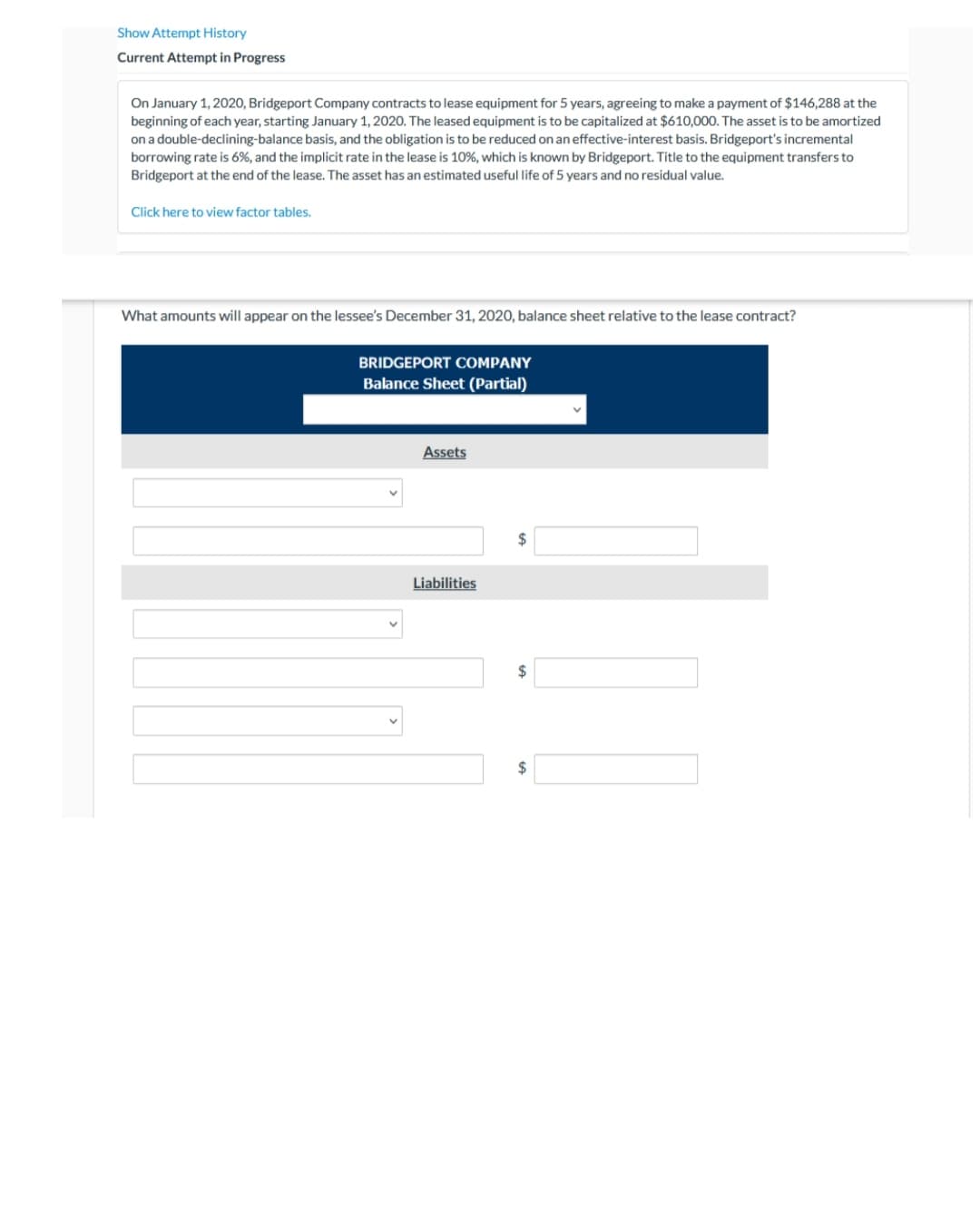

January 1, 2020, Bridgeport Company contracts inning of each year, starting January 1, 2020. The a double-declining-balance basis, and the obligat rowing rate is 6%, and the implicit rate in the leas dgeport at the end of the lease. The asset has an e

Q: The CFA franc devalues. The CFA franc was defined in terms of the French franc (FF) as CFA 50 = FF 1...

A: Solution Concept Currency appreciation means the increase in the value of currency in respect to the...

Q: 1 Aug Started business with $150, 000 in the bank 3 Aug Bought supplies on c...

A: Introduction:- The act of recording or keeping track of any financial or non-financial action is kno...

Q: The following information is extracted from the shareholders' equity section of the statement of fin...

A: The calculation of Book Value of Preferred and Common shares is shown hereunder : Liquidation value ...

Q: ABASE HUMILIATE Co. is currently preparing its combined financial statements for the year ended Dece...

A: Given Adjustments : a. Allocated expense = 40000 b. Error Credited by home office = 100000 c. Error ...

Q: Instructions: Prepare a statement of retained earnings.

A: Statement of retained earnings refers to a statement which shows the changes in the balance of retai...

Q: available for you: Ending Inventory at Cost Goods Available for Sale at retail

A: Calculation of Gross Sales Gross Sales = Goods available for sale at retail - Ending inventory at r...

Q: "The current month's bank statement for your account arrives in the mail. In reviewing the statemen...

A: Answer: Case: "The current month's bank statement for your account arrives in the mail. In reviewin...

Q: Homeyer Corporation has provided the following data for its two most recent years of operation: ...

A: All indirect expenses involved during the manufacturing process are referred to as manufacturing ove...

Q: After considering the given transactions, how much is the total shareholder's equity of the December...

A: Stockholders Equity can be calculated in two ways 1. By using the values from balance sheet 2. Sto...

Q: Flexible Budget for Selling and Administrative Expenses for a Service company Daybreak Technologies...

A: Budget means the expected value of future. Budget is not affected by the actual value as it is prepa...

Q: Provide solution and explanation how work its excel The following transactions occurred during 2...

A: Shareholder's Equity Shareholder's Equity which is comprises of both Preference and Common stock iss...

Q: ow much were the discounts lost?

A: Solution Concept Discount term 3/10 net 30 means that if the payment is made within 10 days of invoi...

Q: On July 1, 2022, an auditing firm obtained a three-year 10% note receivable for auditing services re...

A: Issue price of the note = Present value of principal + Present value of interest payments where, ...

Q: Ayo Company started 2022 with P94,000 of merchandise inventory on hand. During 2022, P400,000 in mer...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: Costs per equivalent unit: Costs Total costs for May in Roasting Department Total equivalent units C...

A: It is a process wherein the cost incurred in the service departments is allocated to other service ...

Q: Schedule of Cash Collections of Accounts Receivable Bark & Purr Supplies Inc., a pet wholesale supp...

A: Sales means the amount recorded in books as revenue earned by selling the goods or services. Account...

Q: How much shall be reported as interest income for 2022? 90,000 96,836 120,000 129...

A: Interest Income - It is the amount of money paid by the borrower to the lenders on the amount of mon...

Q: The cost of a window air conditioner was $340 and had a markup on cost percentage of 50%. During a...

A: Cost = $340 Markup on cost = 50% = 170 Therefore the selling price = $510 During a spring promotion,...

Q: AJUMA Farms operates a farm with various plants and a herd of animals. On January 1, 2021, it had te...

A: Biological assets on December 31, 2021: Animals available on January 1, 2021 – animals sold during t...

Q: Changes in Current Operating Assets and Liabilities-Indirect Method Blue Circle Corporation's compar...

A: Cash flow from operating activities indicates the cash inflow or outflow transactions related to the...

Q: One advantage of switching from a partnership to the corporate form of organization is the following...

A: It makes it easier for the firm to raise additional capital

Q: Hepson Company is specializing on sale of printers and related gadgets, including ink cartridges. Th...

A: Discount lost = Total discount available if the payment were made within 10 days - cash discount tak...

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur i...

A: Sales means the amount recorded in books as revenue earned by selling the goods or services. Account...

Q: count on all

A: In the rate of 3.5% conversion rate, new confirmed booking as, = 3.5 % of 2347892 = 82176

Q: (a) Find the missing numbers in the table if the markup is based on cost. RM Cost 50 Markup Selling ...

A: Solution Note Dear student as per the Q&A guideline we are required to answer the first question...

Q: Boeing Truck Company received an invoice showing 12 tires at $114 each, 15 tires at $157 each, and 1...

A: An account payable is defined as the amount a business owed for purchases they made on credit. they ...

Q: Beauty Spa & Co. manufactures a specialised luxury spa that is supplied to five-star hotels around t...

A: Sales means the amount recorded in books as revenue earned by selling the goods or services. Account...

Q: Use the following selected account balances of Delray Manufacturing for the year ended December 31. ...

A: Cost of goods manufactured: Cost of goods manufactured means total manufacturing costs; including al...

Q: How do fraud symptoms help in detecting fraud?

A: Fraud symptoms are indicators used by investigators to identify the perpetrator. These fraud symptom...

Q: On January 1, 2022. TGIG sold equipment with historical cost of P10,000,000 and accumulated deprecia...

A: Carrying amount of the Note = Present value of the annual instalments where, Present value of the an...

Q: 4. A company had supplies worth P15,000 in its unadjusted trial balance at the end of the year which...

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is pr...

Q: Sheridan Tool Company’s December 31 year-end financial statements contained the following errors. ...

A: Solutions: A)Total Effect of errors on 2021 Net income Understatement of 2020 ending inventory ...

Q: 30,0 g entry is IS

A: The adjusting entry is given as,

Q: Rosenthal Company manufactures bowling balls through two processes: Molding and Packaging. In the Mo...

A: Units transferred out = Beginning WIP + Units started - Ending WIP Given, Units started = 25,080 uni...

Q: Gain on sale of equipment $ 95,000 Cash dividends declared ...

A: The income statement and the retained earnings as,

Q: What is the carrying amount of the note as of December 31, 2022? On January 1, 2022. TGIG sold equip...

A: Carrying amount of the Note = Present value of the annual instalments where, Present value of the an...

Q: YES Partnership started operations on January 1, 201 balances : with the following capital Yves P88,...

A: Solution :- Note: As per our guidelines only the first three subparts will be solved

Q: bor Cost Budget Rip Court Racket Company manufactures two types of tennis rackets, the Junior and P...

A: Rip Court Racket Company manufactures two types of tennis rackets, the Junior and Pro Striker models...

Q: AJUMA Farms operates a farm with various plants and a herd of animals. On January 1, 2020, it had te...

A: December 31, 2021 Fair value with no growth (Same Age) 1 years old animal = 10 x 600 = 6,000 Fair ...

Q: da loa er 31,

A: Interest Income - It is the amount of money paid by the borrower over and above the loan amount to t...

Q: Zephyr sales company has sales of 1.125 million. If the company's management expects sales to grow 6...

A: Lets understand the basics. For answering this question we are required to use below formula. = (100...

Q: a) Explain how differential analysis assist managers in evaluating special order decisions? (No calk...

A: a) Special order refers to a unique one-time order made by a customer(usually one-time) Differenti...

Q: Instructions: Whittier Company plans to sell 1,000 mowers at $400 each in the coming year. Total var...

A: Solution.. Sales price per unit = $400 Variable cost per unit = $325 Fixed cost = $45,000 Con...

Q: For each of the following errors in property, plant and equipment accounts, indicate a specific inte...

A: Internal Control System The main intention to implement the internal control system to reduce the er...

Q: On January 2, 2021, Quezon, Inc. placed P1M in the 5-year time depositof Bank of Laguna. The placeme...

A: Tax is the amount which an individual or business is liable to pay the government for business opera...

Q: Please see the picture below. I need help making a retained earnings statement and a comprehensive i...

A: Net profit means the difference between the income and expenses. Financial statement means the tradi...

Q: 1. What is the average capital of Fred ? 2. What is the average capital of Gemmo?

A: Partnership means a group of persons who come together with a purpose to control and manage the oper...

Q: The left side of any account is the credit side 10 A) True B) False

A: Solution: An account is way of record keeping with two sides. One is left side or debit side and ano...

Q: Thank you, but now, the total current assets is incorrect..

A: Solution Concept In a balance sheet there are two sides assets and liabilities+ equity Balance sheet...

Q: Ending Inventory at Cost 739,160 Goods Available for Sale at retail 3,930,000 16,000 48,500 Sales Di...

A: Under Retail Method, the cost to income ratio is calculated using the following formula: Cost to Inc...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Lease Income and Expense Reuben Company retires a machine from active use on January 2, 2019, for the express purpose of leasing it. The machine had a carrying value of 900,000 after 12 years of use and is expected to have 10 more years of economic life. The machine is depreciated on a straight-line basis. On March 2, 2019, Reuben leases the machine to Owens Company for 180,000 a year for a 5-year period ending February 28, 2024. Under the provisions of the lease, Reuben incurs total maintenance and other related costs of 20,000 for the year ended December 31, 2019. Owens pays 180,000 to Reuben on March 2, 2019. The lease was properly classified as an operating lease. Required: 1. Compute the income before income taxes derived by Reuben from this lease for the calendar year ended December 31, 2019. 2. Compute the amount of rent expense incurred by Owens from this lease for the calendar year ended December 31, 2019.Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.Financial Statement Violations of U.S. GAAP The following are the financial statements issued by Allen Corporation for its fiscal year ended October 31, 2019: Notes to Financial Statements: 1. Long-Term Lease. Under the terms of a 5-year, noncancelable lease for a building, Allen is obligated to make annual rental payments of 40,000 in each of the next 4 fiscal years. 2. Pension Plan. Substai1tially all employees are covered by Allens defined benefit pension plan. Pension expense is equal to the total of pension benefits accrued and paid to retired employees during the year. Because it is a defined benefit plan that is paid every year, no pension liability exists. 3. Patent. The patent had an estimated remaining life of 10 years at the time of purchase. Allens patent was purchased from Apex Corporation on January 1, 2019, for 250,000. 4. Deferred Income Tax Payable. The entire balai1ce in the Deferred Income Tax Payable account arose from tax-exempt municipal bonds that were held during the previous fiscal year, giving rise to a difference between taxable income and reported net earnings for the fiscal year ended October 31, 2019. The deferred liability amount was calculated on the basis of past tax rates. 5. Warrants. On January 1, 2018, one common stock warrant was issued to shareholders of record for each common share owned. An additional share of common stock is to be issued upon exercise of 10 stock warrants and receipt of an amount equal to par value. For the 6 months ended October 31, 2019, the average market value for Allens common stock was 5 per share and no warrants had yet been exercised. 6. Contingent Liability. On October 31, 2019, Allen was contingently liable for product warranties in an amount estimated to aggregate 75,000. Required: Next Level Review the preceding financial state1nents and related notes. Identify any inclusions or exclusions from them that would be in violation of GAAP, and indicate corrective action to be taken. Do not comment as to format or style. Respond in the following order: 1. Balance sheet 2. Notes 3. Income statement 4. Statement of retained earnings 5. General

- Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Investment Discount Amortization Schedule On January 1, 2019, Rodgers Company purchased 200,000 face value, 10%, 3-year bonds for 190,165.35, a price that yields a 12% effective annual interest rate. The bonds pay interest semiannually on June 30 and December 31. Required: 1. Record the purchase of the bonds. 2. Prepare an investment interest income and discount amortization schedule using the effective interest method. 3. Record the receipts of interest on June 30, 2019, and June 30, 2021.Notes Receivable On January 1, 2019, Lisa Company sold machinery with a book value of 118,000 to Mark Company. Mark signed a 180,000 non-interest-bearing note, payable in three 60,000 annual installments on December 31, 2019, 2020, and 2021. The fair value of the machinery was 149,211.12 on the date of sale. The machinery had been purchased by Lisa at a cost of 160,000. Required: 1. Prepare all the journal entries on Lisas books for January 1, 2019, through December 31, 2021. 2. Prepare the notes receivable portion of Lisas balance sheet on December 31, 2019 and 2020.

- Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line methodDetermining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Comprehensive Notes Receivable On January 1, 2019, Seaver Company sold land with a book value of 23,000 to Bench Company. Bench paid 15,000 down and signed a 15,000 non-interest-bearing note, payable in two 7,500 annual installments on December 31, 2019, and 2020. Neither the fair value of the land nor of the note is determinable. Benchs incremental borrowing rate is 12%. Later in the year, on July 1, 2019, Seaver sold a building to Hane Company, accepting a 2-year, 100,000 non-interest-bearing note due July 1, 2021. The fair value of the building was 82,644.00 on the date of the sale. The building had been purchased at a cost of 90,000 on January 1, 2014, and had a book value of 67,500 on December 31, 2018. It was being depreciated on a straight-line basis (no residual value) over a 20-year life. Required: 1. Prepare all the journal entries on Seavers books for January 1, 2019, through December 31, 2020, in regard to the Bench note. 2. Prepare all the journal entries on Seavers books for July 1, 2019, through July 1, 2021, in regard to the Hane note. 3. Prepare the notes receivable portion of Seavers balance sheet on December 31, 2019 and 2020.

- Investment Premium Amortization Schedule On January 1, 2019, Lynch Company acquired 13% bonds with a face value of 50,000. The bonds pay interest on June 30 and December 31 and mature on December 31, 2021. Lynch paid 51,229.35, a price that yields a 12% effective annual interest rate. Required: 1. Record the purchase of the bonds. 2. Prepare an investment interest income and premium amortization schedule using the effective interest method. 3. Record the receipts of interest on June 30, 2019, and December 31, 2021.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)