JFC Corporation values its inventory by using retail method: 1. How much is the ending inventory at cost assuming the company uses average LCM approach? 2. How much is the ending inventory at cost assuming the company uses average retail approach? 3. How much is the ending inventory at cost assuming the company uses FIFO retail approach? 4. How much is the ending inventory at cost assuming the company uses FIFO LCM approach?

JFC Corporation values its inventory by using retail method: 1. How much is the ending inventory at cost assuming the company uses average LCM approach? 2. How much is the ending inventory at cost assuming the company uses average retail approach? 3. How much is the ending inventory at cost assuming the company uses FIFO retail approach? 4. How much is the ending inventory at cost assuming the company uses FIFO LCM approach?

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13MJ: Mornin' Joe

Section: Chapter Questions

Problem 3IFRS

Related questions

Topic Video

Question

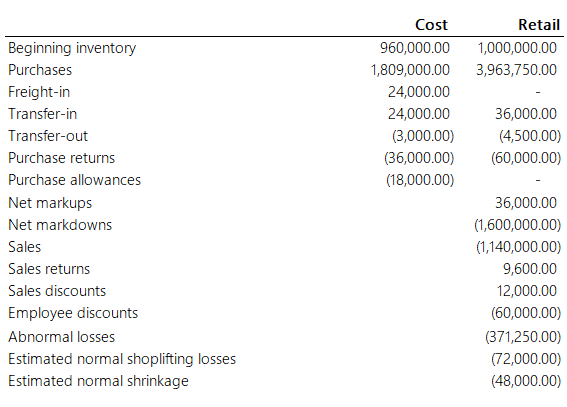

JFC Corporation values its inventory by using retail method:

1. How much is the ending inventory at cost assuming the company uses average LCM approach?

2. How much is the ending inventory at cost assuming the company uses average retail approach?

3. How much is the ending inventory at cost assuming the company uses FIFO retail approach?

4. How much is the ending inventory at cost assuming the company uses FIFO LCM approach?

Transcribed Image Text:Cost

Retail

Beginning inventory

960,000.00

1,000,000.00

Purchases

1,809,000.00

3,963,750.00

Freight-in

24,000.00

Transfer-in

24,000.00

36,000.00

Transfer-out

(3,000.00)

(4,500.00)

Purchase returns

(36,000.00)

(60,000.00)

Purchase allowances

(18,000.00)

Net markups

36,000.00

Net markdowns

(1,600,000.00)

Sales

(1,140,000.00)

Sales returns

9,600.00

Sales discounts

12,000.00

Employee discounts

(60,000.00)

Abnormal losses

(371,250.00)

Estimated normal shoplifting losses

Estimated normal shrinkage

(72,000.00)

(48,000.00)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning