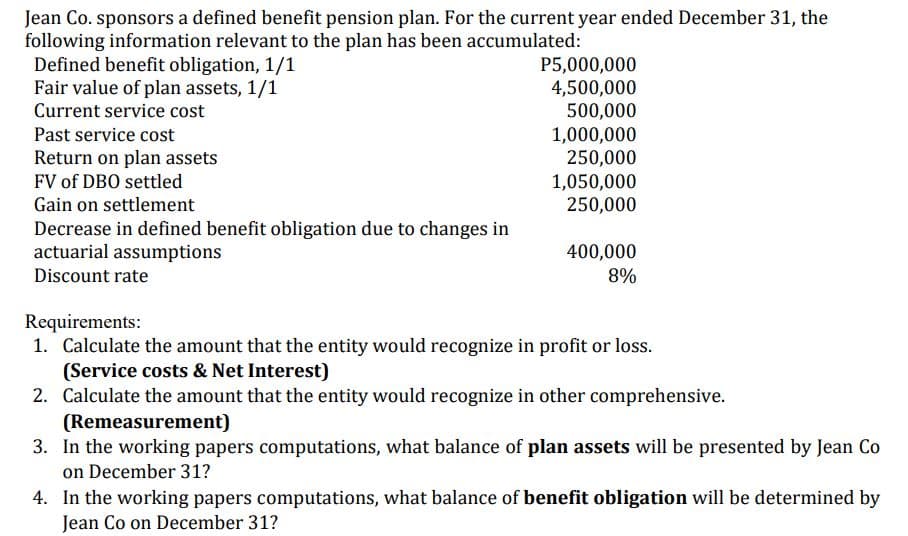

Jean Co. sponsors a defined benefit pension plan. For the current year ended December 31, the following information relevant to the plan has been accumulated: Defined benefit obligation, 1/1 Fair value of plan assets, 1/1 Current service cost P5,000,000 4,500,000 500,000 1,000,000 250,000 1,050,000 250,000 Past service cost Return on plan assets FV of DBO settled Gain on settlement Decrease in defined benefit obligation due to changes in actuarial assumptions 400,000 8% Discount rate

Jean Co. sponsors a defined benefit pension plan. For the current year ended December 31, the following information relevant to the plan has been accumulated: Defined benefit obligation, 1/1 Fair value of plan assets, 1/1 Current service cost P5,000,000 4,500,000 500,000 1,000,000 250,000 1,050,000 250,000 Past service cost Return on plan assets FV of DBO settled Gain on settlement Decrease in defined benefit obligation due to changes in actuarial assumptions 400,000 8% Discount rate

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:Jean Co. sponsors a defined benefit pension plan. For the current year ended December 31, the

following information relevant to the plan has been accumulated:

Defined benefit obligation, 1/1

Fair value of plan assets, 1/1

P5,000,000

4,500,000

500,000

1,000,000

250,000

1,050,000

250,000

Current service cost

Past service cost

Return on plan assets

FV of DBO settled

Gain on settlement

Decrease in defined benefit obligation due to changes in

actuarial assumptions

400,000

Discount rate

8%

Requirements:

1. Calculate the amount that the entity would recognize in profit or loss.

(Service costs & Net Interest)

2. Calculate the amount that the entity would recognize in other comprehensive.

(Remeasurement)

3. In the working papers computations, what balance of plan assets will be presented by Jean Co

on December 31?

4. In the working papers computations, what balance of benefit obligation will be determined by

Jean Co on December 31?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT