Jeremy earned $100,000 in salary and $6,000 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $23,000 in itemized deductions, including $2,000 of charitable contributions to his church. (Use the tax rate schedules.) c. Assume the original facts except that Jeremy has only $7,000 in itemized deductions. What is Jeremy’s tax refund or tax due?

Jeremy earned $100,000 in salary and $6,000 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $23,000 in itemized deductions, including $2,000 of charitable contributions to his church. (Use the tax rate schedules.) c. Assume the original facts except that Jeremy has only $7,000 in itemized deductions. What is Jeremy’s tax refund or tax due?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 2RE: Refer to RE18-1. Assume that Parkers taxable income for Year 1 is 150,000. Prepare the journal entry...

Related questions

Question

Jeremy earned $100,000 in salary and $6,000 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $23,000 in itemized deductions, including $2,000 of charitable contributions to his church. (Use the tax rate schedules.)

c. Assume the original facts except that Jeremy has only $7,000 in itemized deductions. What is Jeremy’s tax refund or tax due?

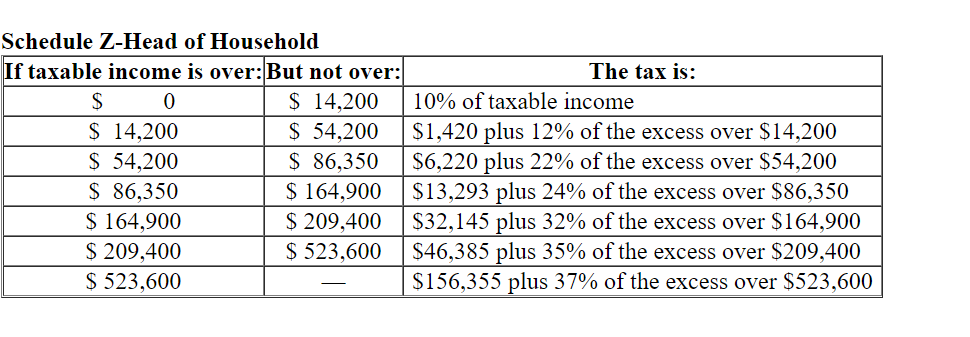

Transcribed Image Text:Schedule Z-Head of Household

If taxable income is over:But not over:

The tax is:

$ 14,200

$ 54,200

$ 86,350

$ 164,900

$ 209,400

$ 523,600

$

10% of taxable income

$ 14,200

$1.420 plus 12% of the excess over $14,200

$ 54,200

$ 86,350

$ 164,900

$ 209,400

$ 523,600

$6,220 plus 22% of the excess over $54,200

$13,293 plus 24% of the excess over $86,350

$32,145 plus 32% of the excess over $164,900

$46,385 plus 35% of the excess over $209,400

$156,355 plus 37% of the excess over $523,600

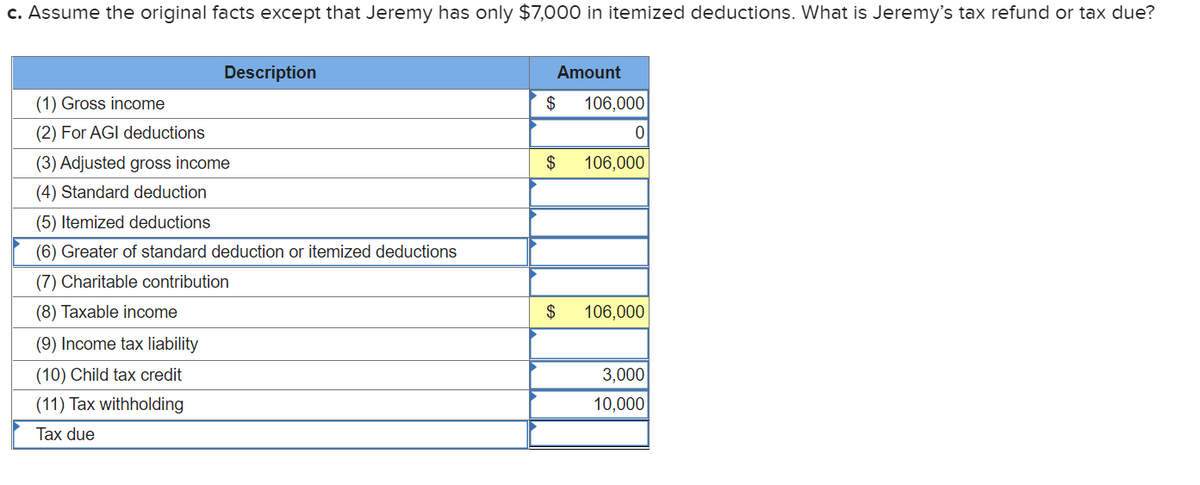

Transcribed Image Text:c. Assume the original facts except that Jeremy has only $7,000 in itemized deductions. What is Jeremy's tax refund or tax due?

Description

Amount

(1) Gross income

$

106,000

(2) For AGI deductions

(3) Adjusted gross income

$

106,000

(4) Standard deduction

(5) Itemized deductions

(6) Greater of standard deduction or itemized deductions

(7) Charitable contribution

(8) Taxable income

$

106,000

(9) Income tax liability

(10) Child tax credit

3,000

(11) Tax withholding

10,000

Tax due

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning