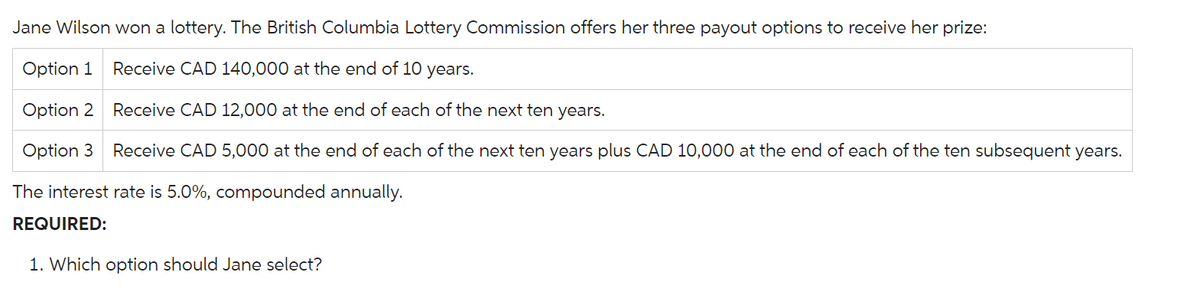

Jane Wilson won a lottery. The British Columbia Lottery Commission offers her three payout options to receive her prize: Option 1 Receive CAD 140,000 at the end of 10 years. Option 2 Receive CAD 12,000 at the end of each of the next ten years. Option 3 Receive CAD 5,000 at the end of each of the next ten years plus CAD 10,000 at the end of each of the ten subsequent years. The interest rate is 5.0%, compounded annually. REQUIRED: 1. Which option should Jane select?

Jane Wilson won a lottery. The British Columbia Lottery Commission offers her three payout options to receive her prize: Option 1 Receive CAD 140,000 at the end of 10 years. Option 2 Receive CAD 12,000 at the end of each of the next ten years. Option 3 Receive CAD 5,000 at the end of each of the next ten years plus CAD 10,000 at the end of each of the ten subsequent years. The interest rate is 5.0%, compounded annually. REQUIRED: 1. Which option should Jane select?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.20MCE

Related questions

Question

Transcribed Image Text:Jane Wilson won a lottery. The British Columbia Lottery Commission offers her three payout options to receive her prize:

Option 1 Receive CAD 140,000 at the end of 10 years.

Option 2

Receive CAD 12,000 at the end of each of the next ten years.

Option 3 Receive CAD 5,000 at the end of each of the next ten years plus CAD 10,000 at the end of each of the ten subsequent years.

The interest rate is 5.0%, compounded annually.

REQUIRED:

1. Which option should Jane select?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning