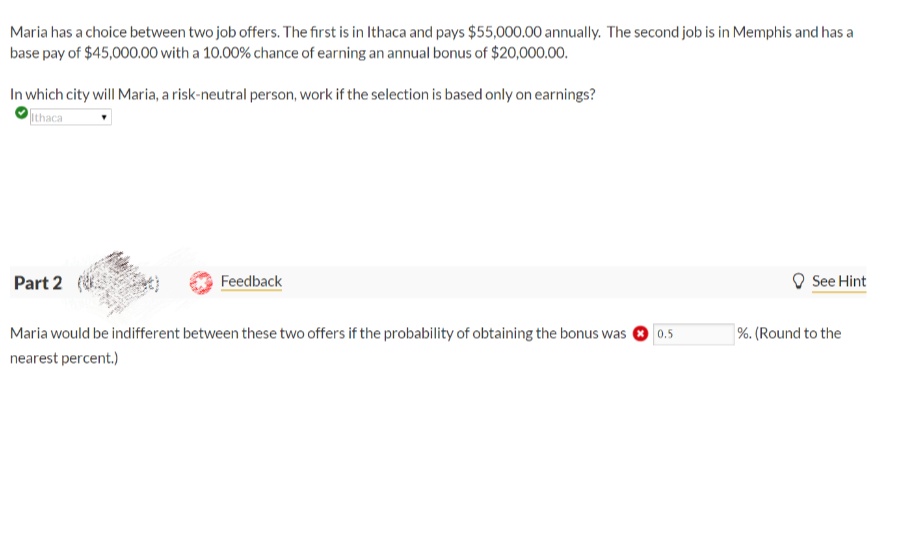

Maria has a choice between two job offers. The first is in Ithaca and pays $55,000.00 annually. The second job is in Memphis and has a base pay of $45,000.00 with a 10.00% chance of earning an annual bonus of $20,000.00. In which city will Maria, a risk-neutral person, work if the selection is based only on earnings? ithaca Part 2 Feedback See Hint Maria would be indifferent between these two offers if the probability of obtaining the bonus was 0.5 %. (Round to the nearest percent.)

Q: Ahmed is considering his plans for the coming weekend. He is currently working as a marketing…

A: Differential analysis: This is a technique of management accounting where in changes in revenues,…

Q: Amy has received two offers from companies that she would like to work for. She has been given the…

A: Following is the answer to given problem

Q: Suppose you hired Maria, a real-estate agent, to help sell your house at the best possible price. As…

A:

Q: Calculate the monthly payment for each.

A: Given: Budget price = 500,000, Down payment = 100,000 Loan amount = Budgeted - down payment =…

Q: Suppose that you are in the fall of your senior year and are faced with the choice of either getting…

A: Given: Tuition fee = $25,000 Interest rate = 5% Cash flow before law graduation = $35,000 Cash flow…

Q: Phil has two periods of work remaining prior to retirement. He is currently employed in a firm that…

A: In this question, Phil considers variety of options, to make the problem solving simple, first we…

Q: A recent UCF graduate just accepted a job offer that promises her the following bonuses at the end…

A: Future value can be referred to as the value of an underlying asset or security at a future date.…

Q: Job "B" offers you $30,000 salary per year. You have 10 PAID days off per year for vacation and sick…

A: Rate Per Hour: For each hour worked, the amount of money charged, paid, or earned: Rather of paying…

Q: Answer the following problems and explain it step by step: 1. A man who is 30 years old at the…

A: Note : As per the guidelines, only first question will be answered. Kindly post the remaining parts…

Q: Jenny Jenks has researched the financial pros and cons of entering into a 1-year MBA program at her…

A: cost of MBA=$51000 Extra earnings =$21000 Period =39 years Cost of capital =5.3%

Q: Maddy works at Burgers R Us. Her boss tells her that if she stays with the company for five years,…

A: Present value = Future value x PV of $1 factor

Q: Consider the imaginary country of Studentaria, a developing country where people live for four…

A: Given: Cost of college education is $800, but cost to Susan is only $500. Opportunity cost of not…

Q: Chris currently works for a software development firm as a programmer / analyst and earns a net…

A: Chris earns a net salary of $65,000 per year. If she quits her job for the business she has to let…

Q: Ahmed considering his plans for the coming weekend. He is currently working as a marketing…

A: Relevant costing is defined as avoidable costs that are incurred while making a certain business…

Q: Ahmed is considering his plans for the coming weekend. He is currently working as a marketing…

A: Incremental cost is the additional costs which are linked with one extra unit. These are calculated…

Q: Chester a twenty year old is considering whether to attend college or to trades . The college…

A: A study that proves that the future worth of the money is lower than its current value due to…

Q: Elroy Rocket is entering his senior year as an accounting major and has a number of options for his…

A: Earnings in Option 1 = Number of Months × Full Time Salary Per Month Earnings in Option 1 = 3 × 3600…

Q: Allison is contemplating a job offer with an advertising agency where she will make $54 000 in her…

A: Opportunity Cost: Opportunity cost refers to the foregone revenue that could have been generated…

Q: Alex has been offered an engineering job with a large company that has offices in Makati and Laguna.…

A: Future worth refers to the value of a current asset at some future date based on the interest…

Q: You have a job in a company that pays you P350,000 per year. For a better future, you want to get a…

A: Opportunity cost is the cost that has been foregone by choosing one option among others. If someone…

Q: An individual has two employment opportunities involving the same work conditions but different…

A: Value of money declines with the passage of time due to various market factors like interest rate,…

Q: Taylor and Charlie currently live in New Orleans. Taylor is currently making $60,000 per year, and…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Taylor and Charlie currently live in New Orleans. Taylor is currently making $60,000 per year, and…

A: Taylor Charlie Currently making $ 60,000.00 $…

Q: Jessica's utility of income is represented by: U(I) = V(241) where I represents annual income. She…

A: In economics, utility refers to the complete satisfaction gained from consuming an item or service.…

Q: して there YOu living is the way You Job "B" offers you $30,000 salary per year. You have 10 PAID days…

A: In the given question it is given that the annual salary per year is $30000. There are 50…

Q: You are the newly hired risk analyst for Smith Inc,, a food distribution company based in Nashville,…

A: Expected loss = 20% Expected Value of each loss = $7,500 Current Net Cost = $1,000,000 Employs =…

Q: Your employer will give you a raise in an annual salary of $10,000 if you pass a Professional…

A: We will apply the required formula to calculate the PV of the raise as the period is 35 we will take…

Q: You have been offered two different jobs from competing businesses. Company A is willing to pay you…

A: N = 40 Option 1 First salary = 120,000 Annual Increase = 5℅ Option 2 First Salary = 45,000 Annual…

Q: Susan is trying to decide whether or not to attend college during the next 12-week session. She has…

A: In finance, incremental profit represents the difference between incremental revenue and incremental…

Q: Ahmed is considering his plans for the coming weekend. He is currently working as a marketing…

A: The following situations are being evaluated for Ahmed.

Q: Kristi, a pharmacist, is planning to open her own pharmacy. Based on her experience in the field,…

A: Lets understand the basics. When person have more than one alternative then person choose…

Q: You are considering two job offers: Job 1 is a full-time position that pays $58,000 annually and Job…

A: Introduction: Pretax earnings are earnings after all operating expenses have been deducted from…

Q: Suppose that you are in the fall of your senior year and are faced with the choice of either getting…

A: Present value of growing annuity Annuity is a series of equal payment at equal interval over a…

Q: Ahmed is considering his plans for the coming weekend. He is currently working as a marketing…

A: Cost of the trip =$ 1,000 Earning if consultancy services =$ 1,900 Overtime Bonus working on weekend…

Q: Ashley Linkletter, age 21, expects to graduate next spring with a bachelor's degree in business…

A: Solution-(1) Clarify her values and lifestyle trade offs? (1) TRADEOFF refers to the reducing the…

Q: uppose that you are in the fall of your senior year and are faced with the choice of either getting…

A: Present value of an annuity with a growth rate Annuity is a series of equal payment at equal…

Q: Patrick was offered a job with a choice between two salary options. Option A: Starts at $10.00 per…

A: The future value shows the value of the money at a predetermined time in the future and is used by…

Q: Suppose that you decide to go to summer school. Your tuition cost is $3,000, books and supplies cost…

A: Opportunity costs are the cost of choosing one option over another that contains potential benefits.…

Q: Victor hernandez Considers a Career Change Victor is somewhat satisfied with his sales career and…

A: Future value is value after compounded growth of income.

Q: Blake is considering whether to enroll full-time in a two-year, webpage design certificate program.…

A: Opportunity cost is an indirect cost that refers to the cost of forgoing an income source.

Q: Ashley Linkletter, age 21, expects to graduate next spring with a bachelor's degree in business…

A: 1)Clarify her values and lifestyle trade offs ? 1)TRADEOFF refers to the reducing the cost of your…

Q: The manager of engineering at the 900-megawatt Hamilton Nuclear Power Plant has three options to…

A: Using LCM and PW analysis LCM=6 years a. Vendor R…

Q: Answer the following: You are contemplating a job offer with an advertising agency where you will…

A: Opportunity cost is the amount of benefit that is foregone due to taking of existing alternative or…

Q: You are earning $34,000 a year in city with a low cost of living. You are considering taking a job…

A: Cost of Living The amount needed by the individual to cover the basic amenities of life is called as…

Q: Suppose that you are in the fall of your senior year and are faced with the choice of either getting…

A: Present value of annuity with a growth rate With first payment (P), discount rate (r), growth rate…

Q: Tina, an entrepreneurial business student, wants to set up a business completing tax forms for…

A:

Q: time and forci

A: Given: To calculate the risk premium and the risk premium with the particular example as,

Q: n engineer intends to travel abroad to take a postgraduate course at a maternity hospital. He…

A: Value would he need to have today to make his plans viable = $72.688.7

Q: You receive two job offers in the same big city. The first job is close to your parents' house, and…

A: Differential analysis is a technique for making decisions that analyses the net outcomes of two or…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Michiko and Saul are planning to attend the same university next year. The university estimates tuition, books, fees, and living costs to be 12,000 per year. Michikos father has agreed to give her the 12,000 she needs to attend the university. Saul has obtained a job at the university that will pay him 14,000 per year. After discussing their respective arrangements, Michiko figures that Saul will be better off than she will. What, if anything, is wrong with Michikos thinking?Fred is considering three job offers in advertising. A full-time position as a coordinator that pays a salary of $40,000 per year. A full-time position as a designer that pays an hourly wage of $28. The job assumes five 8-hour days per week. A sales representative that pays a 5% commission. Sales reps typically sell an average of $100,000 per month in advertising. The following are the specifics about the benefits of the job opportunities: The U.S. government will deduct Social Security (6.2%) and Medicare (1.45%). Fred will deduct 15% of Gross Income to cover Federal Income Tax. Fred does not live in a state with State Income Tax. Fred is planning on taking two weeks of vacation and has typically been sick 3 days per year. The Coordinator job includes two weeks of paid vacation and five paid sick days per year, paid health insurance, life insurance costing $35 per month, and a fully paid retirement plan. The Designer job includes five paid vacation days and three paid sick days…Fred is considering three job offers in advertising. A full-time position as a coordinator that pays a salary of $40,000 per year. A full-time position as a designer that pays an hourly wage of $28. The job assumes five 8-hour days per week. A sales representative that pays a 5% commission. Sales reps typically sell an average of $100,000 per month in advertising. The following are the specifics about the benefits of the job opportunities: The U.S. government will deduct Social Security (6.2%) and Medicare (1.45%). Fred will deduct 15% of Gross Income to cover Federal Income Tax. Fred does not live in a state with State Income Tax. Fred is planning on taking two weeks of vacation and has typically been sick 3 days per year. The Coordinator job includes two weeks of paid vacation and five paid sick days per year, paid health insurance, life insurance costing $35 per month, and a fully paid retirement plan. The Designer job includes five paid vacation days and three paid sick days…

- Fred is considering three job offers in advertising. A full-time position as a coordinator that pays a salary of $40,000 per year. A full-time position as a designer that pays an hourly wage of $28. The job assumes five 8-hour days per week. A sales representative that pays a 5% commission. Sales reps typically sell an average of $100,000 per month in advertising. The following are the specifics about the benefits of the job opportunities: The U.S. government will deduct Social Security (6.2%) and Medicare (1.45%). Fred will deduct 15% of Gross Income to cover Federal Income Tax. Fred does not live in a state with State Income Tax. Fred is planning on taking two weeks of vacation and has typically been sick 3 days per year. The Coordinator job includes two weeks of paid vacation and five paid sick days per year, paid health insurance, life insurance costing $35 per month, and a fully paid retirement plan. The Designer job includes five paid vacation days and three paid sick days…Suppose that you are in the fall of your senior year and are faced with the choice of either getting a job when you graduate or going to law school. Of course, your choice is not purely financial. However, to make an informed decision you would like to know the financial implications of the two alternatives. Let's assume that your alternatives are as follows: If you take the "get a job" route you expect to start off with a salary of $40,000 per year. There is no way to predict what will happen in the future, your best guess is that your salary will grow at 5 percent per year until you retire in 45 years. As a law student, you will be paying $25,000 per year tuition for each of the 3 years you are in graduate school. However, you can then expect a job with a starting salary of $75,000 per year. Moreover, you expect your salary to grow by 7 percent per year until you retire 39 years later. Clearly, your total expected lifetime salary will be higher if you become a…Tina, an entrepreneurial business student, wants to set up a business completing tax forms for other students. Her price would be $41.00 for each job. Fixed expenses include $150.00 for the tax software which Tina would purchase. Tina would hire some accounting students to complete the forms, paying them for two hours at $13 per hour for each job. She would also have paper and supplies costs of $5 per job. How many jobs would she have to generate before she starts to make a profit? Make the assumption that it takes an accounting student two hours to complete one tax return.

- The sales manager is deciding between two possible compensation structures for sales staff. Under one plan, salespeople would receive a base compensation of $80,000 per year plus a 1% commission on all sales to their customers. Under the other plan, the base compensation would drop to $40,000 per year, but the commission rate would increase to 5%. What are the advantages and disadvantages, to the company of both plans? As the accounting manager, would you have a preference? Why or why not? (answer in text form please (without image), Note: .Every entry should have narration please)You graduated college six years ago with an undergraduate degree in Finance. Although satisfied withyour current job, your goal is to become an investment banker, and you wonder if an MBA degree wouldallow you to achieve that goal. After examining schools, you have narrowed your choice to eitherWilton University or Mount Perry College. Although internships are encouraged by both schools, to getcredit for the internship, no salary can be paid. Other than internships, neither school will allowstudents to work while enrolled on the MBA program. However, thanks to a bequest from yourgrandmother, your savings account has enough money to cover the entire cost of the MBA programYou currently work a money management firm, earning $53, 000 annually. Your salary is expected toincrease 3% per year until retirement. You expect to work for 38 more years. Your current job includesa fully paid health insurance plan. Your current average tax rate is 26%.The Ritter College of Business at Wilton…You graduated college six years ago with an undergraduate degree in Finance. Although satisfied withyour current job, your goal is to become an investment banker, and you wonder if an MBA degree wouldallow you to achieve that goal. After examining schools, you have narrowed your choice to eitherWilton University or Mount Perry College. Although internships are encouraged by both schools, to getcredit for the internship, no salary can be paid. Other than internships, neither school will allowstudents to work while enrolled on the MBA program. However, thanks to a bequest from yourgrandmother, your savings account has enough money to cover the entire cost of the MBA programYou currently work a money management firm, earning $53, 000 annually. Your salary is expected toincrease 3% per year until retirement. You expect to work for 38 more years. Your current job includesa fully paid health insurance plan. Your current average tax rate is 26%.The Ritter College of Business at Wilton…

- You graduated college six years ago with an undergraduate degree in Finance. Although satisfied withyour current job, your goal is to become an investment banker, and you wonder if an MBA degree wouldallow you to achieve that goal. After examining schools, you have narrowed your choice to eitherWilton University or Mount Perry College. Although internships are encouraged by both schools, to getcredit for the internship, no salary can be paid. Other than internships, neither school will allowstudents to work while enrolled on the MBA program. However, thanks to a bequest from yourgrandmother, your savings account has enough money to cover the entire cost of the MBA programYou currently work a money management firm, earning $53, 000 annually. Your salary is expected toincrease 3% per year until retirement. You expect to work for 38 more years. Your current job includesa fully paid health insurance plan. Your current average tax rate is 26%.The Ritter College of Business at Wilton…Phil has two periods of work remaining prior to retirement. He is currently employed in a firm that pays him the value of his marginal product, $50,000 per period. There are many other firms that Phil could potentially work for. There is a 50 percent chance of Phil being a good match for any particular firm and a 50 percent chance of him being a bad match. If he is in a good match, the value of his marginal product is $56,000 per period. If he is in a bad match, the value of his marginal product is $40,000 per period. If Phil quits his job, he can immediately find employment with any of the alternative firms. It takes one period to discover whether Phil is a good or a bad match with a particular firm. In that first period, while Phil’s value to the firm is uncertain, he is offered a wage of $48,000. After the value of the match is determined, Phil is offered a wage equal to the value of his marginal product in that firm. When offered that wage, Phil is free to (a) accept, (b) reject…You have been offered two different jobs for the upcoming summer. Since both are full-time positions, you must choose to work only one of the jobs. The first job is in an office. The pay will be $320 per week. The office is located 20 miles from your home, so you estimate that you will spend $25 per week on gas. You will also have to pay $25 per week for parking. Because you are required to dress professionally, you will need to purchase some new clothes. You estimate that you will spend $350 on new clothes for this job during the summer. The second job is at an amusement park. The pay will be $220 per week. The amusement park is also 20 miles from your home, but you can carpool with a friend. Your share of the gas will be $12.50 per week. There is no charge for parking. The amusement park will furnish you with a uniform, so you won't need to buy any special clothes. Assuming that your summer break will allow you to work 12 weeks, which job will provide you with more money? Please…