from Chapter 12. After looking into debt financing through notes, mortgage, and bonds payable, Canyon Canoe Company decides to raise additional capital for the planned business expansion. The company will be able to acquire cash as well as land adjacent to its current business location. Before the following transactions, the balance in Common Stock on January 1, 2021, was $136,000 and included 136,000 shares of common stock issued and outstanding. (There was no Paid-In Capital in Excess of Par-Common.) Canyon Canoe Company had the following transactions in 2021: Jan. 1 Issued 50,000 shares of $1 par value common stock for a total of $200,000. 10 Issued 20,000 shares of 4%, $3 par value preferred stock in exchange for land with a market value of $70,000. Dec. 15 Declared total cash dividends of $15,000. 20 Declared an 8% common stock dividend when the market value of the stock was $4.50 per share. 31 Paid the cash dividends. 31 Distributed the stock dividend. Requirements 1. Journalize the transactions. 2. Calculate the balance in Retained Earnings on December 31, 2021. Assume the balance on January 1, 2021 was $4,250 and net income for the year was $417,000. 3. Prepare the stockholders' equity section of the balance sheet as of December 31, 2021. There was no preferred stock issued prior to the 2021 transactions.

P13-54 Journalizing stock issuances, cash dividends, and stock dividends; preparing stockholders' equity section of balance sheet This problem continues the Canyon Canoe Company situation from Chapter 12. After looking into debt financing through notes, mortgage, and bonds payable, Canyon Canoe Company decides to raise additional capital for the planned business expansion. The company will be able to acquire cash as well as land adjacent to its current business location. Before the following transactions, the balance in Common Stock on January 1, 2021, was $136,000 and included 136,000 shares of common stock issued and outstanding. (There was no Paid-In Capital in Excess of Par-Common.) Canyon Canoe Company had the following transactions in 2021: Jan. 1 Issued 50,000 shares of $1 par value common stock for a total of $200,000. 10 Issued 20,000 shares of 4%, $3 par value preferred stock in exchange for land with a market value of $70,000. Dec. 15 Declared total cash dividends of $15,000. 20 Declared an 8% common stock dividend when the market value of the stock was $4.50 per share. 31 Paid the cash dividends. 31 Distributed the stock dividend. Requirements 1. Journalize the transactions. 2. Calculate the balance in Retained Earnings on December 31, 2021. Assume the balance on January 1, 2021 was $4,250 and net income for the year was $417,000. 3. Prepare the stockholders' equity section of the balance sheet as of December 31, 2021. There was no preferred stock issued prior to the 2021 transactions.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 2AP

Related questions

Question

Transcribed Image Text:P13-54 Journalizing stock issuances, cash dividends, and stock dividends;

preparing stockholders' equity section of balance sheet

This problem continues the Canyon Canoe Company situation from Chapter 12.

After looking into debt financing through notes, mortgage, and bonds payable,

Canyon Canoe Company decides to raise additional capital for the planned business

expansion. The company will be able to acquire cash as well as land adjacent to

its current business location. Before the following transactions, the balance in

Common Stock on January 1, 2021, was $136,000 and included 136,000 shares of

common stock issued and outstanding. (There was no Paid-In Capital in Excess of

Par-Common.)

Canyon Canoe Company had the following transactions in 2021:

Jan. 1 Issued 50,000 shares of $1 par value common stock for a total of

$200,000.

10 Issued 20,000 shares of 4%, $3 par value preferred stock in exchange for

land with a market value of $70,000.

Dec. 15 Declared total cash dividends of $15,000.

20 Declared an 8% common stock dividend when the market value of the

stock was $4.50 per share.

31 Paid the cash dividends.

31 Distributed the stock dividend.

Requirements

1. Journalize the transactions.

2. Calculate the balance in Retained Earnings on December 31, 2021. Assume

the balance on January 1, 2021 was $4,250 and net income for the year was

$417,000.

3. Prepare the stockholders' equity section of the balance sheet as of

December 31, 2021. There was no preferred stock issued prior to the 2021

transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning