Jessica's utility of income is represented by: U(I) = V(241) where I represents annual income. She is offered a job that has a 0.3 chance of earning $21970 and a 0.7 chance of earning $62150 a year. How much would Jessica be willing to pay to insure against the risky income? Answer: $ (DO NOT ROUND YOUR CALCULATIONS UNTIL YOU REACH THE FINAL ANSWER. ENTER YOUR RESPONSE ROUNDED TO TWO DECIMAL PLACES. AND NO SEPARATOR FOR THOUSANDS.)

Jessica's utility of income is represented by: U(I) = V(241) where I represents annual income. She is offered a job that has a 0.3 chance of earning $21970 and a 0.7 chance of earning $62150 a year. How much would Jessica be willing to pay to insure against the risky income? Answer: $ (DO NOT ROUND YOUR CALCULATIONS UNTIL YOU REACH THE FINAL ANSWER. ENTER YOUR RESPONSE ROUNDED TO TWO DECIMAL PLACES. AND NO SEPARATOR FOR THOUSANDS.)

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 43P

Related questions

Question

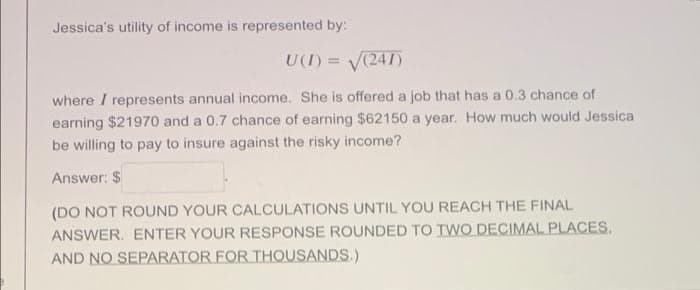

Transcribed Image Text:Jessica's utility of income is represented by:

U(I) = V(241)

where I represents annual income. She is offered a job that has a 0.3 chance of

earning $21970 and a 0.7 chance of earning $62150 a year. How much would Jessica

be willing to pay to insure against the risky income?

Answer: $

(DO NOT ROUND YOUR CALCULATIONS UNTIL YOU REACH THE FINAL

ANSWER. ENTER YOUR RESPONSE ROUNDED TO TWO DECIMAL PLACES,

AND NO SEPARATOR FOR THOUSANDS.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you