January 1-D. Hall, owner, invested $142,750 cash he company in exchange for common stock.

January 1-D. Hall, owner, invested $142,750 cash he company in exchange for common stock.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 68.4C

Related questions

Topic Video

Question

Transcribed Image Text:Question 1- Ch 02 GL 2-13-Con X

mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fnewconnect.mheducation.c

223-A X

-13 i

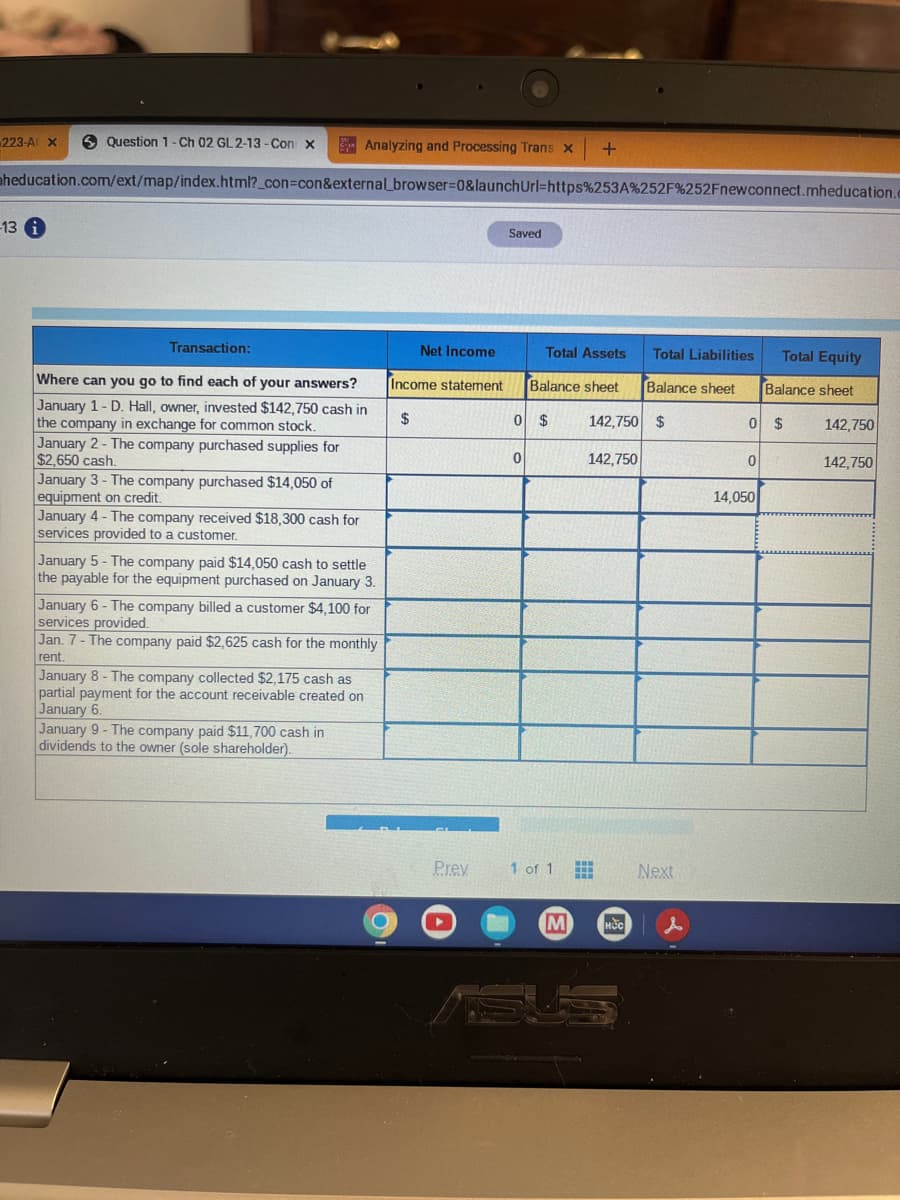

Transaction:

Where can you go to find each of your answers?

January 1-D. Hall, owner, invested $142,750 cash in

the company in exchange for common stock.

January 2- The company purchased supplies for

$2,650 cash.

January 3- The company purchased $14,050 of

equipment on credit.

January 4 - The company received $18,300 cash for

services provided to a customer.

Analyzing and Processing Trans X +

January 5- The company paid $14,050 cash to settle

the payable for the equipment purchased on January 3.

January 6- The company billed a customer $4,100 for

services provided.

Jan. 7- The company paid $2,625 cash for the monthly

rent.

January 8- The company collected $2,175 cash as

partial payment for the account receivable created on

January 6.

January 9- The company paid $11,700 cash in

dividends to the owner (sole shareholder).

Net Income

Income statement

$

Prev

Saved

Total Assets

Balance sheet

0 $

0

1 of 1

M

142,750 $

142,750

Sus

Total Liabilities

Balance sheet

HOC

Next

d

0 $

0

Total Equity

Balance sheet

14,050

142,750

142,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage