Suppose that P dollars in principal is invested in an account earning 3.2% interest compounded continuously. At the end of 5 yr, the amount in the account has earned $1388.09 in interest. Part: 0 / 2 Part 1 of 2 (a) Find the original principal. Round to the nearest dollar. (Hint: Use the model A = Pe' and substitute P+1388.09 for A.) The original principal was approximately S

Suppose that P dollars in principal is invested in an account earning 3.2% interest compounded continuously. At the end of 5 yr, the amount in the account has earned $1388.09 in interest. Part: 0 / 2 Part 1 of 2 (a) Find the original principal. Round to the nearest dollar. (Hint: Use the model A = Pe' and substitute P+1388.09 for A.) The original principal was approximately S

Chapter4: Time Value Of Money

Section4.17: Amortized Loans

Problem 1ST

Related questions

Question

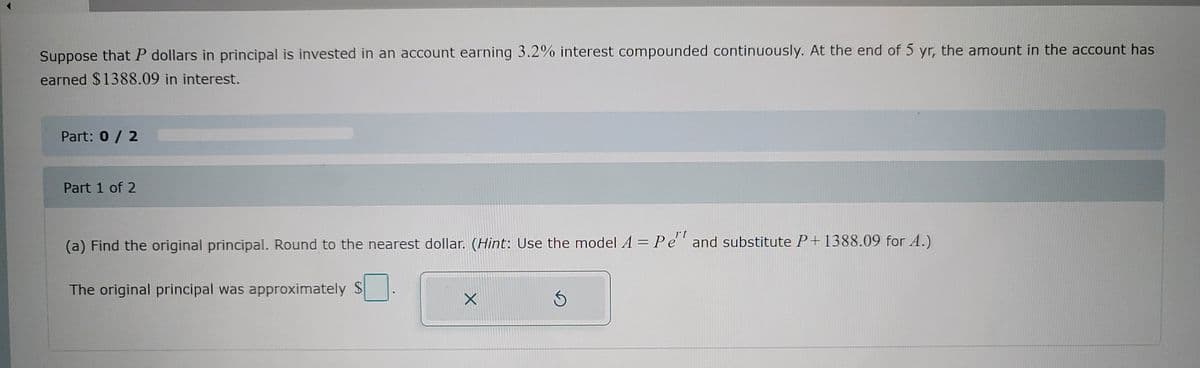

Transcribed Image Text:Suppose that P dollars in principal is invested in an account earning 3.2% interest compounded continuously. At the end of 5 yr, the amount in the account has

earned $1388.09 in interest.

Part: 0 / 2

Part 1 of 2

(a) Find the original principal. Round to the nearest dollar. (Hint: Use the model A = Pe' and substitute P+1388.09 for A.)

The original principal was approximately S

Expert Solution

Step 1

When interest is compounded continuously, it means that the interest is calculated on the amount that is initially invested and it is reinvested into the account's existing balance. The principal is the amount that is originally invested. The rate of interest is the rate at which the compounding is done. The time period refers to the time for which the investment is made. This is different from simple interest in the fact that simple interest calculates interest on the principal amount alone. Compound interest is calculated on the principal amount as well as the reinvested interest amount.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT