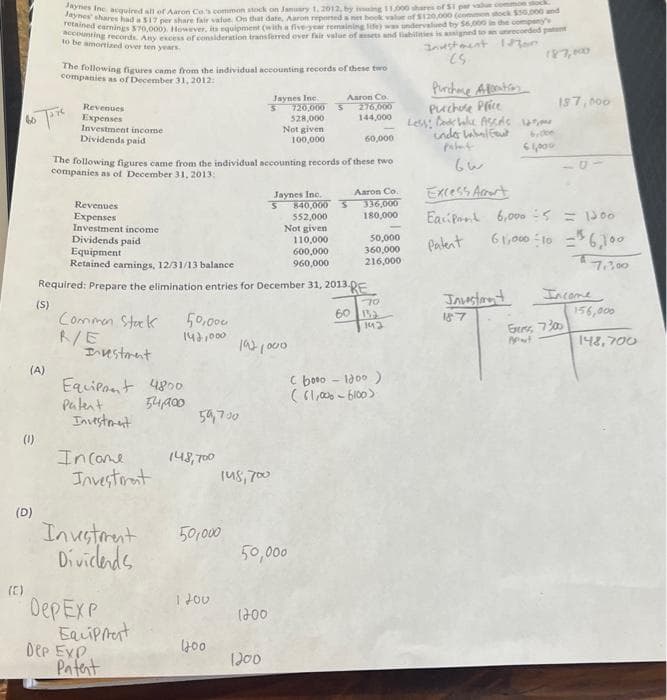

Jaynes Inc. acquired all of Aaron Co's common stock on January 1, 2012, by ng 11,000 shares of S1 par value com Jees sharee had a 517 per share fair value. On that date, Aaron reported at book value of $120,000 (common stock $50,000 and retained earnings $70,000). However, its equipment (with a five-year remaining fide) was undervalued by 56,000 in the ouring records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patient ny's to be amortized over ten years. Investment for (5 The following figures came from the individual accounting records of these two companies as of December 31, 2012: (5) Revenues Expenses Investment income Dividends paid Jaynes Inc. во рт The following figures came from the individual accounting records of these two companies as of December 31, 2013: 720,000 S 528,000 Not given 100,000 Aaron Co. 276,000 144,000 60,000 S Jaynes Inc. Aaron Co. 840,000 S 336,000 552,000 180,000 Revenues Expenses Investment income Dividends paid Equipment Retained earnings, 12/31/13 balance Required: Prepare the elimination entries for December 31, 2013 RE Not given 110,000 600,000 960,000 50,000 360,000 216,000 Purchase Aeratio Puchose Price Less: Cook Asses us under Label Fut Excess Acurt Eacipant Patent byde 61,000 Investore 187,000 0 6,000 = 1200 61,000=106,100 7,300 Income

Jaynes Inc. acquired all of Aaron Co's common stock on January 1, 2012, by ng 11,000 shares of S1 par value com Jees sharee had a 517 per share fair value. On that date, Aaron reported at book value of $120,000 (common stock $50,000 and retained earnings $70,000). However, its equipment (with a five-year remaining fide) was undervalued by 56,000 in the ouring records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patient ny's to be amortized over ten years. Investment for (5 The following figures came from the individual accounting records of these two companies as of December 31, 2012: (5) Revenues Expenses Investment income Dividends paid Jaynes Inc. во рт The following figures came from the individual accounting records of these two companies as of December 31, 2013: 720,000 S 528,000 Not given 100,000 Aaron Co. 276,000 144,000 60,000 S Jaynes Inc. Aaron Co. 840,000 S 336,000 552,000 180,000 Revenues Expenses Investment income Dividends paid Equipment Retained earnings, 12/31/13 balance Required: Prepare the elimination entries for December 31, 2013 RE Not given 110,000 600,000 960,000 50,000 360,000 216,000 Purchase Aeratio Puchose Price Less: Cook Asses us under Label Fut Excess Acurt Eacipant Patent byde 61,000 Investore 187,000 0 6,000 = 1200 61,000=106,100 7,300 Income

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 21P

Related questions

Question

please help me to solve this problem

Transcribed Image Text:6

(0)

(C)

(A)

(D)

Jays Inc. acquired all of Aaron Co's common stock on January 1, 2012, by using 11,000 shares of ST par value common stock

eyes shares had a 517 per share fair value. On that date, Aaron reported net book of $120,000 (common stock $50,000 and

retained earnings 370,000). However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's

accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patient

to be amortized over ten years.

Mor

The following figures came from the individual accounting records of these two

companies as of December 31, 2012:

Revenues

Expenses

Investment income

Dividends paid

Commen Stock

R/E

60,000

The following figures came from the individual accounting records of these two

companies as of December 31, 2013:

Investment

Revenues

Expenses

Investment income

Dividends paid

Equipment

Retained earnings, 12/31/13 balance

Required: Prepare the elimination entries for December 31, 2013 RE

(S)

Equipant 4800

Patent

54,400.

Investment

Income

Investorat

Investment

Dividends

50,000

140,000

DepEXP

Equipment

Dep Exp

Patent

59,700

148,700

50,000

1 200

1200

Jaynes Inc.

148,700

720,000 S

528,000

Not given

100,000

Jaynes Inc.

S

1200

1921000

1200

Aaron Co.

276,000

144,000

Not given

110,000

600,000

960,000

50,000

840,000 S

552,000

Aaron Co.

336,000

180,000

50,000

360,000

216,000

60 13

192

(booo - 1000)

(61,000-6100)

Investment

CS

Purchae Alation

Purchase Price

Less: Cookwu Asses us

under Label Fut

ALL

€1,000

Invest

187

187,000

Excess Acart

Eacit 6,000÷5= 1300

Patent

61,000 106,100

€7,300

Income

Eres 7300

Mat

156,000

148,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning