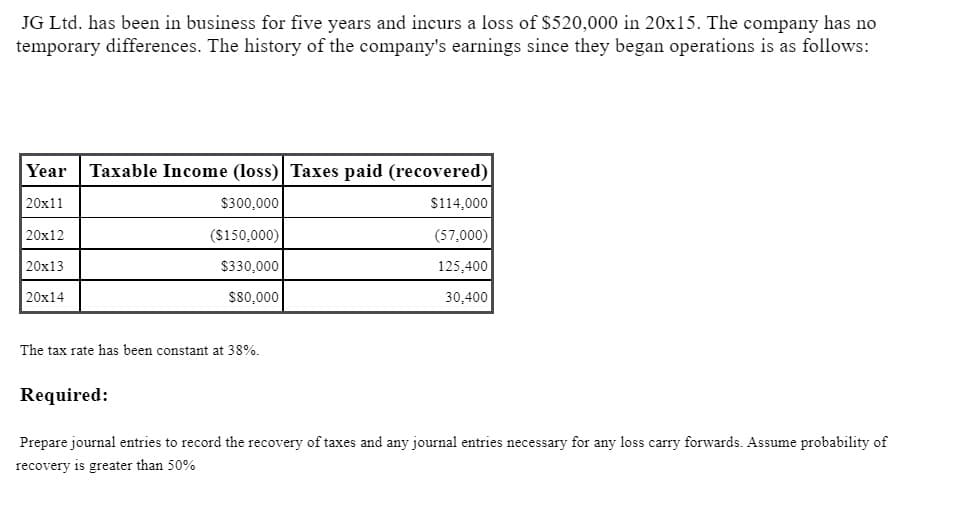

JG Ltd. has been in business for five years and incurs a loss of $520,000 in 20x15. The company has no temporary differences. The history of the company's earnings since they began operations is as follows: Year Taxable Income (loss) Taxes paid (recovered) |20x11 $300,000 $114,000 20x12 ($150,000) (57,000) 20x13 $330,000 125,400 20x14 $80,000 30,400 The tax rate has been constant at 38%. Required: Prepare journal entries to record the recovery of taxes and any journal entries necessary for any loss carry forwards. Assume probability of recovery is greater than 50%

JG Ltd. has been in business for five years and incurs a loss of $520,000 in 20x15. The company has no temporary differences. The history of the company's earnings since they began operations is as follows: Year Taxable Income (loss) Taxes paid (recovered) |20x11 $300,000 $114,000 20x12 ($150,000) (57,000) 20x13 $330,000 125,400 20x14 $80,000 30,400 The tax rate has been constant at 38%. Required: Prepare journal entries to record the recovery of taxes and any journal entries necessary for any loss carry forwards. Assume probability of recovery is greater than 50%

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 19P: The Bookbinder Company had 500,000 cumulative operating losses prior to the beginning of last year....

Related questions

Question

100%

Transcribed Image Text:JG Ltd. has been in business for five years and incurs a loss of $520,000 in 20x15. The company has no

temporary differences. The history of the company's earnings since they began operations is as follows:

Year

Taxable Income (loss) Taxes paid (recovered)

20x11

$300,000

$114,000

20x12

($150,000)

(57,000)

20x13

$330,000

125,400

20x14

$80.000

30,400

The tax rate has been constant at 38%.

Required:

Prepare journal entries to record the recovery of taxes and any journal entries necessary for any loss carry forwards. Assume probability of

recovery is greater than 50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning